Ripple Labs has released its new XRP Ledger-based central bank digital currency (CBDC) platform to connect governments and banks.

The new ledger technology will enable wholesale and retail CBDC transactions, as well as stablecoin architectures amid a global push towards digital payments.

Ripple Onboards Palau and Montenegro Governments

Central banks can use the CBDC platform to control digital money flow through minting, distribution, redemption, and destruction mechanisms. Ripple claims its ledger technology is 120,000 times more efficient than traditional proof-of-work blockchains.

Palau’s government agreed to use the new CBDC ledger for its national digital currency.

James Wallis, the vice president of Ripple’s central bank business, said the new technology would enable instant settlement of cross-border and domestic payments.

The firm has partnered with SBI Remit to allow cross-border transfers between Japan and Thailand.

In April, the Central Bank of Montenegro also announced a partnership with Ripple to pilot its CBDC “to maintain an efficient financial system.”

Bhutan’s central bank confirmed its CBDC partnership with Ripple in 2021 to financially include 85% of its population by 2023.

Ripple Labs still faces uncertainty from U.S. regulators insisting that XRP is a security.

The U.S. Securities and Exchange Commission (SEC) sued Garlinghouse and Ripple co-founder Chris Larsen for earning millions of dollars through XRP’s sale as an unregistered security. Litigation around the allegations has cost the company roughly $200 million.

This weekend, a meeting of the G7 leaders will likely include discussions around a unified policy framework for CBDCs. The International Monetary Fund and the World Bank Group will launch a CBDC handbook at a meeting later this year.

CBDC Push Could Kill Cash and Privacy, Critics Argue

Not everyone is thrilled about the emergence of central bank digital currencies, though.

The state of Florida recently banned CBDCs to protect residents’ privacy. Bitcoin investor Kevin O’Leary said that such concerns are unfounded since the U.S. government can already surveil transactions.

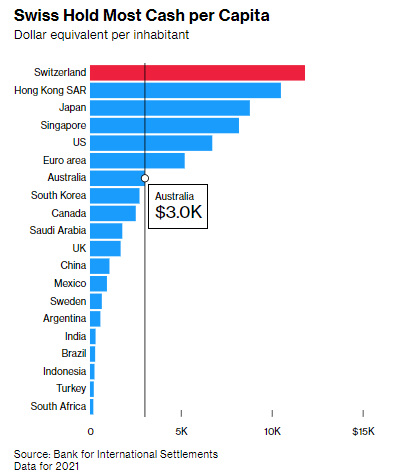

However, a CBDC could forcibly reduce the use of physical cash and its accompanying anonymity.

Swiss citizens recently triggered a plebiscite to strengthen the constitutional importance of cash to curb the spread of digital currencies.

The central bank argues that demand for a retail CBDC would force the central bank to expand its balance sheet and assume more risk.

Federal Reserve Governor Christopher Waller said last year that a migration to a digital dollar would do little to influence a company’s choice to transact with the U.S. He also cited concerns around money laundering that a CBDC may not easily overcome.

“The technological advantages of a U.S. CBDC would have a hard time overcoming long-standing payments frictions without violating international financial integrity standards.”

Ripple’s CBDC platform launch dovetails with its offensive to end the crypto winter and expand its international presence. The payments platform announced it bought Swiss crypto custody firm Metaco using assets on its balance sheet on Wednesday.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.