DeFi offers a shot at a real parallel financial system. But how easy is it to go bankless in 2023?

One of cryptocurrency’s benefits is that it lays the foundation for an entirely novel financial system. When Bitcoin launched in 2009, it offered the world’s first unmediated currency. As crypto caught on and decentralized finance (DeFi) arrived on the scene, everything changed.

DeFi allowed users to leverage blockchain technology to lend and borrow and participate in financial products like insurance and derivatives. It also opened up finance to millions of people around the world who were unbanked. Most of them are in the global south.

In theory, it opened up the world to a parallel financial system. One where you didn’t need a traditional bank to conduct most of your financial activity. So what if you wanted to travel in the opposite direction? What if you wanted to go “bankless?”

Going Bankless

The term “going bankless” refers to a philosophy that aims to curb reliance on the traditional banking system. (Often known as “TradFi” in crypto parlance.)

By going bankless, proponents say, you can take back control of your finances. Many of TradFi’s critics argue that it is too powerful. Going Bankless is a way of taking back that power and avoiding surveillance.

“Going bankless with crypto and DeFi is becoming increasingly attractive. Particularly for those who recognize many of the glaring issues offered by centralized finance and big tech,” Al Morris, CEO of Koii Labs and Chief Architect of the Koii Network, told BeInCrypto. “As the market matures and on/off ramps become more accessible, the challenges of avoiding traditional finance are gradually diminishing.”

Recent troubles in the banking sector have also given fence-sitters more reasons to make the move. The early months of this year have seen the biggest bank crisis since the 2008 financial crash. Signature Bank, Silvergate, Silicon Valley Bank, and Credit Suisse all collapsed amid the turmoil.

“Resources, guidance, and trusted partners in the industry are much easier to come by today than five years ago for investors looking to ditch TradFi,” continued Morris. “At a time when the TradFi market is so uncertain, inflation is ramping up, and banks are failing, there is a window of opportunity for DeFi products to emerge as a credible alternative to the status quo.”

Privacy and Sovereignty

Privacy and financial sovereignty are particularly appealing benefits of DeFi over TradFi. In one 2022 poll, 93% of Americans considered it important to be able to control who could access their personal data. This looks to be a growing concern over coming years and decades. 61% of individuals who are active about their privacy are under the age of 45.

“Adopting a bankless lifestyle allows individuals to escape the privacy limitations imposed by traditional finance and reduces the risk of privacy breaches or invasive monitoring,” continued Morris. “Moreover, DeFi platforms offer access to innovative financial products and services that have the potential for higher yields and greater flexibility than traditional counterparts.”

Morris believes it is likely that, as the crypto ecosystem further evolves and regulatory frameworks become clearer, more people, especially those with a skeptical view of big tech and fiat currencies, will explore DeFi.

Going Bankless Is Hard

However, not everyone is bullish on the idea that you can totally disconnect from the traditional financial system. “Going 100% bankless is impossible today,” Stefania Barbaglio, CEO of Web 3 consultancy agency Cassiopeia, told BeInCrypto.

“Perhaps the situation is different in El Salvador, where you have a prime minister and the government at large supporting Bitcoin adoption,” Barbaglio continued.

“However, in other countries such as the UK, the challenge is actually keeping the bridge between Defi and Tradfi. Most of the banks do not like crypto and could even choose to block your transaction to a crypto platform, or even start questioning and investigating your reasons behind transactions as if there were something to hide.”

There is also the simple matter of complexity. For the Average Joe, the world of DeFi is impenetrable. Even crypto natives, who are used to dealing with wallets and exchanges, can find learning about DeFi difficult.

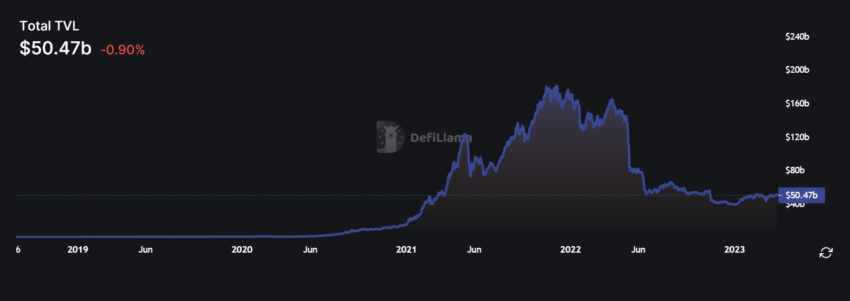

Its popularity can also ebb and flow with the crypto markets. The total value locked (TVL) in decentralized finance peaked in late 2021, according to DefiLlama. (Around the same time that the crypto markets peaked.) It is also more vulnerable than the traditional system. Many experts feared that the depegging of USDC last month threatened to destroy DeFi altogether. At the moment, the system is far too fragile and centralized to take systemic shocks.

“The crypto market is simply more efficient,” said Barbaglio, on a more optimistic note. “That’s why it has so many converts (from traditional banking systems) and is going mainstream. There are crypto-friendly banks that provide an on- and off-ramp crypto bridge, which is super.”

“However, the fact remains that going completely bankless isn’t easy. Especially because most retailers do not accept crypto. You cannot yet go to Tesco and pay for your shopping directly with a Metamask wallet. You might be able to do it with the Coinbase card, depending on where you are in the world, but the fees are enormous and simply don’t make sense. As a former young model fashionista, I was glad to hear that Balenciaga, Gucci, and Farfetch are accepting crypto. More should follow their example,” Barbaglio concluded.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.