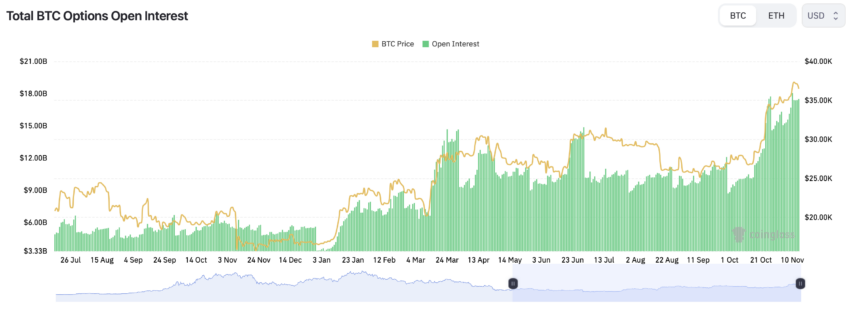

Bitcoin’s price and trading volume are on the rise, along with its open interest in Bitcoin options reaching unprecedented levels, surpassing $17 billion.

A previous all-time high of $16.35 billion had been recorded just before this latest surge.

Market Hype Continues for Bitcoin Options

Investors possess the right to buy or sell an asset at a predetermined price on a future date through options. An increase in the open interest in Bitcoin options is viewed positively by the market. It indicates a surge in investor funds flowing into the market.

At the initiation of the contract, the execution price is set, and the cost of obtaining the option, known as the premium, is paid at that moment.

On November 10, open interest in Bitcoin options reached a brief peak at $18.05 billion, marking its highest point. At the time of publication, it currently stands at $17.5 billion.

Meanwhile, today, popular trading analyst Will Clemente highlighted the event to his 693,400 followers, eliciting a mixed bag of responses.

One X user replied that it “seems as though when it peaks, so does the market.” While another stated,

“Definitely another dip coming.”

Learn more: How To Trade Bitcoin Futures and Options Like a Pro

Increased Speculation Resulting from Bitcoin ETF

Bitcoin remains a focal point of discussion within the crypto community amid ongoing speculation about the imminent approval of a Bitcoin ETF by the US Securities and Exchange Commission (SEC).

As of November 2, BeInCrypto highlighted the potential for a substantial global bull market if Bitcoin ETFs receive approval.

The rationale behind this projection is that the green light for Bitcoin ETFs could unlock a surge of institutional capital that has been on standby, anticipating a regulated entry point into the market.

According to Lucas Kiely, the Chief Investment Officer at Yield App, the approval of Bitcoin ETFs would create a reinforcing cycle, amplifying both the credibility of Bitcoin and the influx of investments simultaneously.

Learn more: Where To Trade Bitcoin Futures: A Comprehensive Guide

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.