The Commodity Futures Trading Commission (CFTC) has brought a tough enforcement action against swap dealer StoneX. The CFTC alleges violations of its Business Conduct Standards.

Under the terms of the CFTC’s order, the respondent will have to a $650,000 penalty. StoneX will also submit regular reports on its progress on the compliance front.

The CFTC Alleges Compliance and Reporting Violations Over Years

The enforcement action against StoneX illustrates just how far the regulator’s hand extends into the minutiae of day-to-day trading and business.

StoneX has chosen not to challenge the CFTC’s charges. Namely, that it failed to oversee its Pre-Trade Mid-Market Marks (PTMMM) reporting in accordance with CFTC standards between 2016 and 2022. Not only were there problems with the accuracy of the PTMMMs, but the firm did not get employees fully up to speed on the process.

Moreover, the company did not send PTMMMs to counterparties in a timely enough manner, the CFTC believes.

StoneX Ventures Into Crypto Transactions

The enforcement action and steep fine come just a bit more than a year after StoneX announced its first foray into crypto dealing.

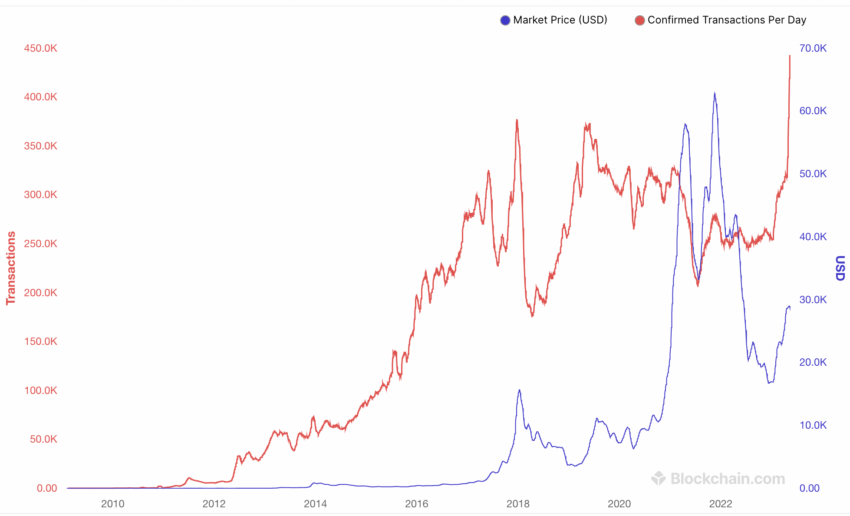

On May 17, 2022, the firm executed its first Bitcoin swap settled with cash, for institutional client Liquidity Solutions Global. Earlier the same month, StoneX offered institutional clients the ability to trade crypto swaps settled with USD.

The pro-crypto stance of the firm may have piqued the interest of Washington’s increasingly innovation-averse regulators. Tensions have run high between the fintech sector and the CFTC for many months.

Learn more about the CFTC’s increasingly aggressive efforts to enforce compliance in the crypto space.

Just last week, Coinbase CEO Brian Armstrong spoke out against the CFTC’s targeting of decentralized finance (DeFi) platforms. Armstrong urged companies and exchanges to challenge the CFTC in court rather than submit blindly to its dictates.

In Armstrong’s view, it is highly questionable whether DeFi platforms operate in a way that makes them subject to the Commodity Exchange Act. Armstrong wants players in the DeFi space to know their rights, and he is far from the only one.

StoneX may have opted to accept the charges hurled at it and settle with the regulators. But time will tell how many DeFi and crypto-oriented firms choose that path rather than a legal showdown.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.