In 2023, the financial markets presented a series of unexpected turns, with groundbreaking technological innovations and unexpected economic shifts. As 2024 begins, BlackRock has identified three macro developments that could significantly influence the crypto market.

These insights are crucial for investors seeking to navigate the digital assets industry and make informed decisions.

What Happened in 2023 and Future Implications

The Unanticipated Strength of the US Economy

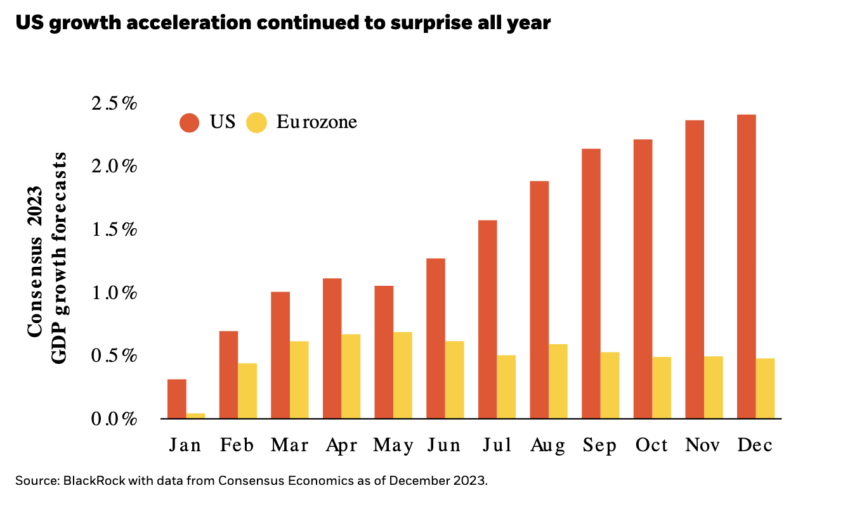

Contrary to the anticipated “hard or soft landing” scenarios, the US economy exhibited a surprising growth trajectory throughout 2023.

“The widely debated “hard landing vs. soft landing” for the US economy turned out to be no landing – or maybe even a takeoff. US GDP growth sequentially accelerated all year and continually outpaced expectations,” BlackRock said.

This defiance of expectations, fueled by robust GDP growth and substantial fiscal incentives like the Inflation Reduction Act (IRA) and CHIPS Act, presents a unique backdrop for the crypto market.

Despite high real rates, the US economy’s resilience suggests a potential increase in investor confidence. The confidence could also extend to digital assets. However, the robust US economic performance raises questions about the Federal Reserve’s future monetary policies, which could indirectly impact the crypto market.

The Liquidity Landscape Post-Fed Actions

Initially, a liquidity crunch seemed inevitable as the Federal Reserve’s policy rates were expected to end under 4.5% in 2023. Surprisingly, the rates reached 5.25% after multiple hikes, with an unexpected liquidity expansion following the Silicon Valley Bank concerns.

This divergence in monetary policy, especially in comparison with other countries, resulted in strong US equity returns. This factor could also spill over into the crypto market. The unique liquidity situation in the US may influence investor behavior towards riskier assets, including cryptocurrencies.

China’s Economic Performance and Global Impact

The anticipated global demand surge following China’s exit from COVID lockdowns in early 2023 did not materialize. China’s slide back into deflation and its impact on commodity prices presents a contrasting economic narrative to Japan’s continued reflation and outperformance in equities.

This divergence has implications for the global economic environment and could influence the crypto market, particularly if these trends affect investor risk appetites and global capital flows.

3 Events That May Impact the Crypto Market in 2024

As 2024 begins, BlackRock anticipates a regime of greater macro dispersion and elevated market volatility to persist. This environment, characterized by a positive stock-bond correlation and core inflation remaining above target, poses unique challenges and opportunities for investors in the crypto market.

Key considerations include:

- The Persistence of Inflation: While there’s a desire to believe the “inflation beast” is tamed, services inflation may remain stubborn in 2024. This scenario could affect investor sentiment towards assets like cryptocurrencies, often seen as hedges against inflation.

- The Future of the US Dollar: The potential for downward pressure on the US dollar, given fiscal concerns and the unsustainability of US twin deficits, raises questions about the attractiveness of cryptocurrencies as alternative assets.

- Europe’s Market Potential: The optimistic outlook for European earnings growth and consumer spending could influence the broader economic environment, indirectly affecting the crypto market, particularly regarding global investment flows and risk preferences.

Read more: How To Make Money With Cryptocurrency: Top 4 Ways In 2024

As investors navigate these uncertain waters, the intersection of macroeconomic factors and their impact on the crypto market will be critical to monitor.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.