As Q2 2024 unfurls, Bitcoin continues to dominate headlines, boasting a staggering 69% price increase in the first quarter alone. This surge, primarily fueled by the debut of spot Bitcoin Exchange-Traded Funds (ETFs) and the anticipation for Bitcoin halving, underlines a transformative phase for the crypto market.

However, Bitcoin’s rally has caused an increase in euphoria, signaling potential market caution. Generally, there are pullbacks or market reversals after the euphoric stage.

What Are Warning Signs From Bitcoin’s Q1 2024 Performance

According to the “Q2 2024, Guide to Crypto Markets” report by Coinbase Institutional and Glassnode, there are some warning signs amidst spectacular Bitcoin price performance.

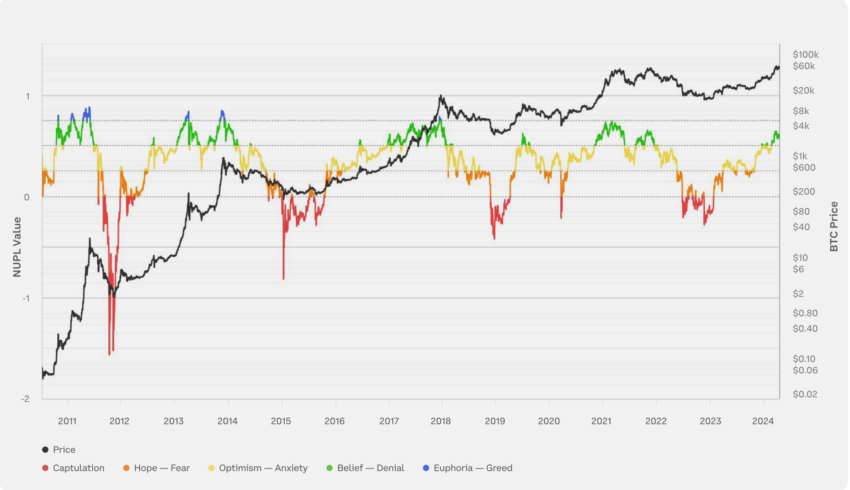

Market sentiment, as measured by the Net Unrealized Profit/Loss (NUPL) indicator, assesses the unrealized profits and losses across the coin supply. This indicator signaled a state of euphoria at the market peaks in mid-2011, 2013, and briefly in 2017.

However, it failed to indicate Euphoria during the 2021 market peak. Instead, the market shifted from the “belief-denial” phase. This same phase of “belief-denial” was also reached during the local peak in March 2024.

Read more: Bitcoin Price Prediction 2024/2025/2030

Furthermore, the cyclical nature of Bitcoin’s market is evident in its supply profitability analysis, which distinguishes phases like “bottom discovery,” “euphoria,” and “bull/bear transition.” These phases reflect underlying market sentiments and potential shifts in investor behavior.

Notably, the current phase, indicated by a high percentage of supply in profit, suggests a nearing market peak as long-term holders (LTHs) begin contemplating profit-taking.

The MVRV (Market Value to Realized Value) ratio, particularly for LTHs, offers a nuanced view of market conditions. An MVRV above 3.5, as observed in Q1, typically heralds the Euphoria stage of a bull market.

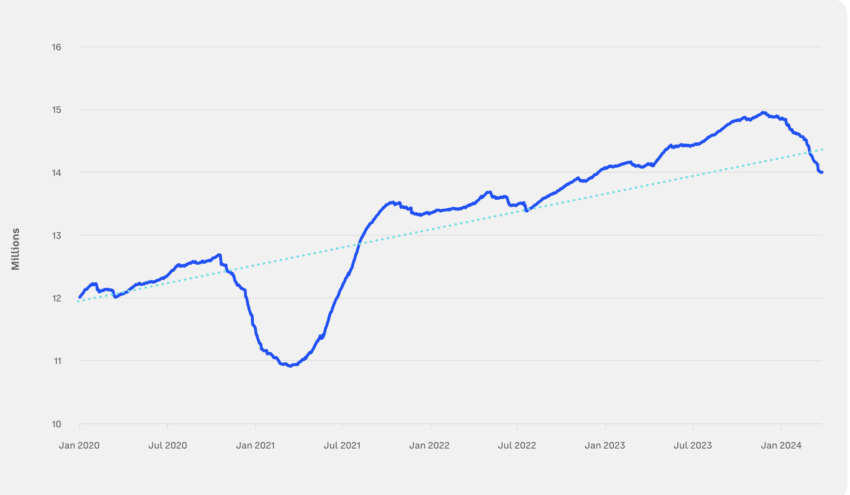

This signifies that LTHs might soon start liquidating portions of their holdings. Indeed, during Q1 2024, there was a dip in the supply held by LTHs below the long-term trend line.

“Long-term holders (LTHs) refers to investors who retain their cryptocurrency holdings for a minimum of 155 days. The activity patterns of LTHs can be used as a barometer for identifying cyclical trends within the cryptocurrency markets, including potential peaks and troughs,” the report, shared with BeInCrypto, explains.

Read more: Who Owns the Most Bitcoin in 2024?

However, Bitcoin’s journey from a volatile asset to a top-performing one is noteworthy. Over the past decade, Bitcoin has been the best-performing asset in eight out of eleven years. It gave an annualized return of 124% from 2013 to 2023.

The introduction of spot Bitcoin ETFs has significantly influenced this trajectory. By facilitating direct investment in Bitcoin, these ETFs have attracted a flood of new investors, heightening demand.

Crucially, the supply of new Bitcoin is constricted, primarily due to mining limitations where rewards halved recently, exacerbating the supply-demand imbalance.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.