Last week, the Bitcoin (BTC) price reached a weekly close above a critical resistance level.

Despite the bullish close, there are short-term signs of weakness developing. Will the last week of 2023 be bullish or bearish?

SponsoredBitcoin Closes Above Resistance

The BTC price has been on an upward trend since the start of the year. Bitcoin increased by 160%, leading to a new yearly high of $44,700 on December 8.

The high was made above the 0.5 Fib retracement resistance level. However, it is unclear if BTC has broken out since the price closed below the area next week and then again above the week after.

This movement adds uncertainty to whether the trend is bullish or bearish.

Market traders use the Relative Strength Index (RSI) as a momentum indicator to identify overbought or oversold conditions and to decide whether to accumulate or sell an asset.

Readings above 50 and an upward trend indicate that bulls still have an advantage, whereas readings below 50 suggest the opposite.

The RSI is increasing and is above 50, both signs of a bullish trend.

Sponsored SponsoredRead More: Where To Trade Bitcoin Futures

What Do the Analysts Say?

Cryptocurrency traders and analysts on X have a bullish outlook on the future trend.

CredibleCrypto believes that the Bitcoin price will continue to increase because of the workings between spot and futures buyers.

For his reasoning, he noted the increase in spot buying on Coinbase, the reset of funding, and the decrease in open interest.

James Van Straten believes that BTC will reach $500,000 this cycle. This is because it has outperformed the previous cycles so far. He tweeted:

“One of the reasons I think #Bitcoin will get to 500k a coin this cycle. Is it currently outperforming the 2015 to 2018 cycle and the 2018 to 2022 cycle from the low. The peak of the 2015 to 2018 cycle was 11,000% While the peak of the 2018 to 2022 cycle was 2,000%. The ETF will break the diminishing returns this cycle.”

Finally, Rekt Capital is bullish because of the halving narrative.

Read More: How To Open a Bitcoin Account

BTC Price Prediction: Will 2023’s Final Week be Bullish?

Technical analysts employ the Elliott Wave theory to identify recurring long-term price patterns and investor psychology, which helps them determine the direction of a trend.

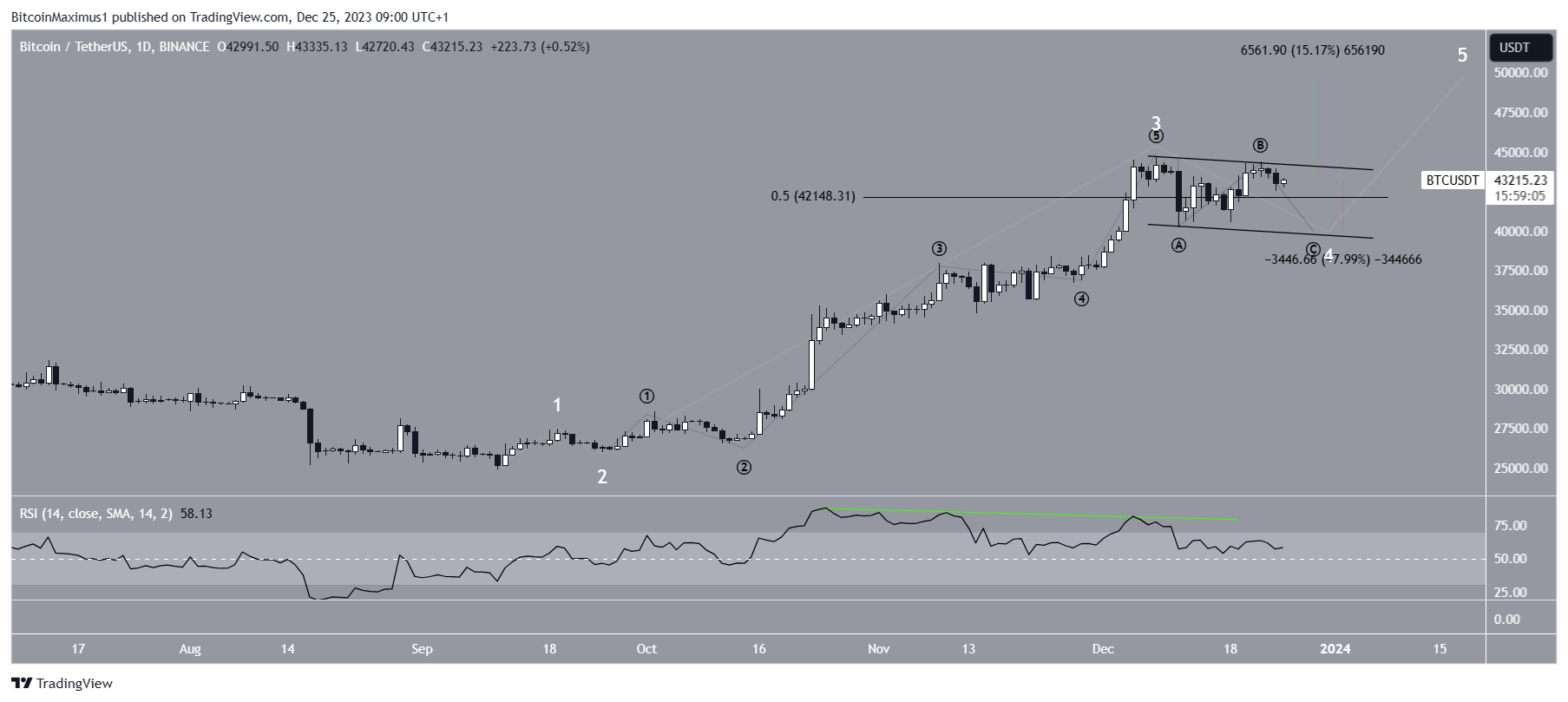

The most likely count suggests that the BTC price has completed the third wave of a five-wave upward movement (white) that started in September and is now correcting. The sub-wave count is shown in black.

This count is supported by the bearish divergence in the daily RSI (green), indicative of a local top.

If the count is correct, the BTC price will decrease to the closest support at $40,000 and complete its correction before moving to the next resistance at $50,000 to complete the entire upward movement.

Despite this short-term bearish BTC price prediction, a breakout from the short-term channel will mean the correction is already complete. The Bitcoin price could then immediately increase to the $50,000 resistance, 15% from the current price.

For BeInCrypto’s latest crypto market analysis, click here.