A large number of Bitcoin options contracts are set to expire today, but will they add to the market momentum already spurred by Ripple’s court victory? A big swathe of Ethereum options contacts are also poised to expire as ETH tops $2,000 for the first time in months.

On July 14, 25,000 Bitcoin options contracts will expire with a notional value of $770,000. While this is not a large expiry event, it may add to market momentum already driven by Ripple and XRP.

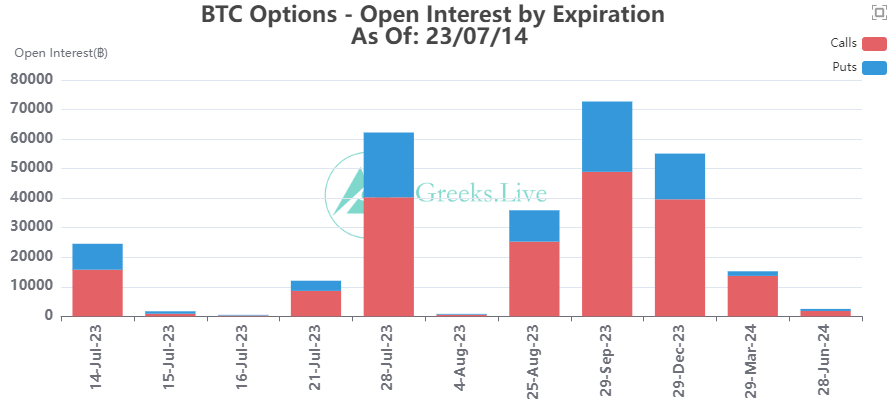

Bitcoin Options Expiry

The batch of Bitcoin options about to expire have a put/call ratio of 0.56. This means that there are around twice as many call (long) contracts than puts (shorts).

The ratio is derived by dividing the number of short seller contacts but the number of long seller contracts. Furthermore, values below one mean that there are more call contracts, indicating bullish sentiment for the underlying asset.

The max pain point for today’s expiring options contracts is $30,500. Max pain price refers to the level with the most open contracts and at which the most losses will be made upon expiry.

Derivatives feed Greeks Live observed that BTC hit a new high for the year. However, “judging by market sentiment, most participants don’t seem to be profiting from the rally,” it added.

“Options positions and volumes were well below average this week and the options market was relatively fragmented.”

Learn more about crypto derivatives: What are Perpetual Futures Contracts in Cryptocurrency?

Additionally, 176,000 Ethereum options contracts are also expiring today. They have a notional value of $355 million and a put/call ratio of 0.66. The max pain point for the ETH contracts is $1,900.

Market Momentum Change

Greeks Live added that many of the whales are “waiting for a change in the market after opening a large position earlier this month.” This week’s trading is more about adjusting positions, it added.

“The current BTC call position is more than double put, and the ETH is more than triple, so once the uptrend begins, the existing options pattern will be disrupted.”

However, that change may have just happened with today’s $80 billion spot crypto market rally.

This may spur derivatives traders to buy more call contracts if they anticipate further momentum and price gains.

Total capitalization was up 6.8% on the day at $1.30 trillion at the time of writing.

However, the broader crypto market is still within its four-month sideways channel, and there has been no longer-term breakout just yet.