Chainlink’s (LINK) price has struggled to maintain its momentum after failing to breach the critical resistance level at $12.38.

Although the altcoin is showing signs of recovery, it is yet to recover its losses from the late August correction. Thus, the potential for growth beyond $11.64 remains uncertain.

Chainlink Witnesses Resistance

According to the Global In/Out of the Money (GIOM) indicator, approximately 106.89 million LINK tokens were accumulated between $11.61 and $13.24, representing a supply worth over $1.2 billion.

Chainlink must breach the $12.94 resistance and flip it into support to enable a rise toward $13.24 and turn the aforementioned supply profitable. This can only happen through sustained bullish sentiment, which is currently lacking.

Breaching these key levels will remain difficult without a strong influx of buying pressure. The accumulation of LINK at these price points shows that the market is poised for potential gains, but the demand necessary to drive the altcoin higher has yet to materialize.

Read More: How To Buy Chainlink (LINK) and Everything You Need To Know

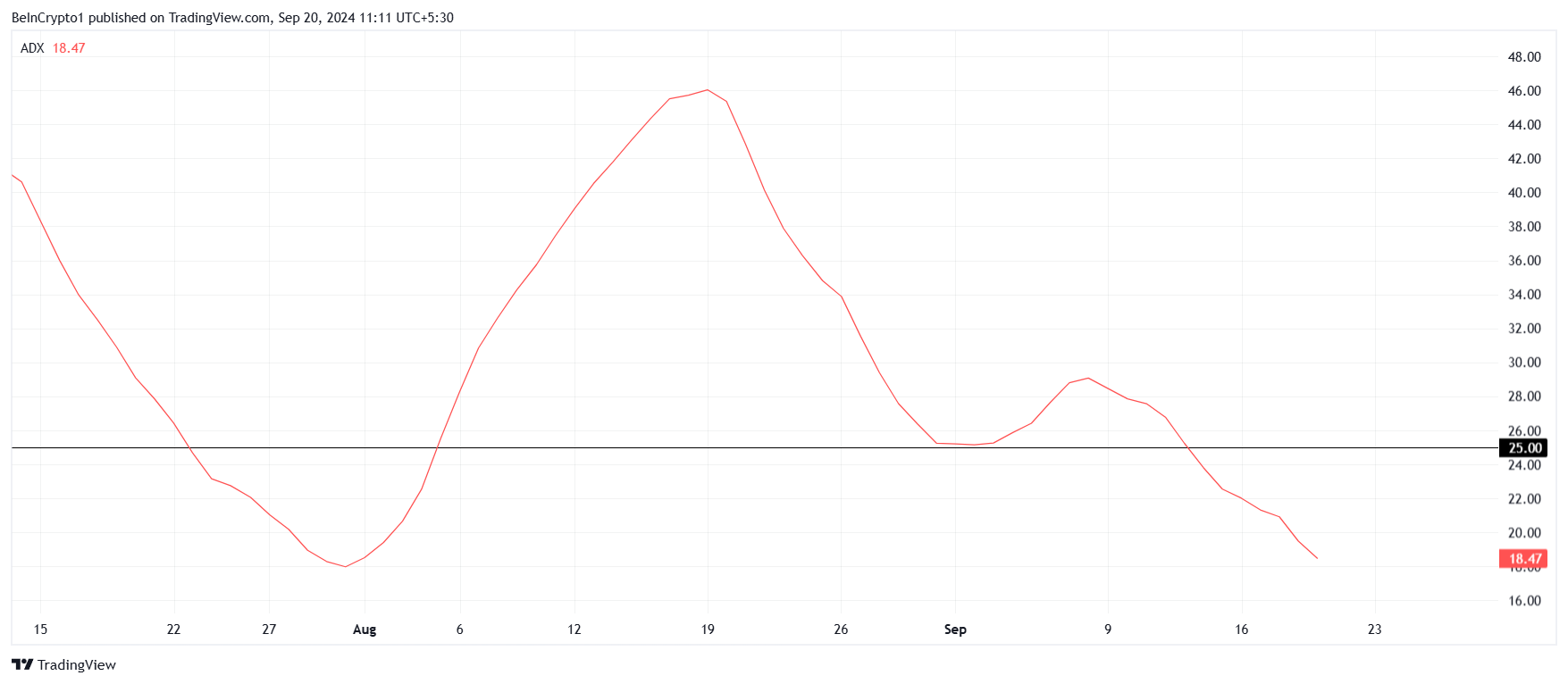

Additionally, Chainlink’s macro momentum suggests that its attempts at a rally may continue to falter. The Average Directional Index (ADX), which measures the strength of a trend, shows that LINK’s uptrend has lost significant strength. ADX has dropped below the key threshold of 25.0, signaling weakness in the market.

This decline in momentum could prevent LINK from gaining the traction needed to breach key resistance levels. Without a strong uptrend, Chainlink is likely to face continued difficulty in its attempt to rise past $12.38 and beyond.

LINK Price Prediction: No Room Ahead

Chainlink’s price has risen by 6.4% over the last 24 hours, now trading at $11.60. Breaching the local resistance at $11.64 could allow LINK to rise toward $12.38, a barrier LINK failed to breach previously.

However, current indicators suggest that even if LINK reaches $12.38, sustaining this rise will be challenging due to weak bullish momentum. A fallback is likely as buying strength diminishes.

Read More: Chainlink (LINK) Price Prediction 2024/2025/2030

If LINK manages to rise above $11.64 and turn it into support, it could breach $12.38. Sustained bullish sentiment would push the altcoin further, potentially breaking through the $12.94 barrier. This would invalidate the bearish outlook and lead to profits for LINK holders.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.