In this article, BeInCrypto takes a look at on-chain indicators like the Stablecoin Supply Ratio (SSR) and the (USDT) supply on exchanges, in order to determine how much buying power stablecoins currently have over the entire bitcoin (BTC) supply.

Furthermore, we analyze the Stock-to-Flow (STF) model to see if it’s still on track to predict BTC price movements.

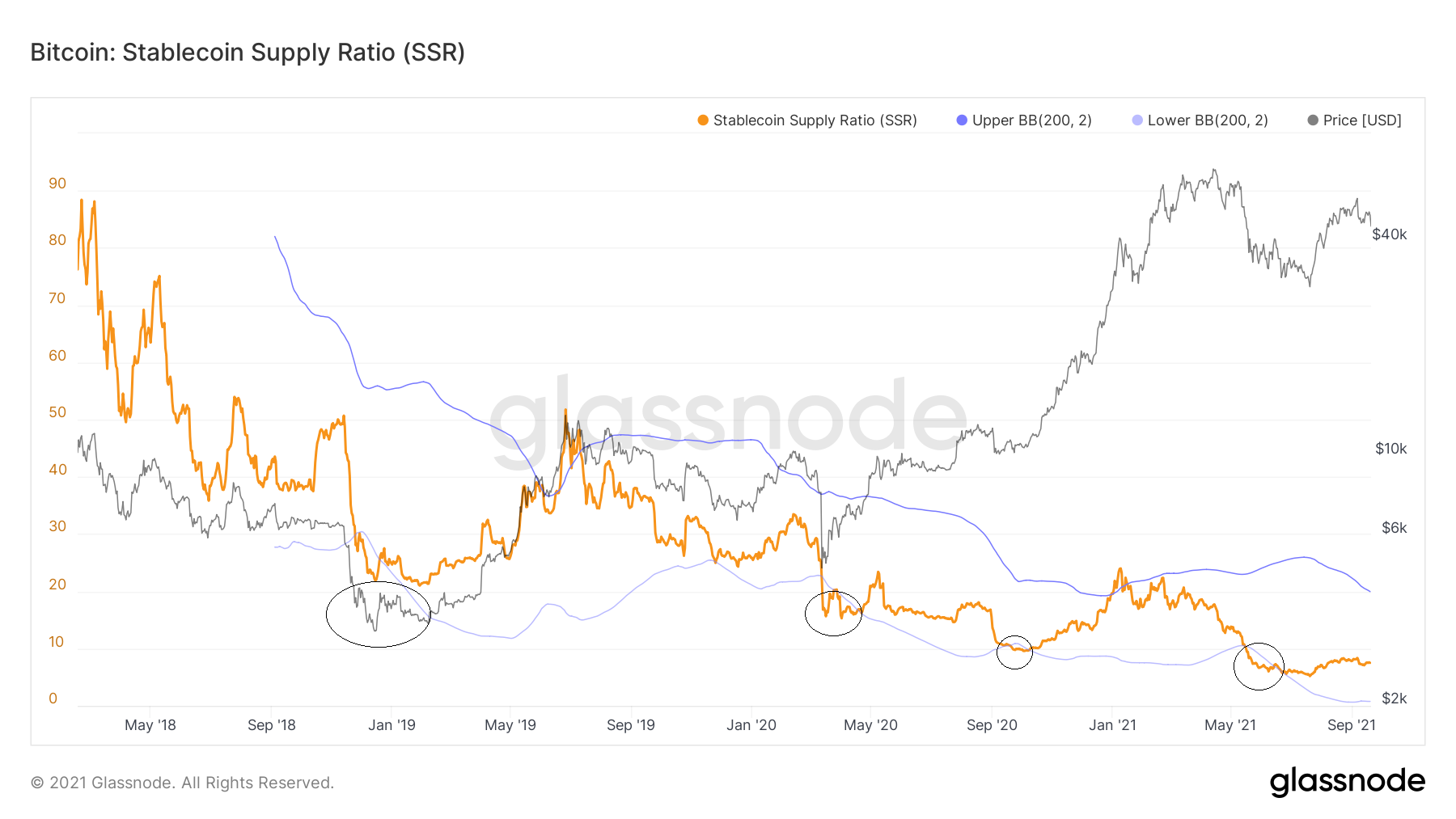

SSR

SSR measures the ratio between the supply of stablecoins and BTC. It can move by either:

- A change in the BTC price

- A change in the stablecoin supply

If SSR is low, it means that a significant percentage of the entire BTC supply can be bought using stablecoins. An SSR value of 10 suggests that 10% of the entire supply can be purchased with stablecoins.

SSR fell to an all-time low of 6 on June 8. Going by the above calculation, this means that 16.66% (1/6) of the BTC supply could be bought by stablecoins at the time.

The low was made below the lower Bollinger band for the fourth time. The previous three times this occurred (black circles), significant upwards movements followed. Similarly, an upward movement ensued after June 8, indicating that SSR drops below the lower Bollinger band are usually bottom indicators.

While SSR is now in the middle of its Bollinger bands, it’s still at 7.5, a relatively low value compared to the majority of its history.

USDT balance

The Tether (USDT) balance on exchanges reached an all-time high in June 2021. After a fall, it created a lower high at the beginning of September.

There was a sharp decrease between Sept 7 and 15. On Sept 7, the BTC price fell sharply from a high of $52,920 to a low of $42,843. It hovered below $45,000 until Sept 15 before moving upwards, as outlined in the previous section.

Therefore, the decrease in the USDT balance on exchanges was likely the result of market participants buying the dip.

Bitcoin stock-to-flow model

The STF deflection shows the difference between the price of BTC and that predicted by the STF model.

The indicator has a horizontal line (dotted) at one. A value of one indicates that the model is perfectly predicting the current BTC price.

Values above one (red) suggest overvaluation while those lower than one (green) show undervaluation.

The indicator has been falling since Feb 20, leading to the July 20 low of 0.27 (arrow), which was the lowest in recorded history. This means that the price never deviated to the downside more than it had on July 20, when the actual BTC price was at $29,783.

While the indicator has been increasing since, it still remains at 0.438. This means that the current BTC price is only 43.8% of that predicted by the STF model. Therefore, it’s still undervalued compared to the model.

Previously, values near 0.40 were reached in March 2017 and July 2017 and also in December 2020. These three periods marked local bottoms prior to significant increases.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.