A busy economic calendar lies ahead for the week, and crypto markets are already starting to head south during early trading. The Federal Reserve’s policy meeting will be one of the key events this week, along with core CPI data.

Macroeconomics outlet The Kobeissi Letter listed the key economic events for the United States for the week beginning December 11. Moreover, Bitcoin has already started to retreat quickly, so how low will markets go?

This Week’s Economic Events

December 12 will see reports on November CPI figures related to the consumer price index. These reports measure changes in the retail prices of goods and services and are generally considered as a measure of inflation.

Core CPI year over year is expected to remain unchanged at 4%. Moreover, the annual inflation rate in the US slowed to 3.2% in October and it is forecast to remain at this level for November.

Wednesday sees November’s Producer Price Index (PPI) report released. This data from the Bureau of Labor Statistics reflects input prices for producers and manufacturers. Since this directly affects retail pricing, PPI is also seen as a good pre-indicator of inflationary pressures.

Read more: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

Wednesday also has the Fed’s policy meeting, which will give indicators of the central bank’s interest rate outlook. Additionally, the meeting will be accompanied by the release of the Fed’s quarterly economic projections summary.

This is known as the “Dot Plot,” which is a chart summarizing the Fed’s benchmark federal funds interest rate outlook for the short, medium, and long term.

“The most recent Fed statement was that rate cut hopes are ‘premature,'” said the Kobeissi Letter. It added, “This week, we expect the Fed to re-enforce that.”

Retail sales data and initial jobless claims will be released on Thursday.

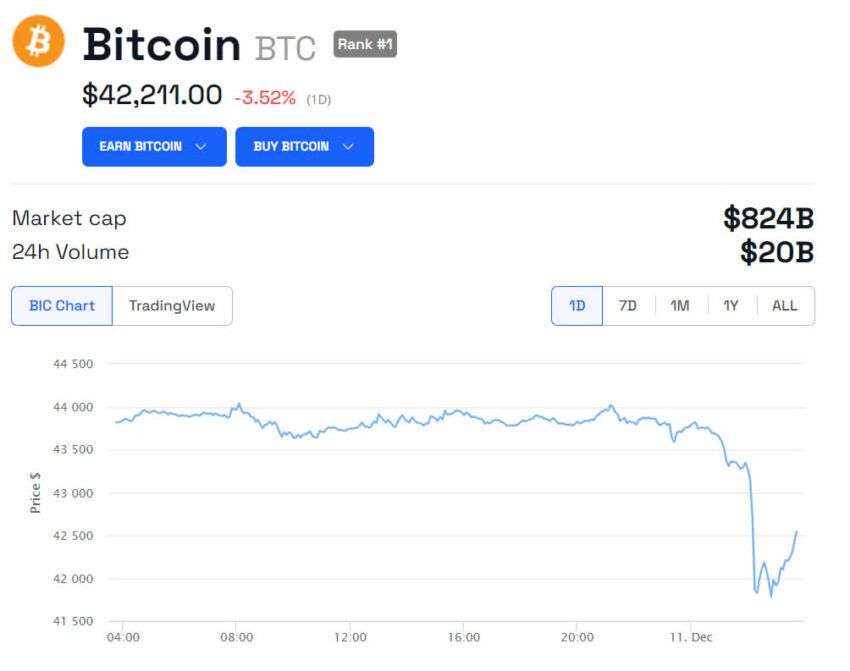

Bitcoin Tanks 3.2%

Crypto markets are already seeing red during the Monday morning Asian trading session. Total capitalization has declined by $80 billion in a 4% slide on the day.

Bitcoin is leading losses with the asset shedding 3.2% in a fall to $42,377 at the time of writing. Analysts had predicted a correction to an overly frothy crypto market and it appears to be starting this week.

Ethereum is faring worse, with a 4.4% slide over the past few hours to hit $2,246.

Most of the altcoins are also dumping at the moment, with losses between 2 and 6 percent.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.