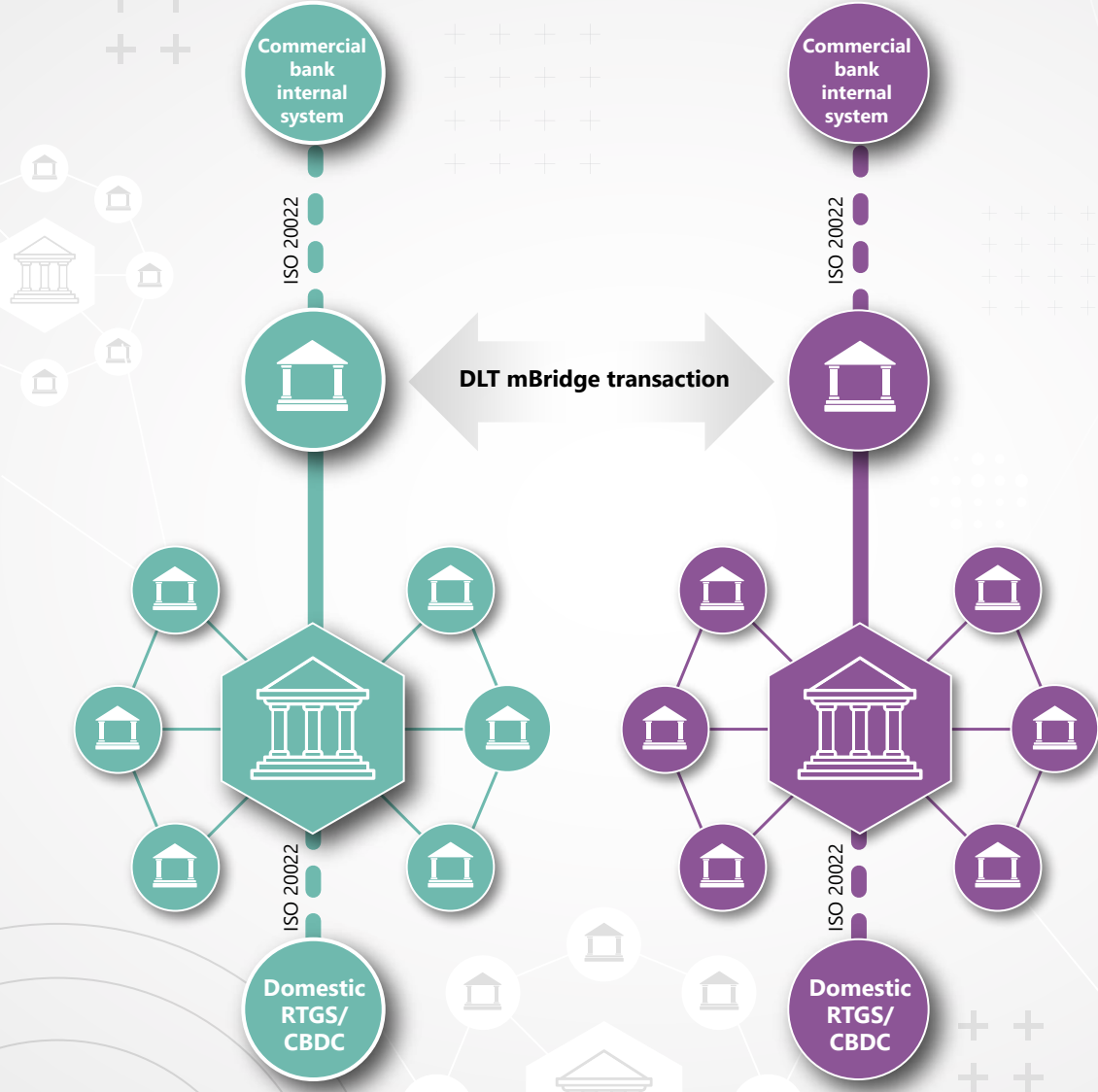

The United Arab Emirates (UAE) and China have executed the first cross-border Renminbi (RMB) central bank digital currency (CBDC) transaction. The payment moved RMB and 50 million dirhams between the UAE and China using mBridge infrastructure as the dollar’s supremacy in Asia comes under fire.

The People’s Bank of China and the UAE Central Bank successfully exchanged 50 million dirhams ($13.6 million) in the first real-time payment on their custom interbank network. The network, which piloted its first trial in 2014, links the central banks of Hong Kong, China, the UAE, and Thailand.

China Defies US With CBDC Tests

Two transactions were conducted during a high-profile gathering in Abu Dhabi yesterday. Saudi Prince Mansour and Chinese Ambassador Yiming Zhang jointly sent 50 million dirhams to China. At the same time, the Chinese central bank conducted a remittance payment in digital RMB.

The transaction was the first real-time payment on the mBridge blockchain infrastructure that links the central banks of Hong Kong, Thailand, the UAE, and China. The network’s first pilot was in 2014. However, it has grown in prominence as China sought to de-dollarize amid tensions with the US.

Read more: Revolutionary Blockchain Ideas

But the mBridge network is not live in the strictest sense. While plans indicate a mid-year rollout, the Bank for International Settlements said it is too early to set dates. The project still needs to address foreign exchange costs and liquidity.

US CBDC and Stablecoins Will Support Dominance

One of the challenges in trying to de-dollarize is that many countries have more ready access to US dollars than any other currency. As of December last year, around 58% of foreign reserves at central banks were US dollars. This phenomenon means that countries with a lot of dollars who conduct international trade in dollars have lower counterparty risk.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

In Argentina, where the fiat currency has been devalued, most merchants prefer dollars. Even Javier Milei, the recently elected libertarian leader, reportedly does not support Bitcoin as much as he does US dollars.

According to David W. Birch, the author of a book called The Currency Cold War, a preference for dollars supports creating a US central bank digital currency. He said that the race to a US CBDC is like the space race between America and Russia. In his view, America should be going all out to win it.

Morgan Stanley’s crypto head, Andrew Peel, said US dollar dominance could benefit from the rise of the US dollar stablecoin. Rising interest from institutional players like Visa and the increase in blockchain settlements means stablecoins can significantly affect the financial sector.

However, Danny Chong, the CEO of DeFi yield platform Tranchess and a former investment banker, begs to differ. Speaking to BeInCrypto on the recent tokenization boom and the potential for stablecoins, he said,

“CBDCs and Stablecoins are…very close. Unbeknownst to many, there has been a rise in foreign stablecoins. The stablecoin backed by the Japanese yen is becoming one of the major assets being exchanged for foreign currencies. The global use of this stablecoin could soon outpace its dollar-based counterparts.”