The price of Bitcoin has skyrocketed in different regions, some of which face daunting fiat currency devaluation. Turkey, whose BTC prices were 1.3% higher than global spot prices in July, saw its inflation rise to almost 70% in January, while Bitcoin’s price in South Korea is up an astonishing 10.23%.

On March 6, exchange rates for fiat currencies in Egypt and Turkey fell as central banks tried to contain inflation, while South Korean crypto traders benefited from strict forex controls.

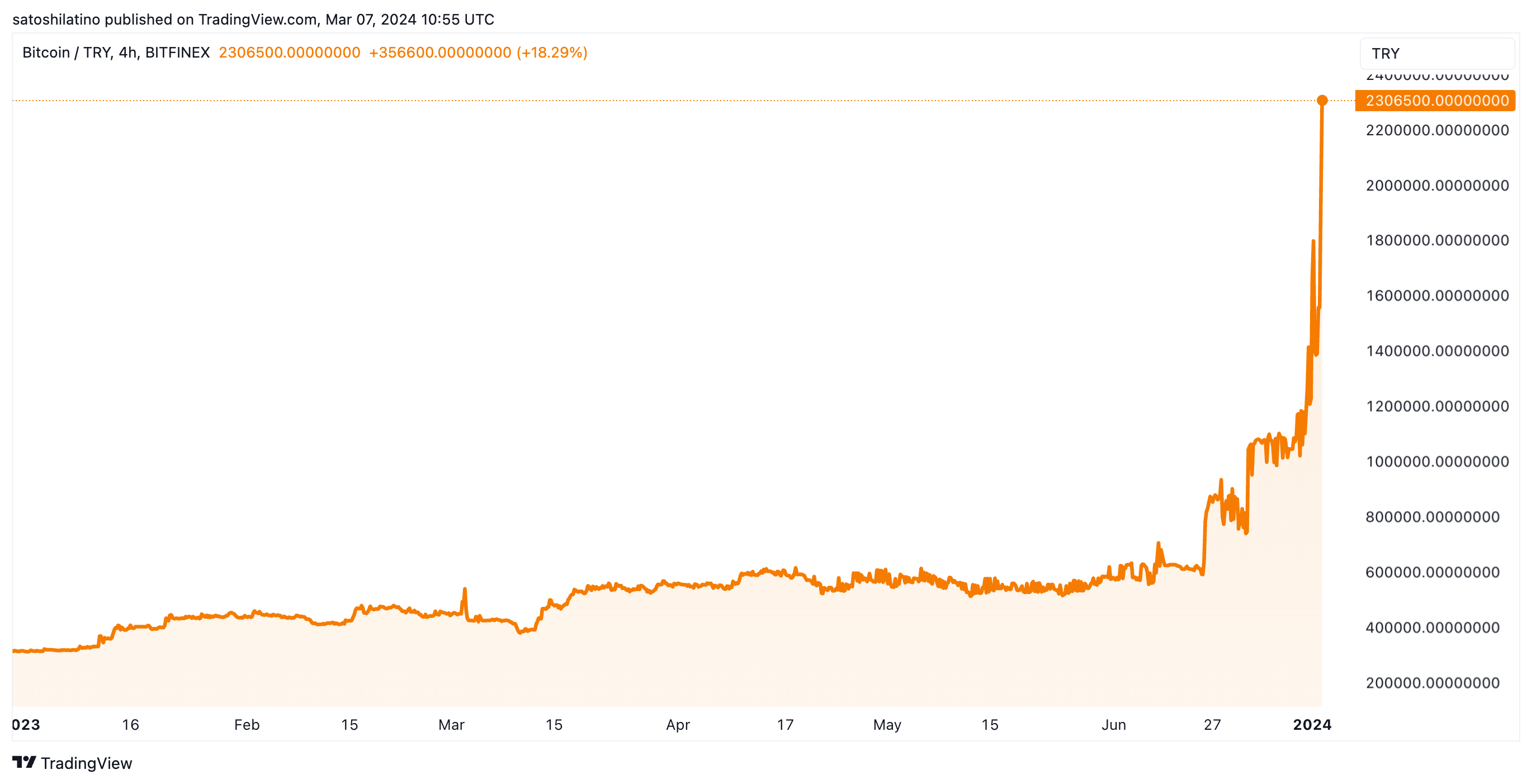

How the Lira’s Decline Drove Crypto Adoption

Turkish inflation rose to 67.07% in January, dashing hopes of a pause in rate hikes. At the same time, the Turkish Lira devaluation continues its more than 40% decline against the US dollar in the past year.

The Turkish Finance Minister, Mehmet Simsek, predicted that inflation would be sticky in the coming months. Eight months ago, the Lira’s decline led to a Bitcoin premium of around 1.3%. Simsek said in January that the government is close to finalizing crypto regulations.

In the meantime, crypto exchange OKX recently launched a platform to serve Turkish clients specifically. The launch included Turkish Lira trading pairs for Bitcoin and Ethereum. The CEO of Noones App, Ray Youssef, saw this as a positive development as peer-to-peer trading could solve issues Egypt and regions in the Global South face.

“Egypt just got twice as poor in a SINGLE day! And crypt is 100% Illegal there. To all the central banks in the world and to all the people of the Global South listen well: The central banks of your nations are not the sole cause of your pain, they are being attacked by the colonial west! Crypto is not the enemy but when used in p2p markets are our ONLY solution !” Youssef said.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

Given Turkey’s history of crypto money laundering, authorities could look to limit foreign investment in local crypto exchanges. This could help traders offset the Lira weakness as more Bitcoin circulates domestically at a premium to the spot price.

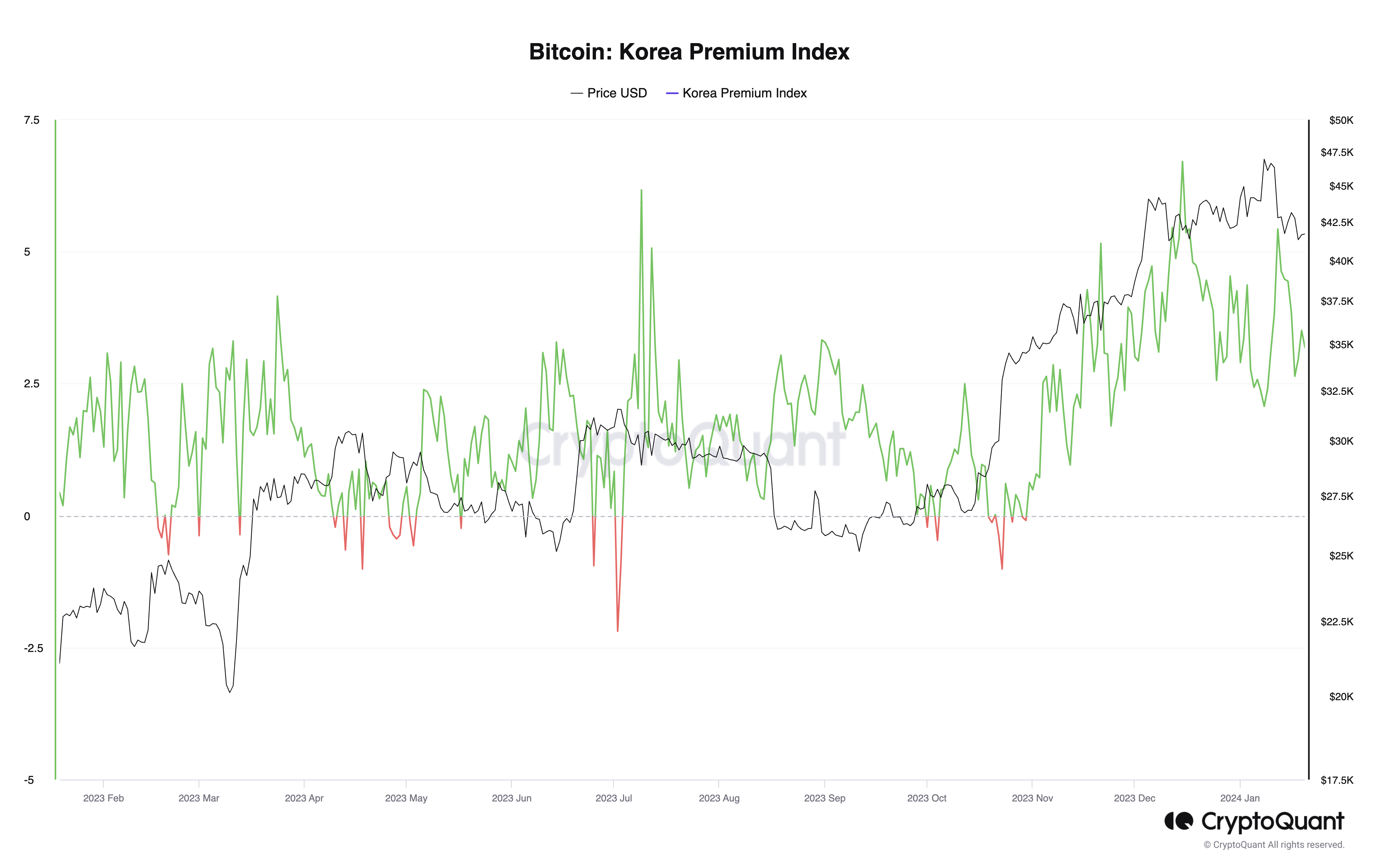

South Korea Kimchi Protects Local Currency

Another phenomenon has occurred in South Korea, where the government restricts forex flows into the crypto market. The region’s so-called Kimchi premium rose 10% following the recent Bitcoin rally, where the asset price rose beyond global prices.

The South Korean government forbids foreigners to invest in local crypto exchanges. In addition, locals are not allowed to engage in crypto arbitrage trading to take advantage of the local premium, keeping all the crypto in the country. As a result, an asset like Bitcoin trading at a premium signals buying pressure in the local market.

The Kimchi premium has regularly occurred around Bitcoin market tops. Earlier this week, the price of Bitcoin rose briefly above $69,000 before dropping more than 3%, which coincided with the surge in the Kimchi premium. Eight months prior, Bitcoin traded almost 3% higher on Bithumb, Korea’s largest exchange, with the 14-day moving average of the Korean Premium Index similar to its value during the 2021 Bitcoin cycle peak.

Read more: What Is Fiat Currency? How Does It Differ From Cryptocurrency?

Given the recent news, BeInCrypto contacted Bithumb for comment on the Kimchi surge but did not hear back at publication time. The exchange is the largest crypto trading venue in South Korea.