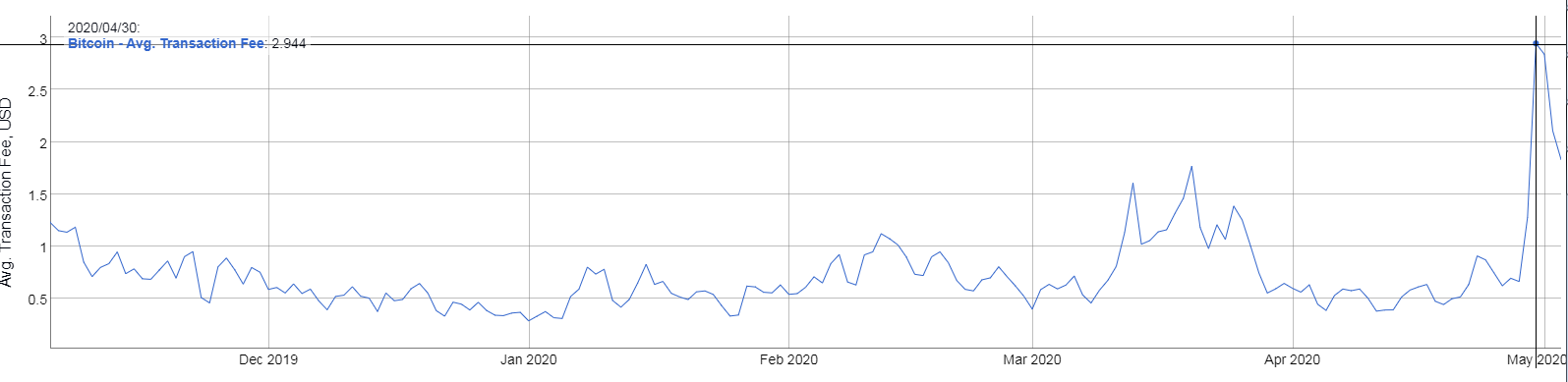

Bitcoin’s transaction fees are currently at a 10-month high as it approaches its third halving, tentatively set to happen on May 12. General buyer interest has increased, as has other indicators showing that the network is experiencing an uptrend in nearly all facets.

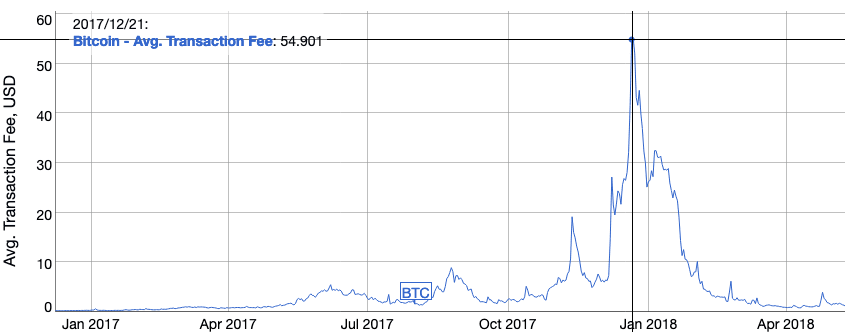

The evident increase in Bitcoin purchases, pushing its price up by nearly $1,500 in a span of two days, has caused the network’s transaction fees to skyrocket by a staggering 450 percent during the same period. A similar trend was present during the late 2017 bull run, with large buyer entry driving transaction fees abnormally high.

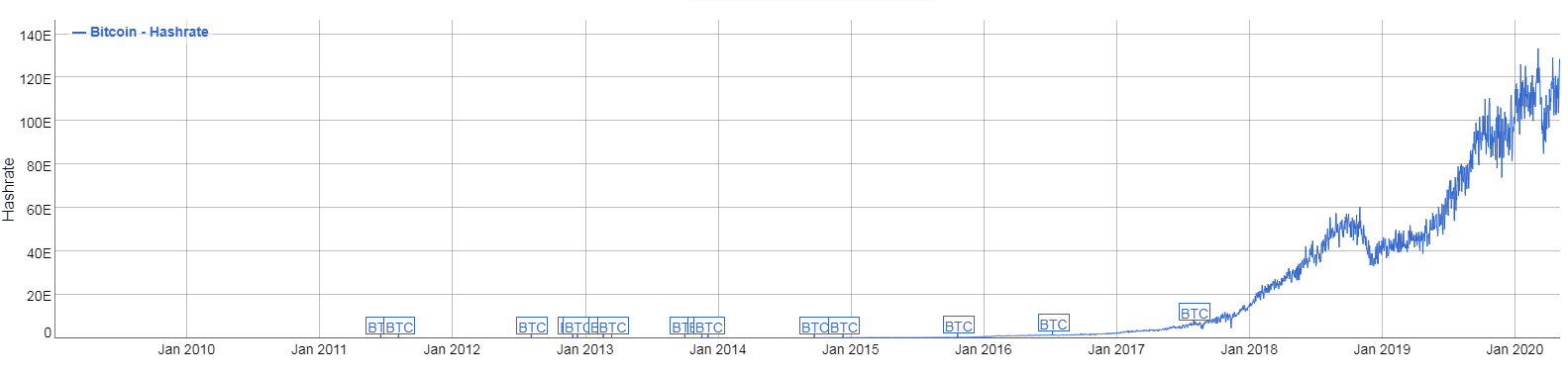

Bitcoin Hashrate, Volumes, and Fees Surge Pre-Halving

However, the halving has already made its presence known, with numerous network indicators pointing to buyers attempting to buy in with the hopes that the block reward reduction event will drive the price up in the medium to long-term. Options trading volumes have risen in April, as has perpetual swaps. A report released last week by TokenInsight shows that enthusiasm for cryptocurrency derivatives remains steady, while a Grayscale Investments report shows encouraging figures for institutional investment.

Halving Mere Days Away

The fervor over the upcoming halving, expected to occur on May 12, has put investors into a high state of anticipation. The halving will reduce miners’ block rewards from 12.5 BTC to 6.25 BTC. The reduction in supply, many believe, will push the price up over time, though past halvings have shown that this rally usually takes a few months to materialize.

The halving, along with the general network developments and influx of investments into the space has brought about increased confidence in cryptocurrencies as an asset class and Bitcoin as a store of value.

The halving will reduce miners’ block rewards from 12.5 BTC to 6.25 BTC. The reduction in supply, many believe, will push the price up over time, though past halvings have shown that this rally usually takes a few months to materialize.

The halving, along with the general network developments and influx of investments into the space has brought about increased confidence in cryptocurrencies as an asset class and Bitcoin as a store of value.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rahul Nambiampurath

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

READ FULL BIO

Sponsored

Sponsored