Binance (BNB) price has failed to break above the $315 resistance since dropping below the milestone on May 8. This week BNB’s price declined below $310 to stretch the May 2023 losses to 9%. On-chain data suggest investors could make negative BNB price predictions as crypto whales begin to sell.

On Friday, May 12, Binance announced it was “proactively” ending trading activity in Canada. This negative social sentiment was further reinforced when the Australian arm of the top-ranked cryptocurrency exchange alerted customers about potential banking and on-ramping issues on May 18.

As TradFi regulators and authorities continued to crack down on crypto exchanges globally, the Binance coin (BNB) price has taken a hit. BNB on-chain data indicate a concerning level of deterioration in certain critical fundamental metrics.

BNB Chain is Losing Traction

Earlier this month, media outlets reported how Binance’s spot trading declined for the second consecutive month. It now appears that this negative trend is also spreading across the BNB chain blockchain network.

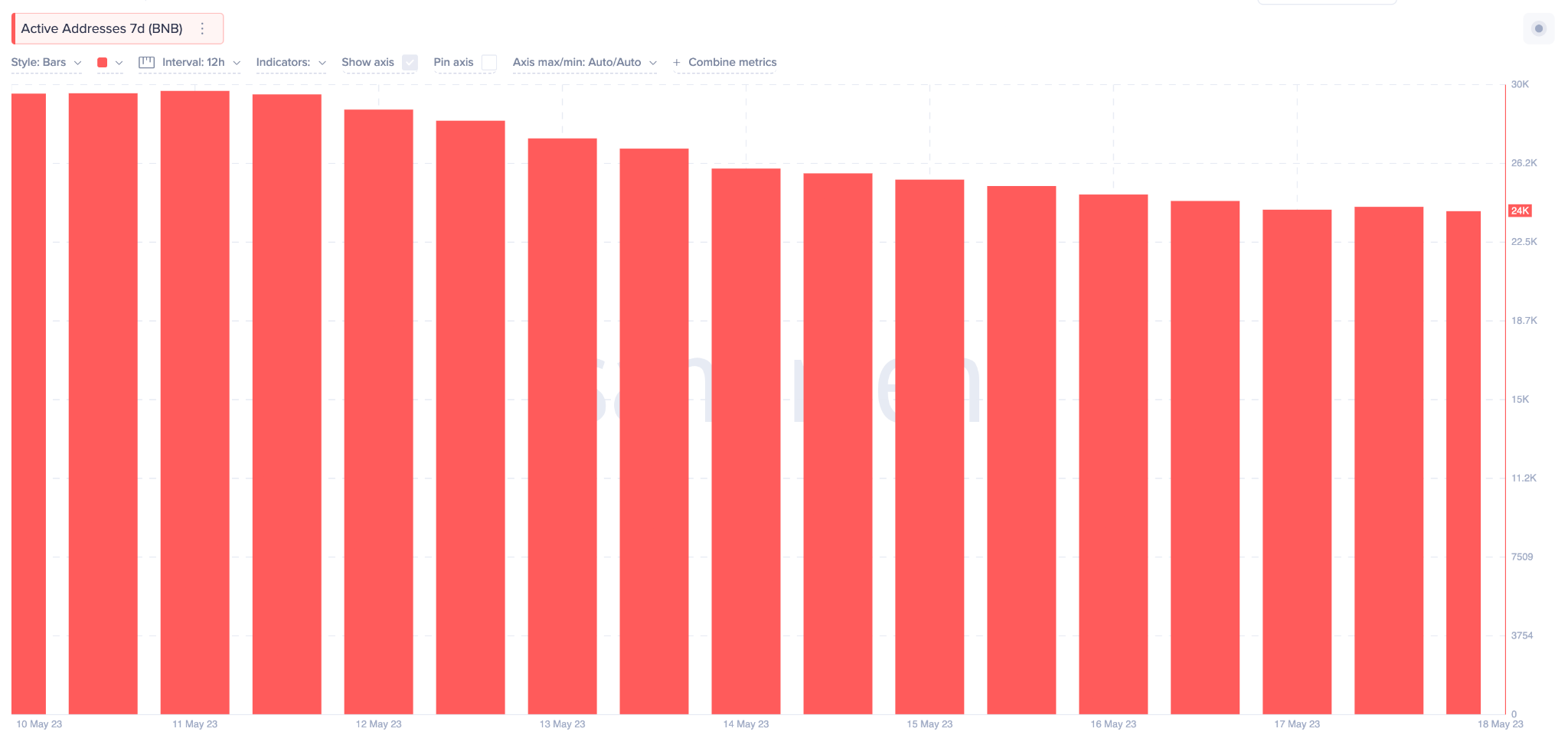

The Santiment chart below illustrates how the BNB daily Active Addresses (7d) have declined persistently since May 10. Between May 10 and May 19, it dropped 19% from 29,609 to 24,009 active addresses.

The Active Addresses (7d) metric takes a seven-day average of the unique wallet addresses carrying out transactions on a blockchain network. And when it decreases, as seen above, it signals that the network is losing market share to competitors.

If the Binance-backed blockchain network is unable to find new demand, BNB holders can anticipate more price downswing.

Whales are Growing Pessimistic

In response to the negative market sentiment, large institutional investors across the BNB network are taking bearish positions. The chart below shows how whales holding balances of 10,000 to 100,000 BNB coins have been offloading since the start of May.

This week, between May 13 and May 19, they sold off another 160,000 BNB.

Whales are large investors holding at least $100,000 worth of cryptocurrency. Due to their disproportionately huge financial clout, their buy/sell patterns can considerably impact price.

At the current BNB market price of $309, the coins sold are worth approximately $50 million. If the whales’ sell-off frenzy continues, it could exacerbate the negative impact of the bearish market sentiment.

To conclude, the drop in network activity and crypto whales taking bearish positions are valid reasons to make bearish BNB price predictions.

BNB Price Prediction: $300 Pullback Looks Likely

According to the prevailing on-chain signals, the bears might force a BNB price pullback toward $300 in the coming days.

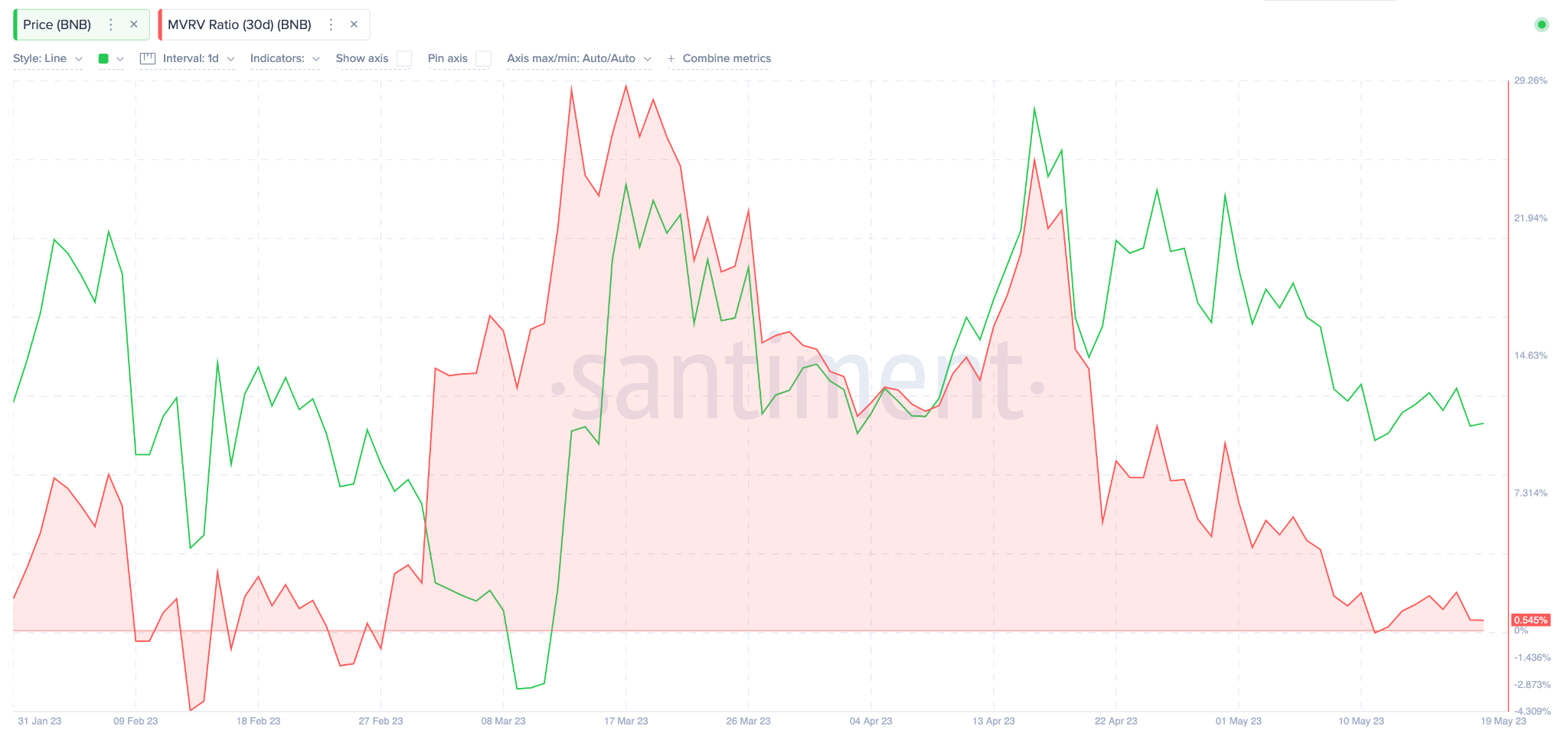

Despite the recent price retracement, Santiment‘s Market-Value to Realized-Value (MVRV) data indicates that most crypto investors that bought Binance Coin within the past month are still holding profits of around 1%.

Historical trading patterns suggest BNB holders will likely keep selling until the price declines by another 3% toward $300.

And if the Binance Coin bearish price prediction plays out, it could drop 3% further, toward the $290 zone, before they cut their losses.

Conversely, the bulls could still flip the narrative if the price rises by another 2%. Nevertheless, investors looking to break even at the $315 zone could mount a roadblock inadvertently.

Otherwise, Binance could rise much higher toward the next significant resistance level at $325.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.