Bitcoin SV, the product of a second civil war between Bitcoin Cash advocates, has been in the news over the past few days as the coin first briefly flipped its rival Bitcoin Cash. This came shortly after the final keys missing from the billion-dollar Tulip Trust were delivered to Satoshi Nakamoto claimant, Craig Wright. Now, it has been noted that the daily volume for Bitcoin SV came close to reaching its market cap, alerting further suspicions.

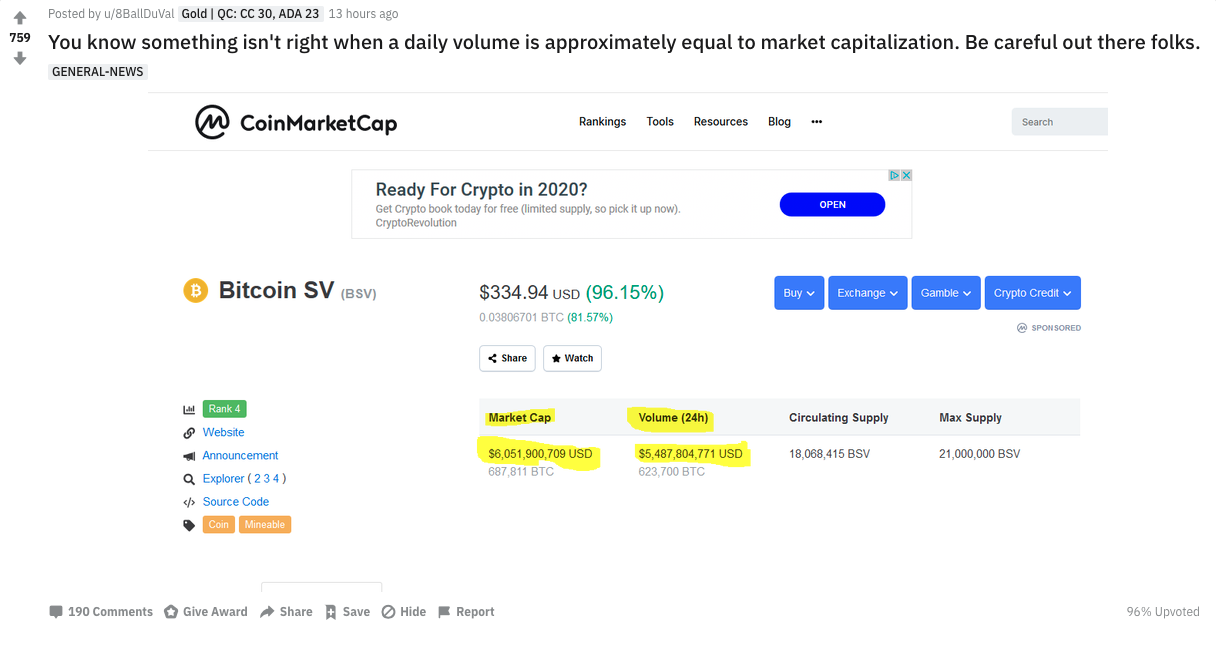

At the time the odd trading volume was spotted, Bitcoin SV had shot up astronomically, nearly doubling in value to sit at $334 with a market cap of $6 billion. However, as spotted by an eagle-eyed Redditor (8BallDuVal), the daily volume was an astonishing $5.48 billion. In context, Bitcoin’s market cap sits at $158 Billion with its latest 24-hour volume less than a third of that at $45 billion.

This trading volume should be seen as a red flag, but for what is up for debate. CoinMarketCap has been at the center of fake trading volume scandals before, although it is attempting to address this. Perhaps this is another fake? However, external factors around Bitcoin SV and Wright could be at play. Perhaps Wright, who claims to be back in possession of the keys to billions in cryptocurrency, is making massive waves in the Bitcoin SV market; or with the price spike, there is indeed a massive influx of trading?

A Whale of a Time

The subplot to the entire Bitcoin SV saga is that Wright is currently in the grips of a legal battle with his former business partner’s brother, Ira Kleiman. The Kleinman case has cornered wright who claims to be the Bitcoin creator Nakamoto with Ira arguing that if this is true, half of 1 million early mined Bitocin belong to the estate.

Wright has countered by saying he does not have access to the funds due to missing keys. However, at the time of the SV pump, the missing private keys suddenly materialized. If Wright is to be believed, he now has access to billions of dollars in cryptocurrency at his disposal and could be making a massive splash in the SV marketplace as an overbearing whale.

This argument starts to hold more water when one considers just how liquid and available Bitcoin SV is after major exchanges, such as Binance, delisted the coin following the Wright controversies of last year.

This pump was in no small part possible exactly because BSV was delisted from most major exchanges. Much easier to pump shitcoin on 3rd rate exchanges with low liquidity. #UnintendedConsequences

— Joe007 moved on to other things 💀 (@J0E007) January 15, 2020

Another Case of Fake Bitcoin SV Volumes?

Of course, the simpler reasoning for Bitcoin SV’s daily volume almost reaching its entire market cap could be fake volumes. CoinMarketCap. launched its own Liquidity Metric to combat the “volume inflation” problem on exchanges but was still seen to be listing exchanges known for faking volumes.

The scourge of fake volumes continues to plague the cryptocurrency space with their damage seen in boosting exchanges that are not as active as they seem, and in the case of coins, it can also paint a false picture of the current market, leading to major pumps.