US Securities and Exchange Commission (SEC) Crypto Assets and Cyber Units head David Hirsch has confirmed the agency is pursuing action against several firms. In addition to centralized companies like Coinbase and Binance, the agency has not ruled out prosecuting decentralized finance (DeFi) platforms.

Speaking at the Securities Enforcement Forum Central in Chicago, Hirsch said the label of “DeFi” is not going to deter them from doing their work. However, he admitted the agency does not have the resource to prosecute all tokens it thinks violate current securities laws.

SEC’s History in DeFi Enforcement

The SEC’s first action against a decentralized finance platform charged two Floridians, Gregory Keough, Derek Acree, and their company Blockchain Credit Partners for selling two tokens as unregistered securities. The business partners agreed to cease operations and pay disgorgements worth $12,849,354, as well as $125,000 in penalties.

At the time, the SEC’s head of prosecuting complex financial products, Daniel Michael, said:

“The federal securities laws apply with equal force to age-old frauds wrapped in today’s latest technology.”

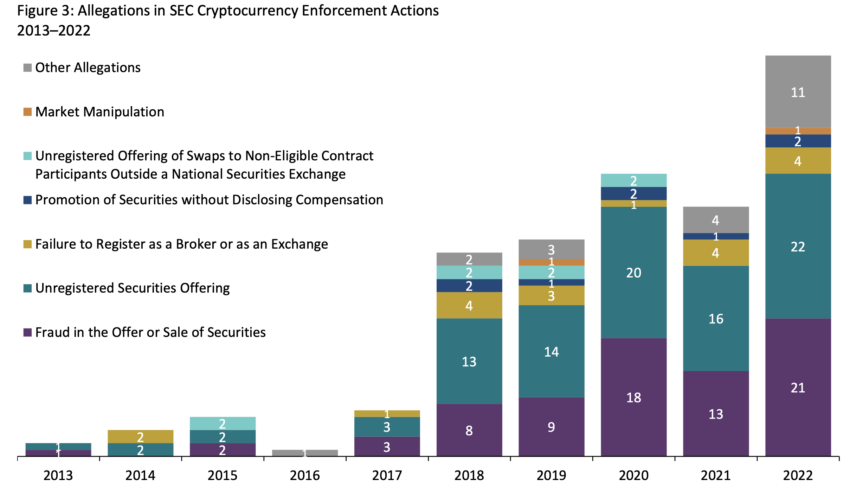

In 2022, most of the agency’s enforcement actions were against Initial Coin Offerings. Crypto projects use ICOs to sell new tokens to raise funds, an activity the SEC labels an unregistered securities offering.

More recently, the SEC filed actions against LBRY, a decentralized content creation and sharing platform, as well as Richard Heart, the founder of the PulseChain ecosystem. It won litigation against LBRY after courts ruled its LBC token was an unregistered security.

Find out here the core differences between DeFi differs and centralized finance.

SEC Suggests Binance and Coinbase Were Just the Start

Unlike like enforcements against traditional firms, who typically rush to settle with the agency, crypto companies often choose to litigate. This puts a strain on the agency’s enforcement resources, Hirsch said.

Review a list of Binance alternatives here.

Earlier this year the SEC sued Binance for allegedly deceiving regulators and mismanaging customer funds. It later filed an enforcement action against Coinbase for operating as an unregistered broker-dealer.

According to Hirsch, it is investigating intermediaries for crypto investors, including brokers, dealers, exchanges, clearing agencies, “or any others who are active in this space,” falling under its jurisdiction. It is looking at entities who have failed to meet investor disclosure and regulatory requirements.

Got something to say about the SEC commitment to pursuing DeFi enforcement, its lawsuits against Binance and Coinbase, or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.