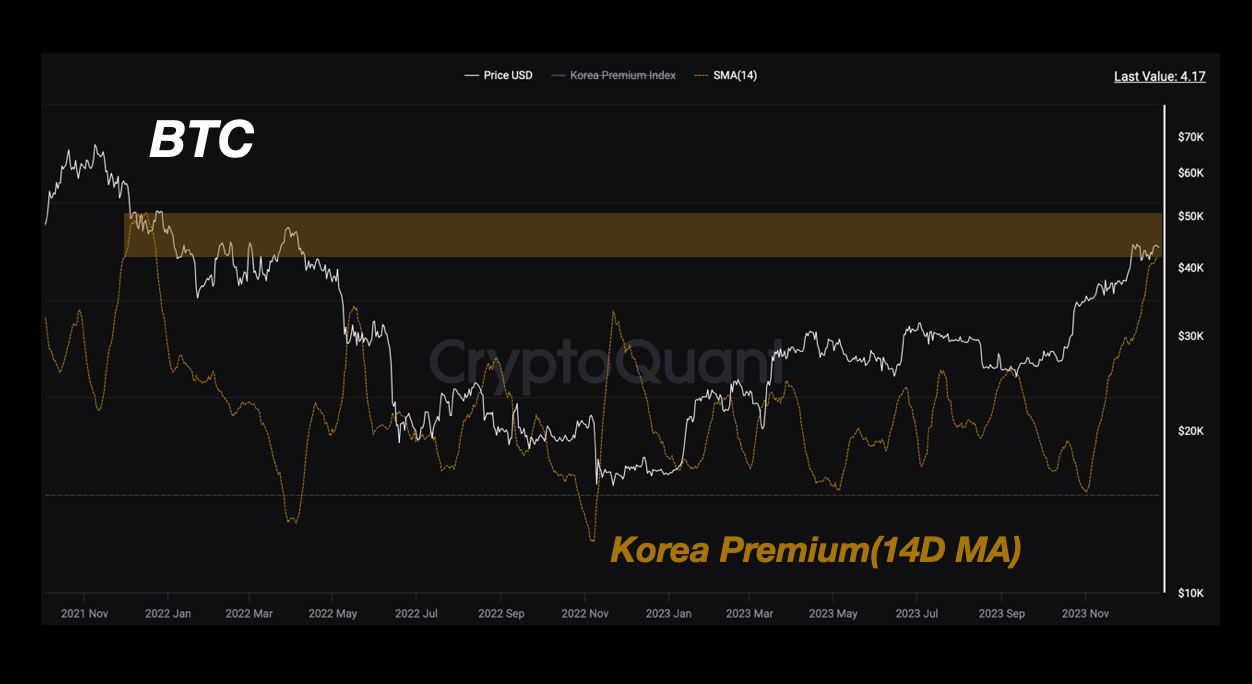

Market signals in the Far East are emerging for the first time since the last Bitcoin cycle top. The Korean premium is showing an overheated market, which could be a signal of a local Bitcoin top.

The Korean premium, often referred to as the Kimchi premium, is when Bitcoin’s price might be listed at a higher price on a South Korean exchange than in US or European markets. This creates arbitrage opportunities.

Korean Bitcoin Markets Overheated

On December 26, on-chain analytics firm CryptoQuant reported that high Korean premium values “could indicate Korean retail investors’ strong buying pressure.”

However, the index is also often used to identify price tops. This is because Koreans have immediate access to cash to buy coins on exchanges, and there is high FOMO hype, it explained.

Moreover, the current 14-day moving average for the Korean Premium Index is similar to what it was during the Bitcoin cycle peak in late 2021. It stated:

“We are very curious to see if the Korean Premium Index will provide important clues to price tops this time too.”

Last week, trader “TimelessBeing” observed the signal, commenting:

“Kimchi premium has been synonymous with local tops over the past few years.”

In addition to the cycle peak, there were also peaks in the Kimchi premium during the May and November Bitcoin market crashes in 2022.

The current price for a BTC on Korea’s leading exchange, Bithumb, is a little over 58 million KRW at the time of writing. This is equivalent to around $44,680 in USD, almost 3% higher than global spot markets with a current BTC price of $43,430.

Read more: Top 7 Platforms To Earn Bitcoin Sign-Up Bonuses in 2024

Crypto Market Outlook

Bitcoin has tested resistance just above $44,000 at least six times this month. However, it has failed to progress any further.

The momentum suggests that a correction could be on the cards. This is also suggested by the overheated Korean Bitcoin market.

BTC is currently trading up 1.2% on the day but has been flat within a tight range the past week. Furthermore, the holiday week usually sees low volatility and very little action on crypto markets.

Total capitalization is at a 2023 high of $1.75 trillion and altcoins are leading markets.

Ethereum remains lackluster at $2,273. Solana, on the other hand, is still on a charge. SOL has gained 7.7% on the day to tap $125 during late trading on December 25.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.