The Bank of International Settlements (BIS) has delineated how the introduction of central bank digital currencies (CBDC) could bring about new risks.

“Since risks change, this is not a one-off action but needs to take place on a recurrent basis,” the report declared.

Central Banks Must Adapt Approach to Acknowledge CBDC Risks

The recent report states that the BIS suggests central banks should view CBDCs not merely as a more efficient digital form of money. However, central banks should see it as a fundamental operational shift in the daily conduct of transactions:

“Given the major implications of issuing a CBDC, this should not be considered to be a technological project but rather a fundamental change in the way that the central bank operates.”

However, it emphasizes the necessity of implementing a comprehensive risk management framework for the CBDC model.

“The multi-faceted nature of the risks calls for an integrated risk management framework to inform the design of a CBDC model and to manage risks throughout its lifecycle.”

Meanwhile, the report proposes that maintaining continuous surveillance on CBDCs and adjusting plans as necessary will be essential.

“This requires the development of robust business continuity plans to ensure the reliability and continuity of services based on possible scenarios and threats, throughout the full (digital) currency cycle.”

Read more: Digital Rupee (e-Rupee): A Comprehensive Guide to India’s CBDC

BIC Chief Advocates for a Unified Global Set of Rules

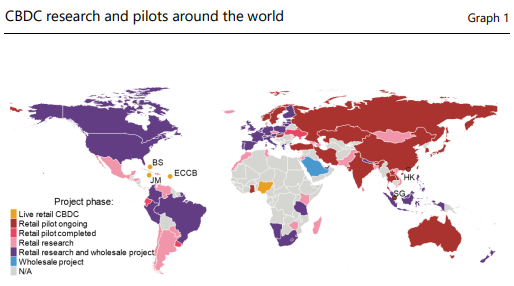

Meanwhile, this comes after the BIS Chief, Augustin Carstens, underscored the importance of nations collaborating to establish a set of consistent rules for CBDCs.

Furthermore, he emphasizes the importance of a successful implementation of CBDCs. He explains this involves not only technological advancements but also necessitates a sophisticated legal framework:

“Money is a social construct. People trust in it today because they know others will trust in it tomorrow. The legal framework is a key underpinning for the legitimacy of money, and the trust that people place in money. Without the law, money cannot function.”

Read more: How To Open a Bitcoin Account in 3 Easy Steps

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.