Over the past day, the cryptocurrency market experienced substantial turmoil as Bitcoin saw its price drop below $65,000, leading to widespread liquidation.

This sharp decline wiped out nearly $565 million in market value, impacting long and short traders.

Long Traders Lose Over $400 Million

The downturn in the crypto market caught bullish traders off guard, resulting in losses exceeding $400 million for this cohort within the last day alone.

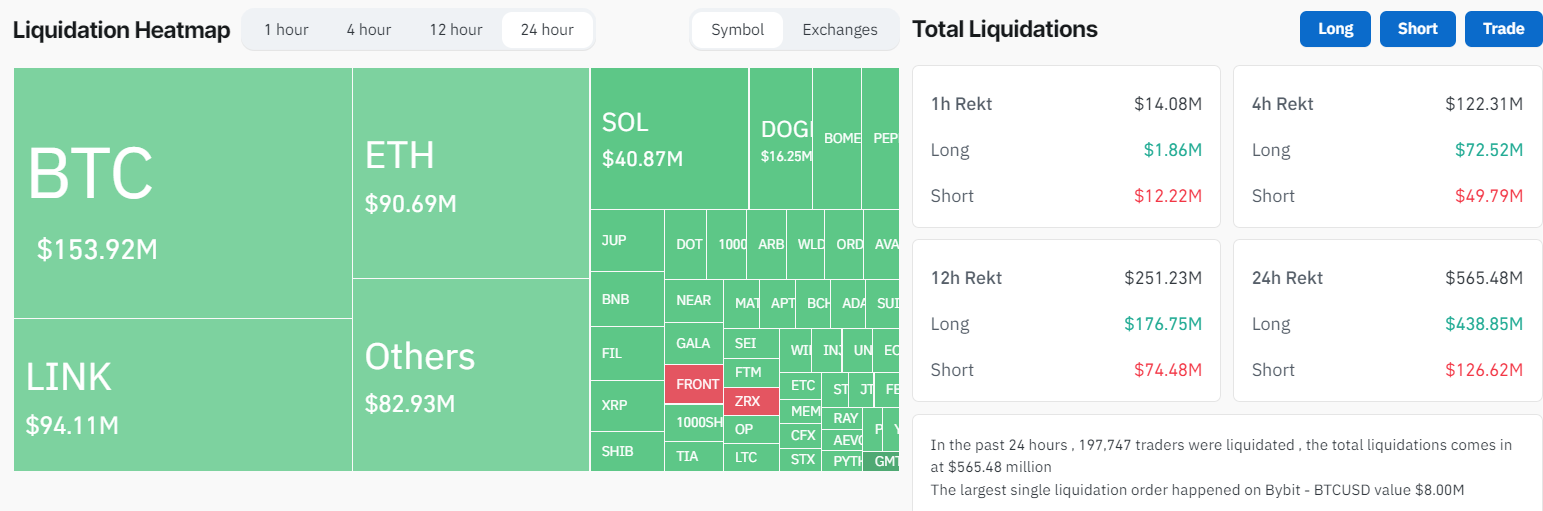

According to data from CoinGlass, price speculators saw a total loss of $565 million during this period. Long traders bore the brunt of losing $438 million, while short traders faced liquidation of $126 million.

Notably, Bitcoin long traders suffered the most significant blow, losing $153 million, followed by Chainlink enthusiasts with $94 million in losses. Ethereum and Solana’s traders also lost more than $130 million combined.

These events impacted over 200,000 traders, with over 50% trading on Binance and OKX exchanges.

Read more: 10 Best Crypto Exchanges and Apps for Beginners in 2024

This downturn can be attributed to Bitcoin’s price brief drop to under $65,000, its lowest since early March. As the leading digital asset, BTC’s price movements typically dictate the broader market’s trajectory. Consequently, major cryptocurrencies like Ethereum, Avalanche, BNB, Cardano, and Chainlink experienced significant price declines.

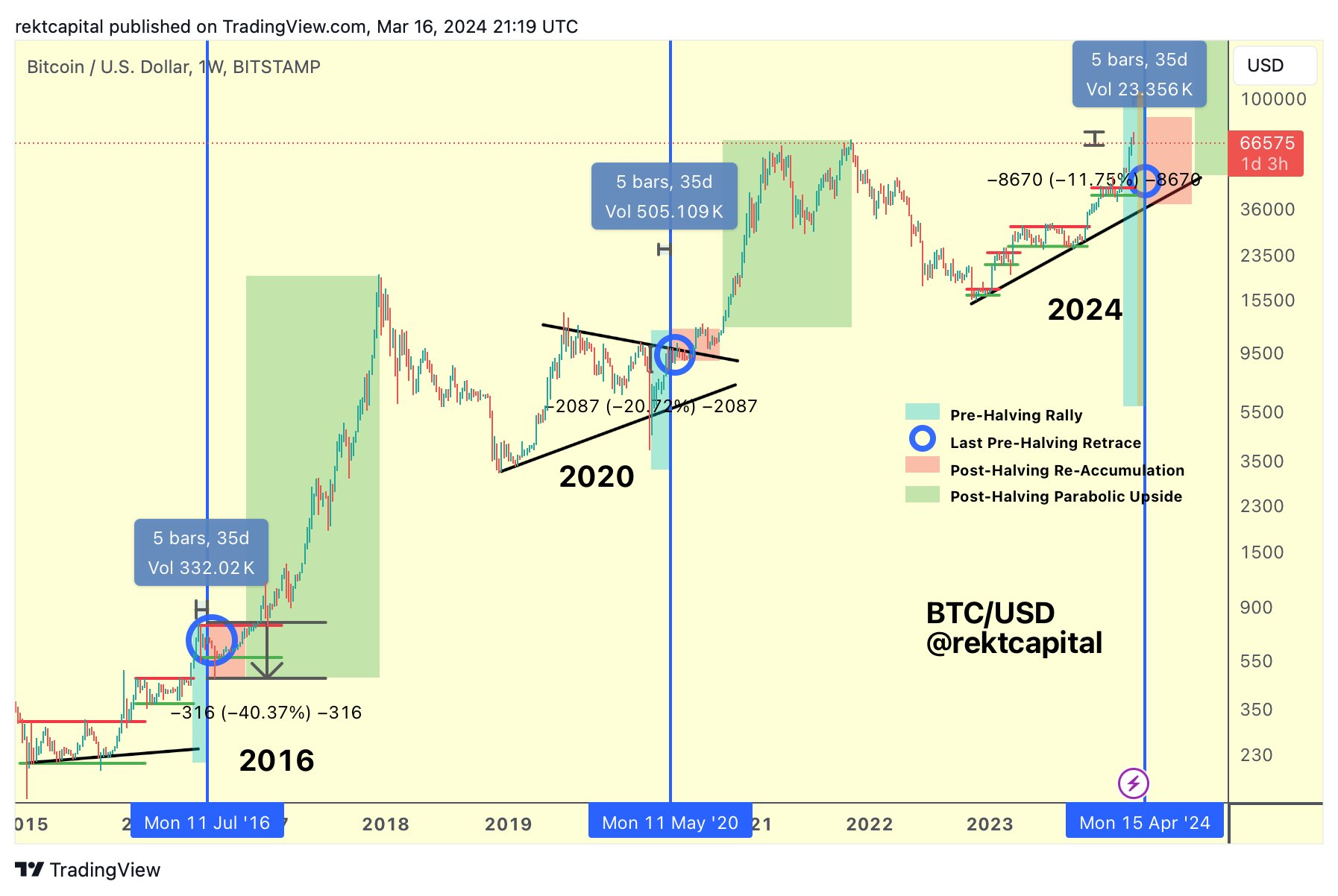

Meanwhile, several crypto analysts have interpreted this decrease as a predictable market behavior. According to Rekt Capital, despite the introduction of spot Bitcoin exchange-traded funds (ETFs), the current bull market remains susceptible to a pre-halving retrace. These retraces typically occur 14-28 days before the Bitcoin halving.

Read more: Bitcoin Price Prediction 2024/2025/2030

Comparing previous cycles, the analyst notes that BTC’s current 11% pullback within 31 days of the halving resembles past patterns where retraces were 20% and 40% deep in 2020 and 2016, respectively.

“Bitcoin will retrace deep enough to convince you that the Bull Market is over. And then it will resume its uptrend,” Rekt Capital concluded.

As such, the analyst warned that BTC would enter the “Danger Zone” within the next three days and urged traders to be cautious.