Central bank digital currency (CBDC) research and development has been a high priority in China, and the United States appears to be following suit. The Federal Reserve of New York and a group of private banking firms recently launched a 12-week ‘digital dollar’ pilot project. But there are still concerns over how this might affect financial freedom.

On March 9, 2022, U.S. President Joe Biden placed the “highest urgency” on research and development efforts into a potential U.S. central bank digital currency. Was it a move to stay relevant or competitive compared to other regions?

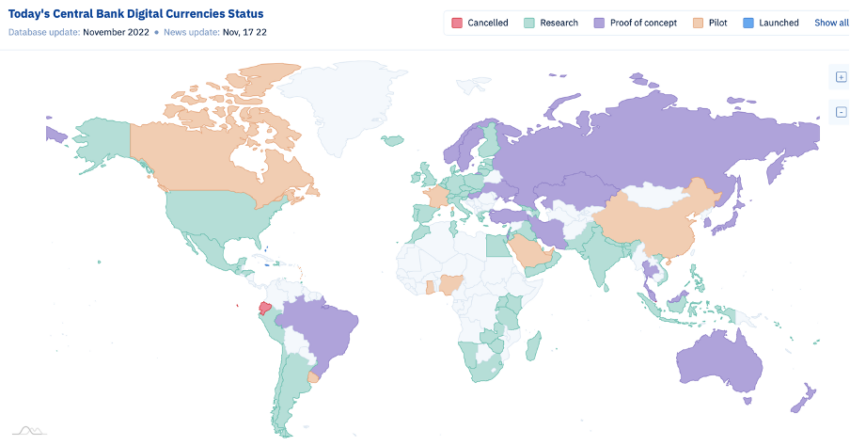

Many would agree. A handful of nations, including China and Russia, have already started pilot programs. The U.S., U.K., and most of the eurozone are still under the investigation and research stage. This is evident in the CBDC tracker chart below found below:

There’s a noticeable difference in CBDC development by region. Western nations are at risk of falling behind in this regard.

The U.S. is now taking its first steps at closing this gap.

Proof-of-concept trials

On Nov. 15, various leading investment banks partnered with the U.S. Federal Reserve to begin work on the digital dollar. The NY Fed’s “Innovation Center” will join Citigroup, Mastercard, Wells Fargo, HSBC, and other major financial players to run tests, BeInCrypto reported.

Adding to that, the official post read:

“The Federal Reserve Bank of New York announced that its New York Innovation Center (NYIC) will participate in a proof-of-concept project to explore the feasibility of an interoperable network of central bank wholesale digital money and commercial bank digital money operating on a shared multi-entity distributed ledger.”

The proof-of-concept will run for 12 weeks and will test different attributes and functions of a digital dollar.

The project is specifically being carried out to test the “technical feasibility, legal viability, and business applicability of distributed ledger technology” on a Regulated Liability Network (RLN).

Key aspects

The 12-week trial will focus on six key areas:

- Regulatory framework: The platform will align with the existing regulatory framework and preserve existing requirements for deposit-based payments processing, notably maintaining know your customer and anti-money laundering requirements.

- Scope: The PoC will simulate digital money issued by regulated institutions in U.S. dollars, although the concept could extend to multi-currency operations and regulated stablecoins.

- Tokens: The PoC will simulate 100% fungible and redeemable tokens with other forms of money.

- Industry collaboration: The PoC will include dialogue with the broader U.S. banking community, including community and regional banks.

- Results: Following the conclusion of the PoC, the banking group will publicize the results, which they hope will be an essential contribution to the literature on digital money.

- Plans: The banking group participants are not committed to any future phases of work once the PoC has been completed.

The NYIC pilot project news followed another recent research initiative from Nov. 4. Dubbed Project Cedar, the first phase of the CBDC trial tested foreign exchange spot trades.

This was done to determine whether a blockchain solution could improve the “speed, cost, and access to cross-border wholesale payments.”

Joining the race

Regions like Russia and China, among others, have already begun tinkering with how CBDCs would be used in the average person’s day-to-day life.

China recently surpassed the 100 billion yuan ($13.9 billion) milestone in digital yuan transaction volume on Aug. 31, 2022. This accounts for a 36.3% rise in volume since June.

This showcases the rapidly growing adoption rate of China’s digital yuan (also referred to as the e-CNY.)

Per a People’s Bank of China (PBoC) report, citizens of select cities in China would be granted access to digital yuan wallets. China aims to expand the scope of its current digital yuan trials to the whole of some of its most populous and developed provinces by the year’s end, according to Fan Yifei, deputy governor of the People’s Bank of China.

While still in the early phases, Russia has also begun laying the groundwork for its digital ruble CBDC support.

Reducing exposure

Both China and Russia have motives to act quickly on CBDC implementation in order to reduce their dependence on the United States dollar. Some Chinese state researchers even floated the idea of a pan-Asian digital currency.

The digital token would be pegged to a basket of 13 currencies, including the yuan, Japanese yen, South Korean won, and those of the 10 ASEAN countries.

The South China Morning Post wrote,

“More than 20 years of deepened economic integration in East Asia has laid a good foundation for regional currency cooperation. The conditions for setting up the Asian yuan have gradually formed.”

This just goes to show why the U.S. and other nations, such as the U.K., are acting with caution and calculation. That said, there are still great concerns and doubts concerning a world economy running on CBDCs.

Financial freedom, right?

CBDCs have the potential to make tracking and surveillance that much easier for governments, potentially eroding financial freedom despite what they might claim. It’s no coincidence that the world’s most authoritarian regions are the ones at the head of the pack, rushing to deploy them.

For instance, the International Monetary Fund (IMF) touted CBDCs as a path to financial inclusion. But there could be some severe implications that came to light after the IMF-World Bank Annual Meeting in October.

Deputy Managing Director Bo Li highlighted different use cases of how CBDCs were being studied and how they might improve financial inclusion through programmability.

Although, his comments received severe backlash as they portrayed the opposite of financial inclusion. The take from those comments is that governments want to be able to program money to control what people can and cannot buy.

In a 2021 white paper, the World Economic Forum wrote about what the potential downsides of trying to micromanage society with CBDCs. Some concerns included placing limits on transaction sizes, how much currency one would be allowed to hold, and the nature of goods that a person could purchase.

Nick Anthony, the Policy Analyst at the Cato Institute’s Center for Monetary and Financial Alternatives, has similar concerns. BeInCrypto contacted him to comment on the latest development on CBDCs.

He stated that:

“Far too many policymakers—in Congress and agencies alike—are looking at CBDCs as if their job is to be keeping up with the Joneses. And it does seem that the Fed’s pilot is the next step in that. But the fact that countries like China and Nigeria are leading the way on CBDCs should be their signal to go the opposite direction.”

CBDC implications

In an overview and the latest development, the United States Federal Reserve Board released a paper to discuss ‘Macroeconomic Implications of CBDC’ on Nov. 17. It analyzed the potential positives and negatives and emphasized the role of a CBDC in regard to monetary policy and remuneration.

Per this paper, a digital dollar could improve welfare by ‘reducing financial frictions in deposit markets, boosting financial inclusion, and improving the transmission of monetary policy.’ However, there are some restrictions to it as well:

“A CBDC entails significant risks, including the possibility of bank disintermediation and associated contraction in bank credit, as well as potential adverse effects on financial stability.

A CBDC also raise important questions regarding monetary policy implementation and the footprint of central banks in the financial system. Ultimately, the effects of a CBDC depend critically on its design features, particularly remuneration.”

Nonetheless, it doesn’t come as a total surprise why politicians and banks support CBDCs. This is because they would allow for a peer-government/bank-peer exchange. You might remember that Prime Minister Justin Trudeau ordered banks to freeze accounts of his political critics in Canada.

In any form, the relationship between a government and its CBDC will raise challenging questions regarding what financial freedom really means.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.