In remarks to the Futures Industry Association Expo 2023 on Monday, Commodity Futures Trading Commission (CFTC) Chair Rostin Benham tried to portray his agency as playing the role of a neutral enforcer of financial market probity.

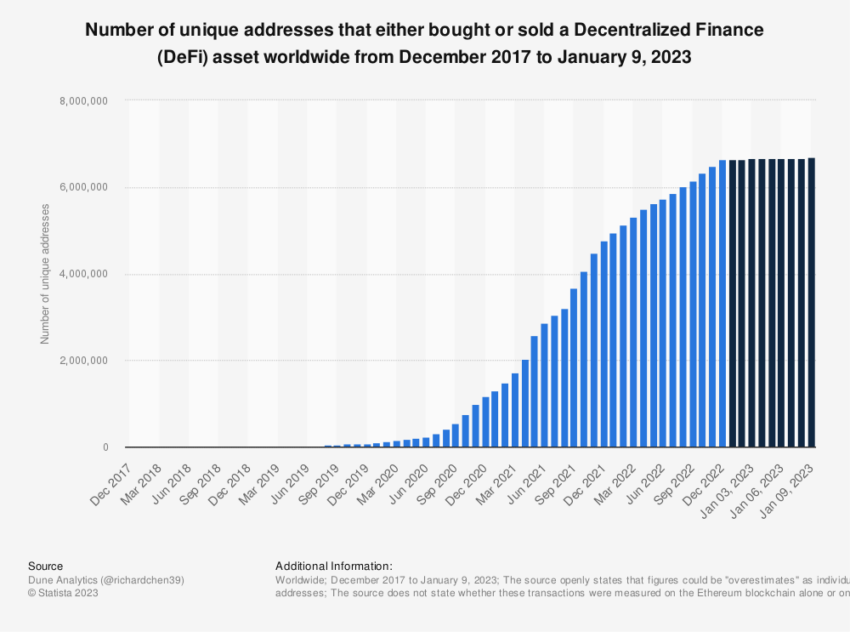

Yet Benham described a vastly expanded effort to crack down on decentralized finance (DeFi) and cryptocurrency platforms. He freely boasted about the number of enforcement actions that the CFTC has taken against such players in recent months.

The CFTC Seeks Authority to Curb DeFi

During his address, Benham made a nominal effort to cast the CFTC as a neutral umpire of the markets. One that does not favor or disfavor any particular type of firm or platform.

“It has never been, and it will never be our job to choose winners and losers. The onus is on the market and its participants to determine which innovations add value and which end with novelty,” Benham stated.

In spite of these assurances, many of the speaker’s following remarks took pains to depict DeFi platforms as bad actors. And to justify the harsh actions that the CFTC has taken and plans to take.

Benham spoke with pride of the number of actions targeting DeFi and cryptocurrency. According to his figures, nearly half of them now target bad actors operating in these areas.

“Continuing our success in the fight against fraud and illegal conduct involving digital assets, 45 of those actions this fiscal year involved digital asset related misconduct, representing over 34% of the 131 such actions brought by the Commission since 2015,” he said.

Benham Takes Initiative Against New Platforms

The speaker described his agency’s record as the natural outcome of a proactive stance. And the latter, he went on to suggest, is what any reasonable person would want.

“If you require analogy, think about whether you would comfortable on the road if only some individuals were required to have a drivers’ license, or whether, given the choice, you would entrust your healthcare to an untrained, or unlicensed physician,” he said.

Benham went on to congratulate his agency for having filed complaints and an order targeting Sam Bankman-Fried. And the latter’s imploded crypto exchange, FTX.

But Bankman-Fried and FTX were among only a few people and platforms called out by name during the remarks. For the most part, Benham spoke in broad terms about his agency’s pursuit of various types of fraud. Such as pig butchering, retail fraud, failures of reporting and disclosure, and other common types of malfeasance.

The CFTC and Today’s Financial Markets

The really significant development that Benham believes calls for enhanced regulatory powers is the transition of financial operations to DeFi platforms. Entities engaging in digital trade and investing are “no longer physically delineated” as in the past, he said.

Benham was not interested in the objections of prominent figures in the market, such as Coinbase CEO Brian Armstrong. Who has asked whether the Commodity Exchange Act really empowers the CFTC to keep such broad segments of the financial markets on a leash.

Or to keep them subject to legal criteria developed many decades in advance of DeFi’s emergence.

Learn more about Brian Armstrong’s struggles with regulators at both the CFTC and SEC.

Benham’s agenda was clear: The CFTC needs a broader mandate.

“I have continued to advocate for additional authority in the crypto space . . . and worked closely with Congress on ways to solidify much needed amendments to our authorizing statute,” he said.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.