On Thursday, BlackRock’s iShares Bitcoin Trust (IBIT) experienced its first outflow after nearly four months. Previously, IBIT registered an outflow on May 1.

The week started strong for spot Bitcoin exchange-traded funds (ETFs), with net inflows of approximately $202.6 million on Monday. However, the tide quickly turned, with substantial outflows following closely behind.

BlackRock Records Its Second Outflow Day

On Tuesday, investor withdrawals reached around $127.1 million. Similarly, on Wednesday, funds continued to flow out, totaling approximately $105.3 million.

Despite a slight reduction, Thursday also saw outflows of $71.8 million from the spot Bitcoin ETFs. Notably, BlackRock’s IBIT registered an outflow of $13.5 million, marking a rare occurrence since its inception in January.

The iShares Bitcoin Trust’s performance has been largely resilient amidst market fluctuations. Indeed, Thursday’s activity was only the second instance of outflows since the fund’s launch.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

In contrast, the ARK 21Shares Bitcoin ETF (ARKB) bucked the trend, garnering net inflows of $5.3 million on the same day. Meanwhile, other funds, such as the Fidelity Bitcoin Trust (FBTC), recorded the highest outflow at $31.1 million.

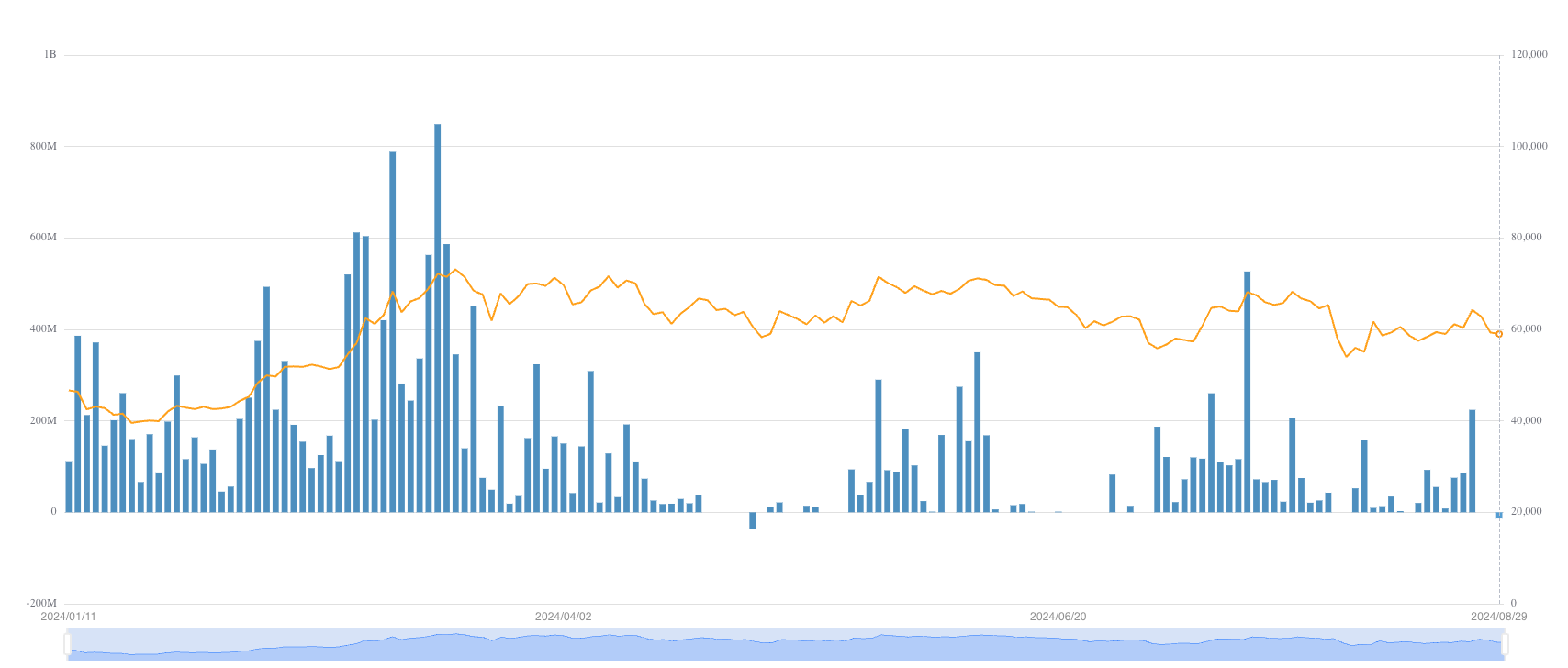

The backdrop to these capital movements is a notable decline in Bitcoin’s price, which has fallen approximately 7.5% since Monday and is currently trading at $59,400. Maartunn, a crypto analyst, emphasized that Bitcoin is testing the average cost basis of the BlackRock Bitcoin ETF for the fourth time.

“Each time a price level is tested, it weakens,” he remarked, highlighting the fragile nature of this support level.

With BlackRock Bitcoin ETF holding about 340,855 BTC, it ranks as the third-largest global holder after the mysterious Satoshi Nakamoto and the leading crypto exchange, Binance. This substantial holding accentuates the significance of the ETF’s average cost basis as a potential market support during downturns.

Moreover, historical performance data paints a grim picture for the upcoming month. According to Coinglass, Bitcoin has consistently underperformed in September, with an average return of -4.78% since 2013, making it the cryptocurrency’s worst month.

Read more: Who Owns the Most Bitcoin in 2024?

Furthermore, the third quarter has often proved challenging for Bitcoin and the broader crypto market. As September looms, investors seem to be positioning themselves cautiously, anticipating the traditional downturn. This strategic shift is evident in the recent outflows from various Bitcoin ETFs, including BlackRock’s iShares Bitcoin Trust.

“The market is showing signs of weakness, with Bitcoin prices continuing to fluctuate and settle at lower levels, marked by insufficient liquidity and reduced volatility. Currently, market investors are largely adopting a wait-and-see approach, likely holding off on making significant moves until major upcoming events unfold, such as the release of US economic and employment indicators or decisions from the Federal Reserve regarding interest rates,” Alvin Kan, the COO at Bitget Wallet, told BeInCrypto.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.