Bitcoin (BTC) is decreasing but attempting to create a higher low.

XRP (XRP) might have finished its corrective wave.

Ethereum (ETH) is retesting its previous breakout levels as support.

Stellar (XLM) and Dash (DASH) are trading inside horizontal ranges.

Binance Coin (BNB) has been increasing since breaking out from a symmetrical triangle.

Tron (TRX) has broken down from an ascending support line.

BTC

BTC is following a short-term descending resistance line. The line has been in place since the all-time high price of April 14.

So far, BTC has unsuccessfully attempted to break out thrice.

At the current time, the price is attempting to find support and create a higher low.

The two closest support levels are created by the 0.618 and 0.786 Fib retracement levels, found at $53,416 and $52,300 respectively.

Technical indicators are gradually turning bullish. Both the MACD & RSI are increasing.

Therefore, BTC is expected to create a higher low and gradually begin to move upwards.

ETH

ETH has been increasing since breaking out from the $1970 area on April 2. The upward move continued until the token reached a new all-time high price of $2549.

Since then, it has been moving downward. On April 18, it reached the $1970 area once again, where it initiated a bounce.

Technical indicators are neutral, failing to confirm the direction of the trend.

Despite this, the trend can be considered bullish as long as ETH is trading above this area.

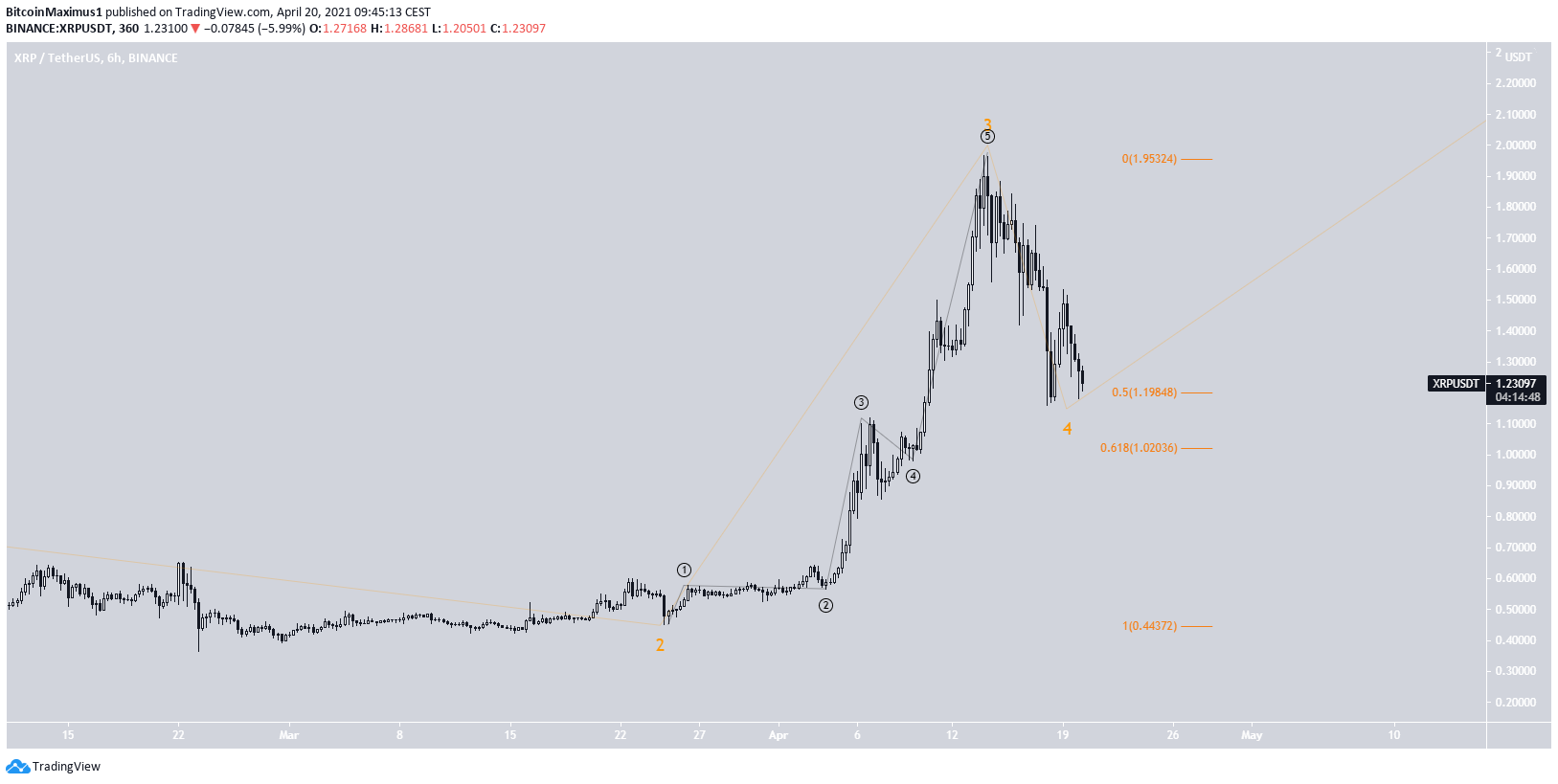

XRP

XRP has been moving downwards since April 14. This potentially marked a short-term top.

It is likely the top of wave three (orange), which was reached at the 1.61 Fib projection of sub-waves 1-3 (black).

XRP is currently in correction and has reached the 0.5 Fib retracement level at $1.36.

While it could drop to the 0.618 Fib level at $1.02, it is expected to begin an upward move towards $2 soon.

XLM

XLM has been moving downwards since April 14, when it reached a high of $0.69. The token fell through the $0.58 area, which was expected to act as support.

Afterward, it fell all the way to the $0.45 level. This is the previous resistance area and is now expected to act as support.

Therefore, XLM is likely to trade in a range between $0.45-$0.58.

DASH

The price movement of DASH is very similar to that of XLM. The token has been decreasing since April 17. It has fallen below the $330 area, which was expected to act as support.

Afterwards, it reached the previous breakout level at $255 and bounced.

Currently, it is trading inside a range between $255 and $330.

BNB

BNB has been moving upwards since breaking out from a symmetrical triangle on March 30.

The upward movement continued until a high of $638 was reached on April 13. This was made right at the 2.61 external Fib retracement of the previous decrease.

BNB has reached the 0.5 Fib retracement support at $431. The next support is found at $382, the 0.618 Fib level.

As long as BNB is trading above at least one of these areas, the possibility of continuation remains high.

TRX

TRX has been moving downwards since April 17. Shortly afterward, it broke down from an ascending support line.

While it has decreased considerably since, there are bullish reversal signs.

Both the MACD & RSI have generated bullish divergence.

Therefore, a bounce is expected, which could take TRX back to the ascending support line.

For BeInCrypto’s latest bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.