Bitcoin witnessed a steady climb as investors anticipate imminent insights from United States Federal Reserve Chairman Jerome Powell.

The forthcoming testimony, set to echo through the chambers of Congress, holds the potential to shape the future of Bitcoin and the entire crypto market.

Bitcoin Price Soars Ahead of Fed Chair Powell’s Testimony

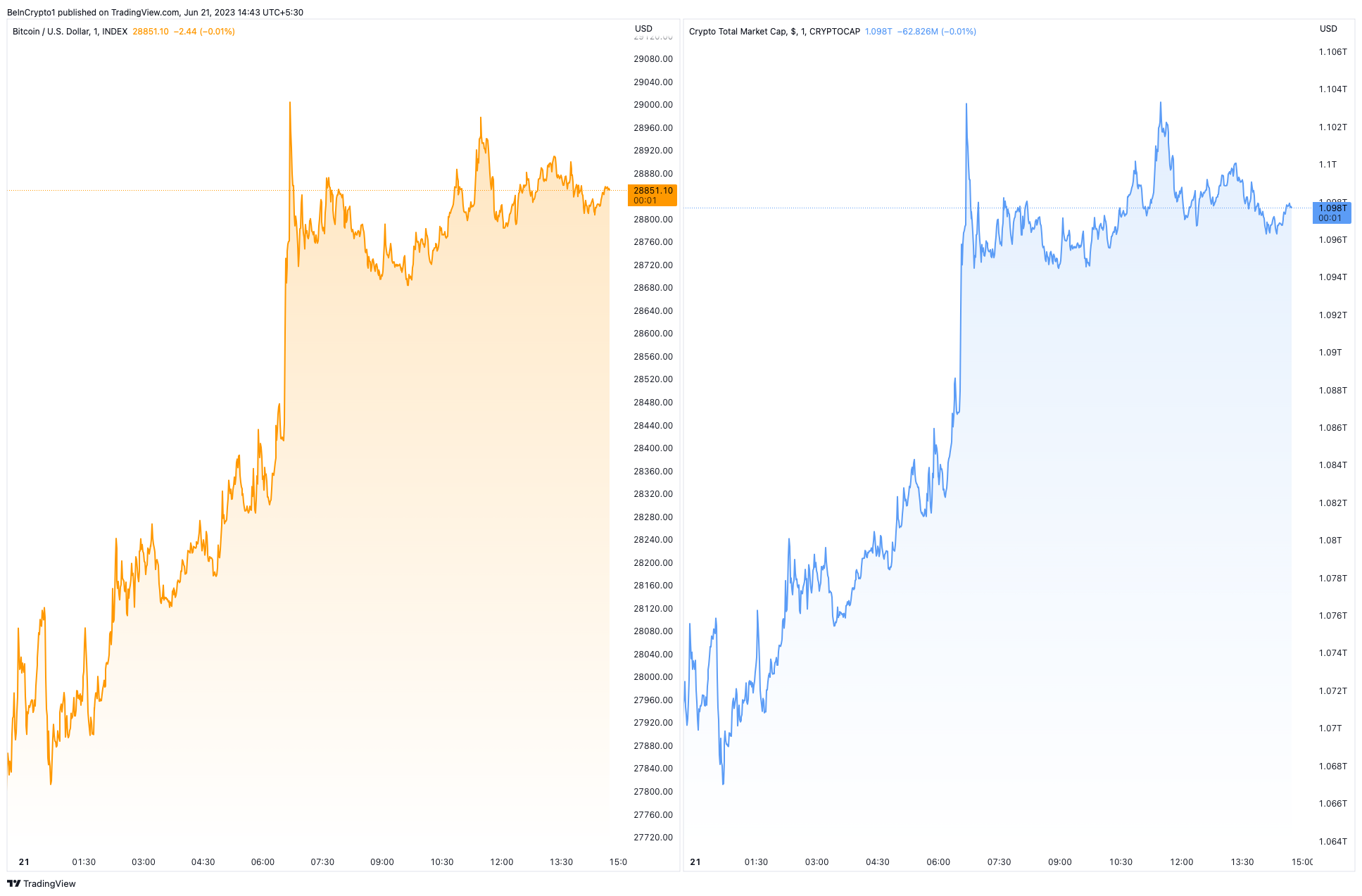

Undeterred by previous rate hikes, eager investors continue to fuel the crypto market’s $20 billion capitalization surge, representing a 1.97% increase. Meanwhile, Bitcoin is witnessing an 800-unit upswing, or a rise of 2.81%, as of 10:00 UTC on Wednesday.

Crypto market observers keenly focus on Fed Chair Powell’s upcoming testimony before the House Financial Services Committee at 14:00 UTC.

Read more: Why Is the Crypto Market Up Today?

Investors expect the forthcoming remarks from a series of Fed officials to provide a clearer perspective on the US economy. This interest builds upon the Federal Reserve’s recent pause in its rate-hiking campaign initiated in March 2022.

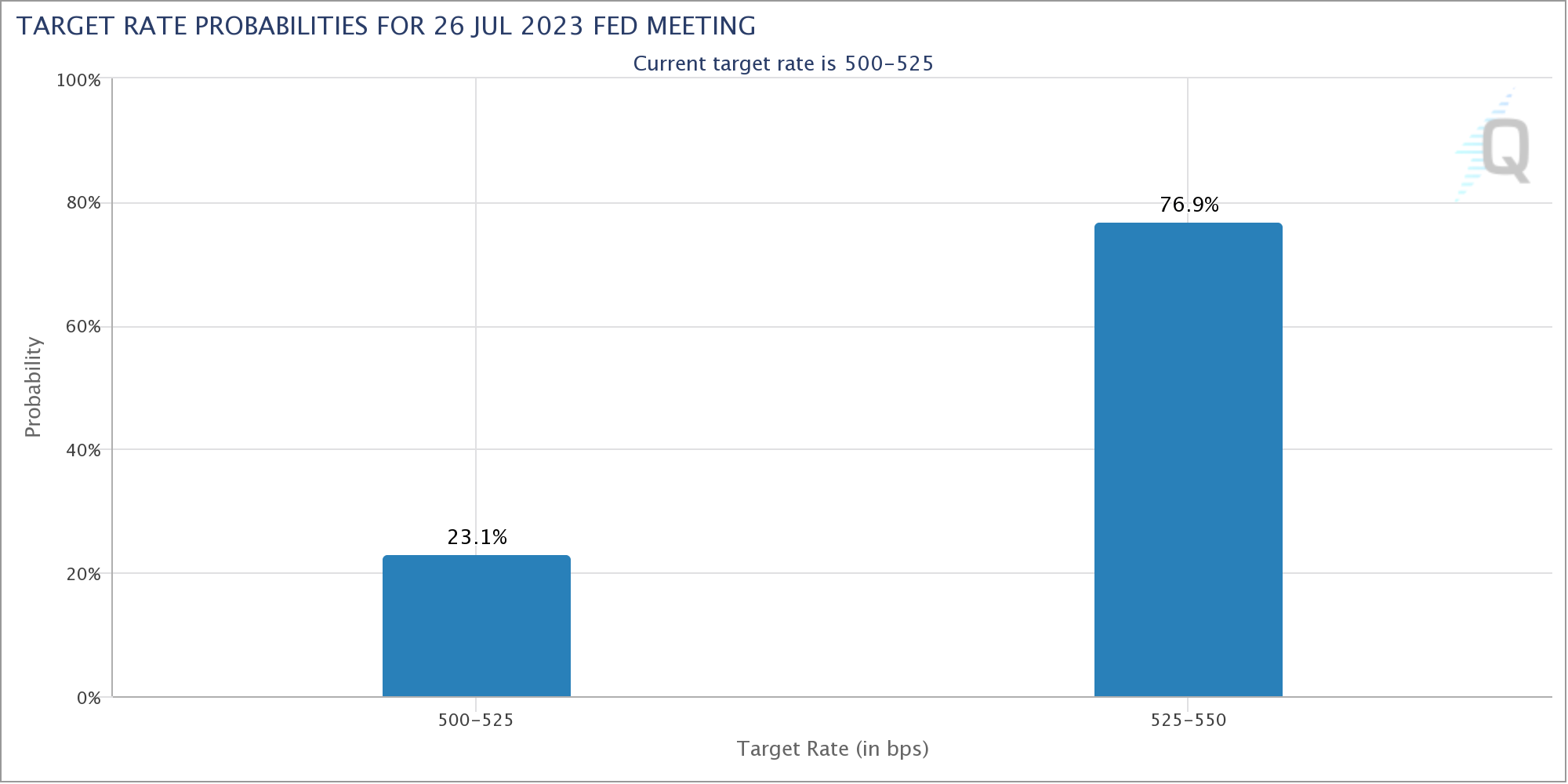

Despite its current halt, the strategy has signaled further rate hikes on the horizon. Per central bankers ‘ estimations, the prognosis for two additional increases of 25 basis points each this year lends a fresh, yet cautious, optimism to investors.

The unexpected surge in May’s housing starts and building permits fuels this confidence. Both exceeded forecasts, presenting potential indicators of a more robust US economy on the horizon.

However, it is not solely domestic fiscal health influencing Bitcoin’s allure. Global financial trends, such as the United Kingdom’s looming Bank of England interest rate decision and the surprisingly high US inflation figures — registering at a steeper than anticipated 8.7% for May — also sway investor sentiment.

Since economic data can unpredictably impact the crypto market, no significant revelations are anticipated this Wednesday.

As Fed Chair Powell’s statements loom large, Bitcoin’s rise underscores a delicate balance between investor anticipation, economic forecasts, and the undeniable influence of key decision-makers. The uptrend hangs in the balance, waiting for words that could spur further investment or inspire cautious withdrawal.