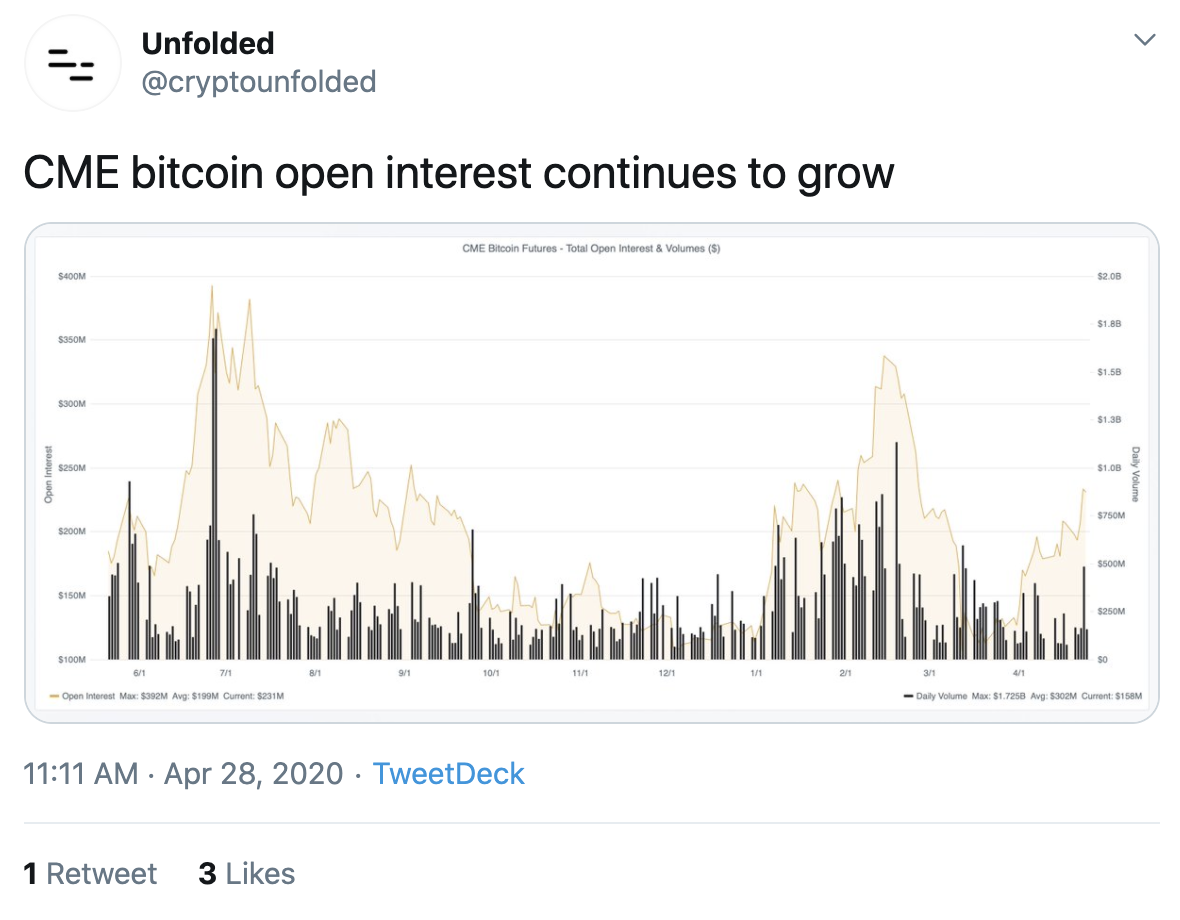

Open interest for Bitcoin on the CME continues to grow. It is currently at levels seen before the March sell-off.

Bitcoin futures are roaring back after a significant drop in March. Last month, open interest fell after an historic sell-off where the entire cryptocurrency market dropped some 50% in a single day.

Open Interest Returns to Normal

Bitcoin futures exchanges are roaring back in a big way, indicating that the market may be showing some strength. As Unfolded (@cryptounfolded) recently covered, open interest is steadily rising and spiked yesterday. Open interest was rising rapidly in February before the COVID-19 panic rattled markets. As BeInCrypto reported, open interest began to rise mid-April and has continued to grow since then. The rebound seems to mirror the rise seen in mainstream U.S. financial markets. Volume for futures also rose this month, seeing the largest daily volume jump in weeks earlier in April.

Open interest was rising rapidly in February before the COVID-19 panic rattled markets. As BeInCrypto reported, open interest began to rise mid-April and has continued to grow since then. The rebound seems to mirror the rise seen in mainstream U.S. financial markets. Volume for futures also rose this month, seeing the largest daily volume jump in weeks earlier in April.

A Shakeup in Bitcoin Futures Markets

The drastic sell-off in March reshuffled the market leaders for Bitcoin futures. As of now, Binance and Huobi lead the market in trading volume. BitMEX, once first, has now dropped to the fourth-largest in futures trading volume. Whether or not this shakeup will hold remains to be seen, but BitMEX’s reputation has suffered the most. The exchange was blamed for the crash on March 12; many users noticed that, after the exchange went down for maintenance, the historic sell-off ceased.

At the time of writing, Bitcoin has maintained its position above the $7,700 price point and is relatively stable on the daily. Trading volume has stayed high compared to last year despite the market turbulence.

However, traders should watch macroeconomic indicators to better gauge what the short-term holds. Many are still concerned that the global economy may not rebound as strongly as expected, although the IMF maintains that a ‘V-shaped recovery’ is still possible.

Whether or not this shakeup will hold remains to be seen, but BitMEX’s reputation has suffered the most. The exchange was blamed for the crash on March 12; many users noticed that, after the exchange went down for maintenance, the historic sell-off ceased.

At the time of writing, Bitcoin has maintained its position above the $7,700 price point and is relatively stable on the daily. Trading volume has stayed high compared to last year despite the market turbulence.

However, traders should watch macroeconomic indicators to better gauge what the short-term holds. Many are still concerned that the global economy may not rebound as strongly as expected, although the IMF maintains that a ‘V-shaped recovery’ is still possible.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Advertorial

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

READ FULL BIO

Sponsored

Sponsored