BlackRock, the global investment giant, has made a strategic decision to steer clear of launching a Ripple XRP ETF (exchange-traded fund).

The primary reason behind this decision hinges on the ongoing regulatory ambiguity surrounding XRP.

No Plans to Launch Ripple ETF

According to Fox Business senior reporter Charles Gasparino, BlackRock’s opposition to an XRP ETF lies in the ongoing Securities and Exchange Commission (SEC) vs Ripple lawsuit. Judge Torres’ recent classification of XRP as a “regulatory gray area” – not squarely fitting into the security or non-security category – adds layers to this complexity.

This legal ambiguity poses a significant challenge for financial institutions. Indeed, these prioritize regulatory compliance and risk management in their operations.

Still, Ripple CEO Brad Garlinghouse maintains SEC Chair Gary Gensler is a “political liability.” Garlinghouse’s strong words reflect the tensions between the crypto industry and regulatory bodies. It highlights the latter’s influence on the market and institutional decisions.

“I do think the chair of the SEC, Gary Gensler, is a political liability in the United States. And I think he’s not acting in the interests of the citizenry, he’s not acting in the interests of the long-term growth of the economy, and I don’t understand it,” Garlinghouse said.

XRP Price Could Fall Off a Cliff

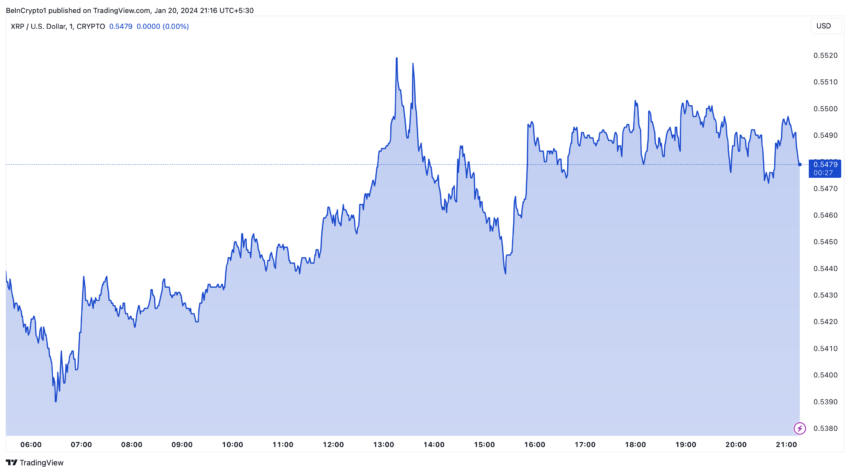

The market sentiment around XRP further complicates BlackRock’s position. Technical analyst Ali Martinez noted the cryptocurrency’s struggle to maintain the crucial support level at $0.55.

A breach below this level could trigger a substantial sell-off, potentially driving the XRP price to $0.34. Such volatility underscores the risk factors institutions like BlackRock must consider when exploring crypto-related products.

“XRP is currently grappling to maintain its footing at the crucial $0.55 support level. Should this support fail to hold, be prepared for a possible sell-off scenario that could see XRP descending toward $0.34,” Martinez said.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

BlackRock’s decision reflects a broader trend of caution among major financial players in the crypto space, especially regarding assets embroiled in regulatory disputes. Their stance reflects their commitment to adhering to regulatory frameworks and ensuring investor protection.

As the Ripple-SEC saga continues, it serves as a pivotal case for the crypto industry, potentially setting precedents for how digital assets are treated under US law. Until more clarity and stability in the regulatory environment, major institutions will likely remain on the sidelines.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.