Ethereum (ETH) co-founder Vitalik Buterin was spotted moving 600 ETH worth approximately $1 million into a Coinbase exchange wallet on Monday, August 21. Historical on-chain data examines how ETH price could react to this noteworthy transaction.

On Monday, August 21, an 0xd8d wallet address linked to Vitalik Buterin’s Ethereum Name Service (ENS) pseudonym —Vitalik.ETH was spotted moving 600 ETH, worth $1.01 million, into a Coinbase wallet. The wallet now holds only 3,935 ETH ($6.57 million) at the time of writing.

When large crypto investors move bits of their holdings into an exchange wallet, it typically means they are looking to cash out into fiat or trade in for other tokens.

On-chain data analysis explores how previous noteworthy outflows by Vitalik have moved the market to project how ETH prices could potentially react in the coming days.

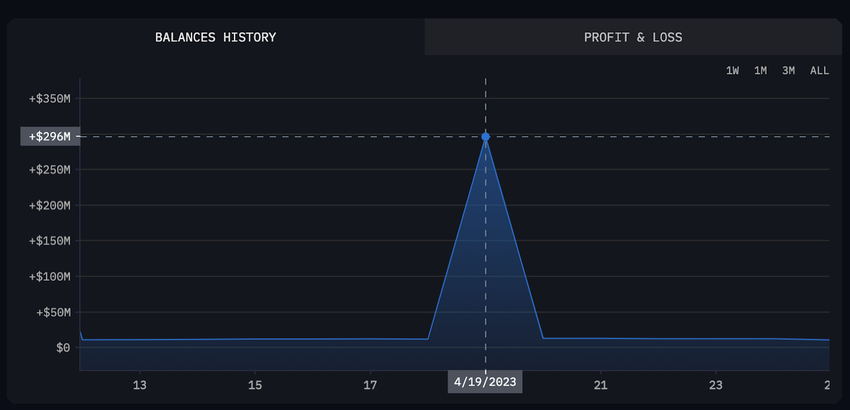

Ethereum Price Declined 13% After Vitalik Sold In April

Large transactions from recognized high-net-worth holders and influential figures like Vitalik Buterin often influence the markets significantly. Historical data culled from Arkham Intelligence shows how Ethereum’s price sank by 13% barely a week after Vitalik made a significant outflow in April.

As shown in the chart below, Vitalik had moved out a whopping $283 million worth of ETH on April 19. Interestingly, ETH price began to wobble within just 48 hours and later declined 13% from $2,102 to $1,840 by the close of April 25.

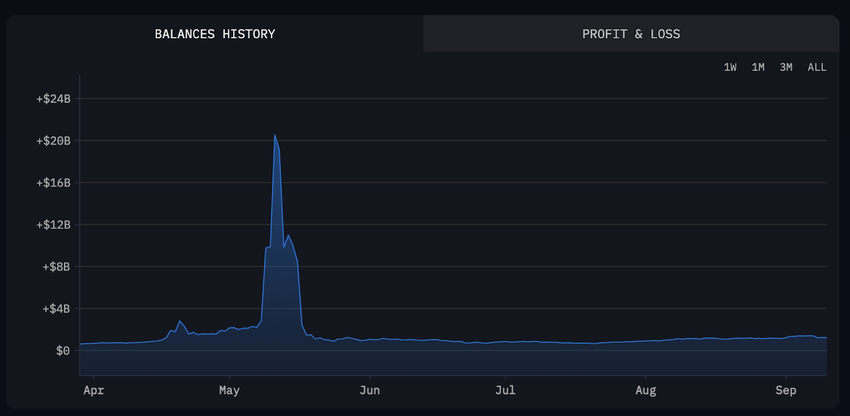

Also, back in 2021, Vitalik’s alternate 0Xabf address, which currently holds 248,027 ETH (~$415 million), exhibited a similar premonitory pattern.

On November 5, 2021, Vitalik moved out a total of $19.5 billion worth of ETH over an eventful period of two weeks. That period coincided with Ethereum losing its all-time high of $4,890, which it hasn’t reclaimed ever since.

Crypto Traders Yet to React to Vitalik’s Outflow

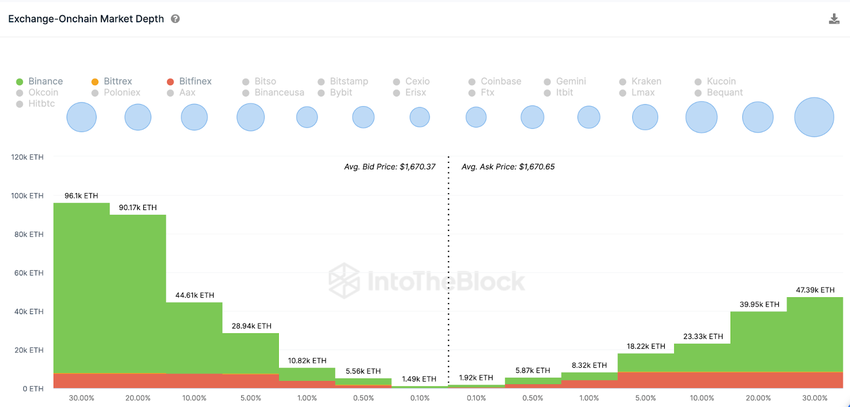

At the time of writing, 12 hours after Vitalik’s most recent noteworthy $1 million transaction, Ethereum traders are yet to make significant reactionary moves. According to IntoTheBlock‘s aggregate Exchange On-chain Market Depth, the bulls still dominate ETH trading orders’ balance.

As depicted below, the bulls currently have the upper hand with 277,690 ETH buy orders, towering above the bears’ 145,000 ETH sell orders.

The Exchange On-chain Market Depth chart shows the real-time price distribution of active Ethereum orders placed across recognized crypto exchanges.

As seen above, the “Buy/Ask” wall is significantly higher “Sell/Bid” side by nearly 132,700 ETH orders. This shows that Ethereum market demand remains steady despite Vitalik’s noteworthy $1 million cash out.

In summary, strategic investors will be looking for further notable transactions on Vitalik’s addresses and Ethereum Foundation wallets.

ETH Price Prediction: Slow Recovery to $1,800

Ethereum price could react to Vitalik’s latest outflow with gradual higher lows toward $1,800 as the market FUD subsides.

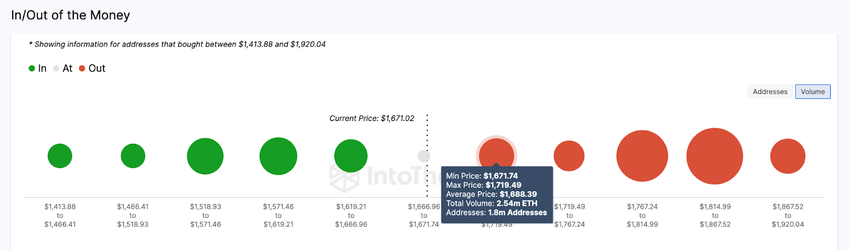

The In/Out of Money Around Price data, which shows the price distribution of current holders, also validates this mildly-positive prediction.

However, the 1.8 million addresses bought 2.54 million ETH at the maximum price of $1,720, which will offer initial resistance. But, if a bullish momentum grows, the strategic traders could promptly raise their bids, pushing the ETH price toward $1,800.

Conversely, the bears could push the ETH price below $1,600 if Vitalik Buterin makes more outflows in the coming days.

But, as shown above, 1.88 million addresses had bought 2.2 million ETH at the average price of $1,620. They could offer considerable support if they HODL.

However, ETH could slide toward the $1,500 if that support level folds.

Looking For a New Exchange? These Are the Best Crypto Sign-Up Bonuses in 2023