The Bank for International Settlements’ (BIS) Chief, Augustin Carstens, has recently emphasized the urgent need for nations to collaborate on crafting an interoperable set of rules for central bank digital currencies (CBDCs).

As the world shifts towards digitalization, CBDCs could cater to the public’s demand for digital, programmable money, enabling faster, safer, and cheaper cross-border transfers, thereby driving innovation in the financial system.

BIS Chief’s Push for a CBDC Regulatory Framework

In a recent speech, Carstens highlighted the importance of central banks in providing money for society, primarily through cash and central bank reserves. He noted,

“Currently, these account for only a small share of the money used by the public. The bulk of it consists of commercial bank money, in the form of bank deposits.”

Central banks play a crucial role in maintaining the public’s trust in money, thereby ensuring the safety and value of money.

However, the current monetary system needs to evolve to meet the changing demands of users. With the decline in cash use and the rise in digital services, people are seeking new forms of money that are digital and programmable. They also expect their money to be easily transferable across borders.

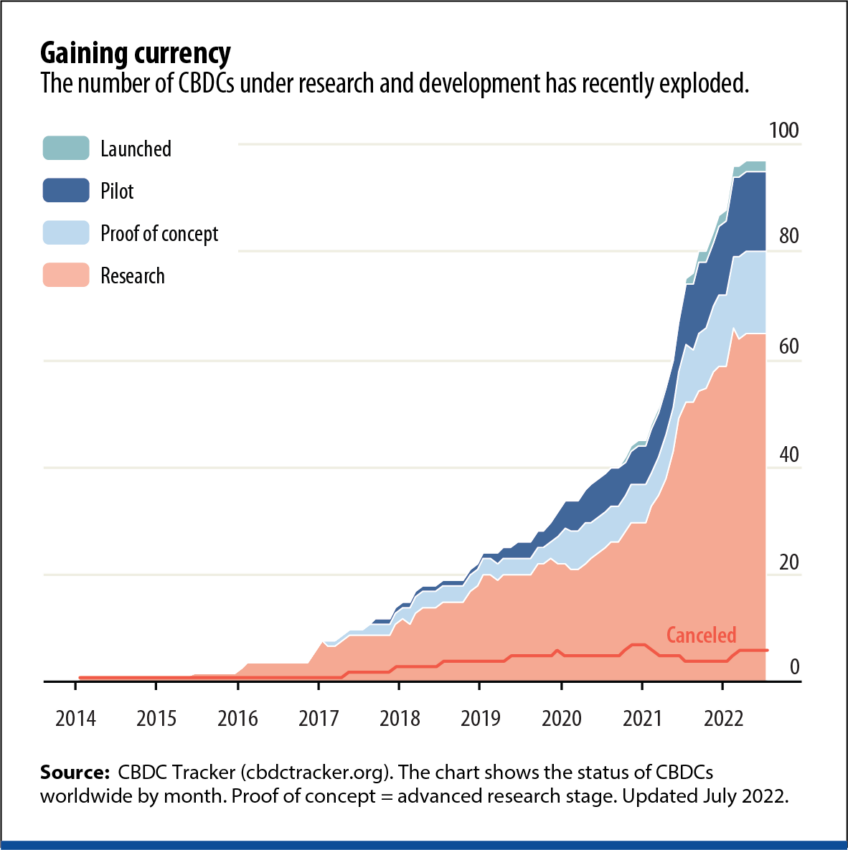

Addressing these demands, central banks worldwide are exploring how CBDCs could fit the bill. In 2022, 93% of central banks engaged in some form of CBDC work. More than half were running concrete experiments or working on pilots by July 2022, according to IMF data.

Interoperability and Privacy Need to Be Top Priorities

However, implementing CBDCs is not just about technology; it also requires an advanced legal framework. As Carstens pointed out,

“Money is a social construct. People trust in it today because they know others will trust in it tomorrow. The legal framework is a key underpinning for the legitimacy of money, and the trust that people place in money. Without the law, money cannot function.”

This legal framework for CBDCs must ensure legitimacy, privacy, integrity, and choice. It should also be firmly grounded in the law and include clearly defined rights and obligations. Most importantly, it should preserve the privacy of CBDC users and the protection of their data.

In a recent UK survey, citizens expressed fears about surveillance and financial stability risks associated with a government-issued digital currency.

All in all, these are complicated and delicate points that must be addressed in a productive way. Without them, the widespread adoption of a CBDC is unlikely.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.