In this article, Be[in]Crypto analyzes the behavior of different Bitcoin (BTC) wallet sizes, in order to determine which are increasing or decreasing their positions.

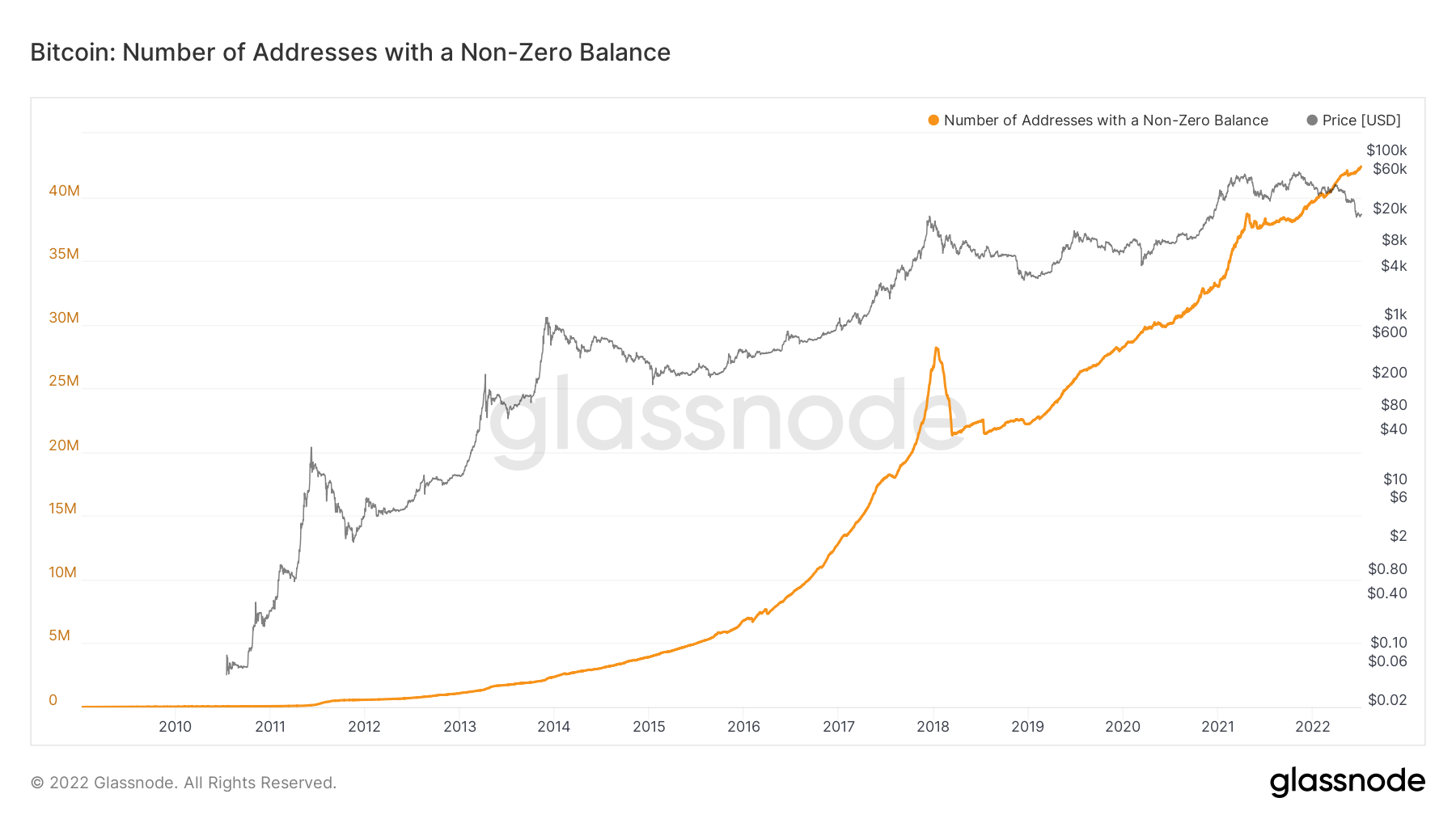

Number of BTC addresses

The total number of non-zero BTC addresses has been moving upwards since March 2018. This followed a sharp sell-off after the then all-time high in Dec 2017. The rate of increase accelerated greatly after Dec 2018, when the current bull run began.

Initially, the number of new addresses dipped slightly in April 2021 when BTC reached a local top. However, the upward movement continued afterward in Oct 2021.

After another small dip this May, the number of new addresses reached a new all-time high of 42,171,167 on July 7.

So, despite the market correction, the interest at BTC is still at an all-time high.

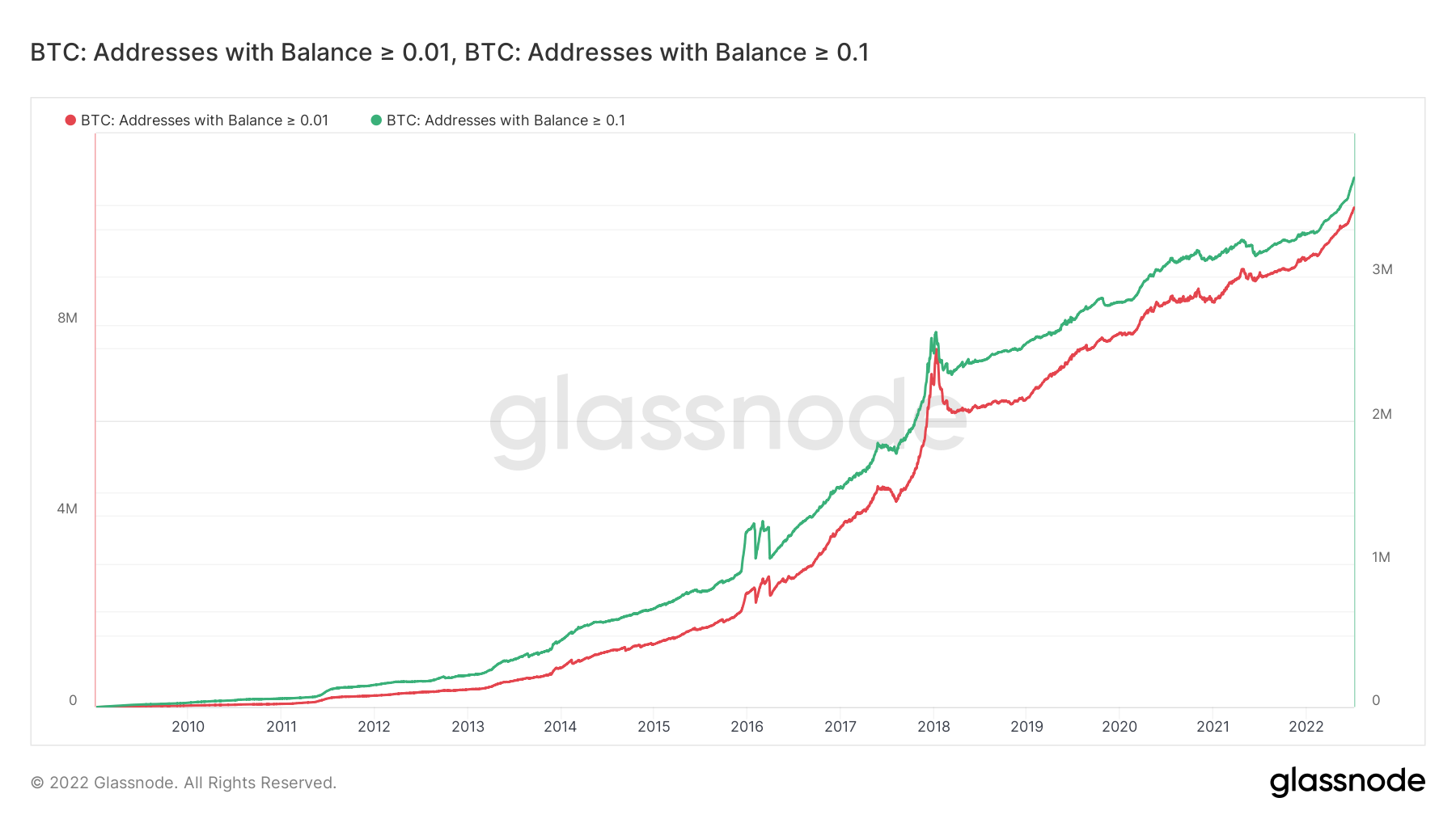

Small sized addresses

The number of addresses with more than 0.01 (red) and 0.1 (green) BTC has been increasing at a rapid rate since the beginning of 2021. Despite the correction, there has been no dip in the increase of these addresses.

Therefore, it can be stated that small addresses are continuously increasing throughout this correction.

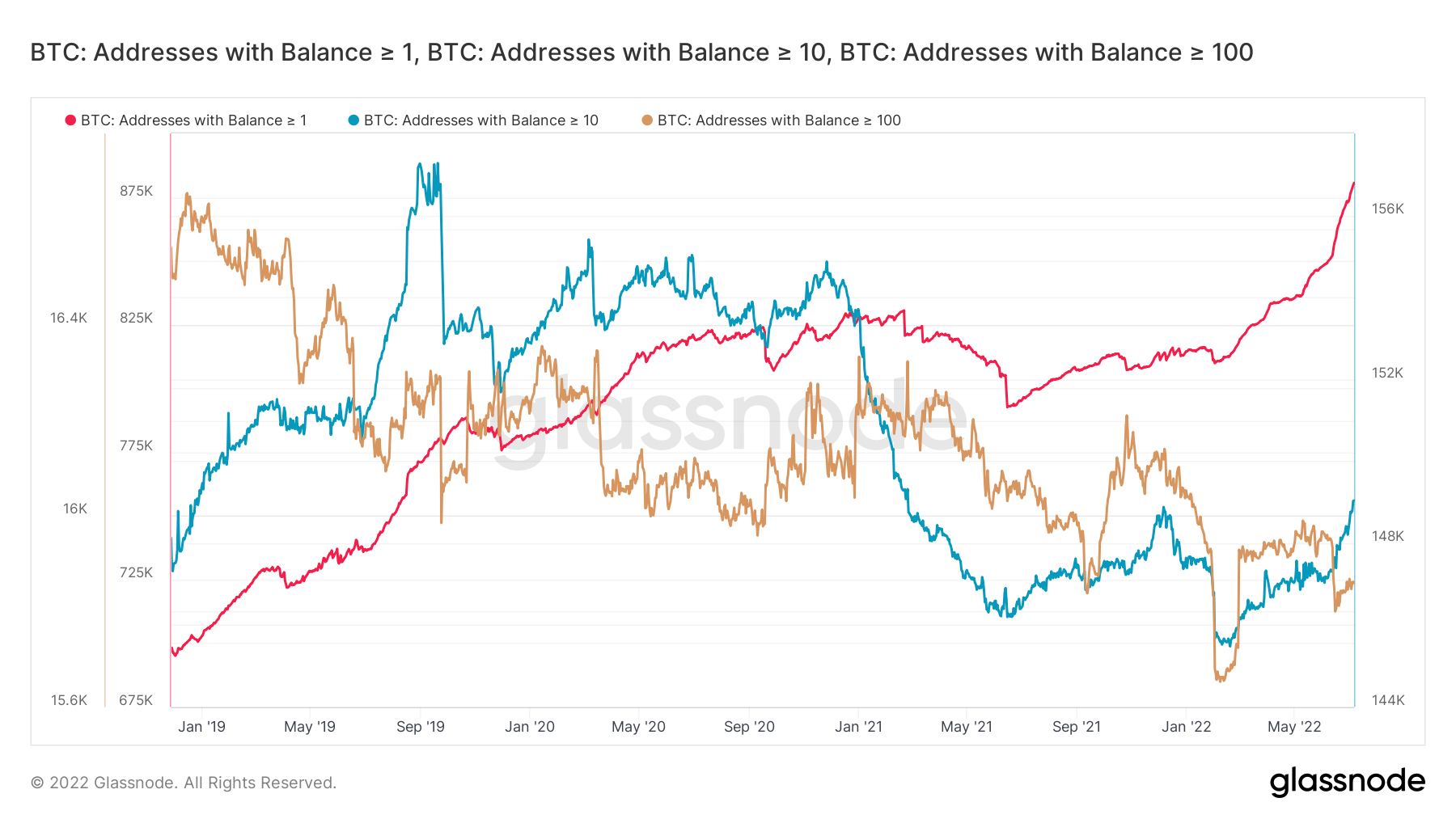

Medium sized addresses

The trend for medium sized addresses is not as clear.

Firstly, the number of addresses with more than one BTC (red) has increased significantly and is at a new all-time high.

However, addresses with more than 10 (blue) and 100 (orange) has decreased since the beginning of 2021. While both have started to increase since March, they are nowhere close to their all-time highs.

So, the data for medium sized addresses shows that while they are increasing since the beginning of the correction, the trend has been mostly downwards since the beginning of 2021.

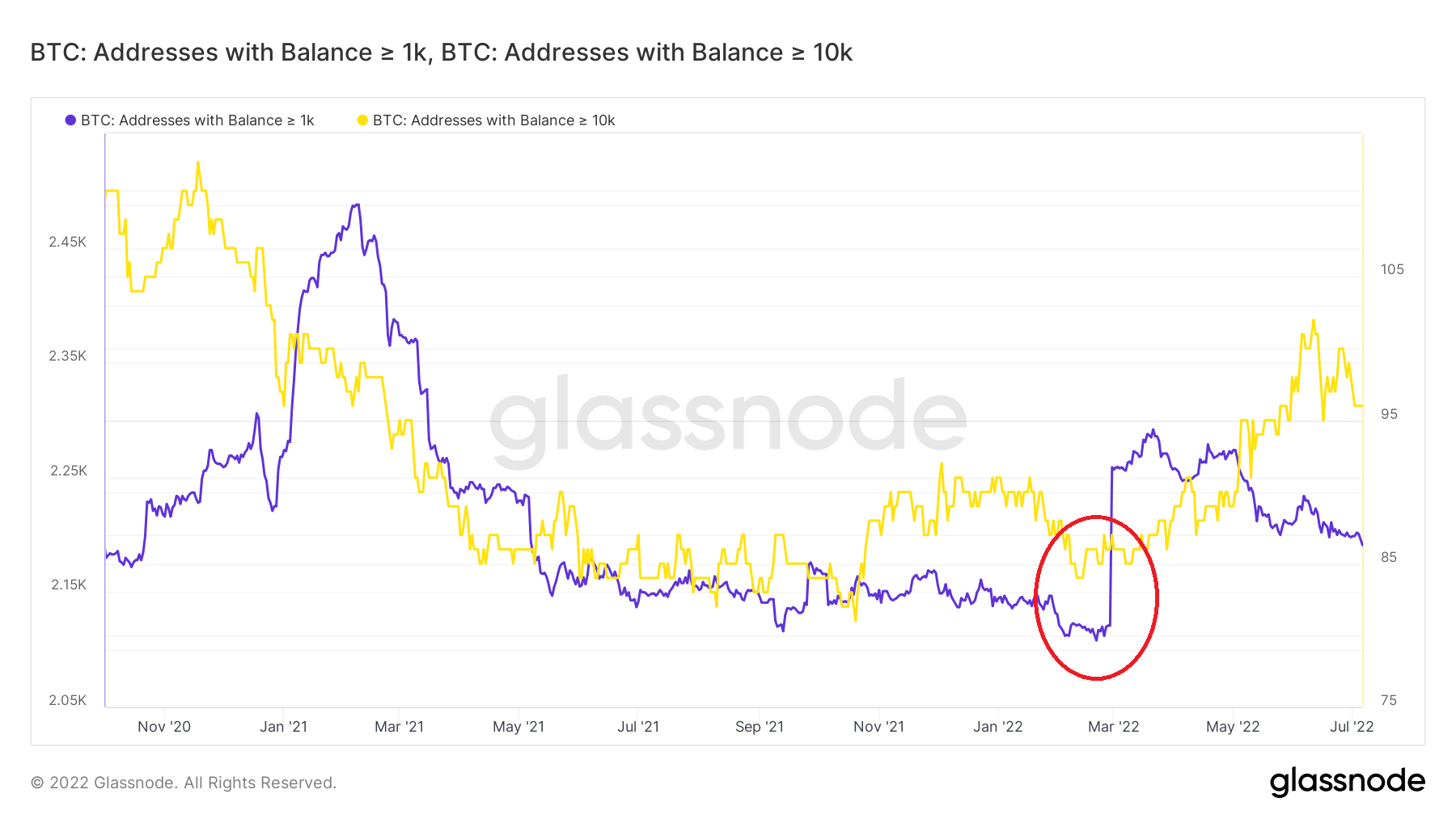

Large sized addresses

The readings for large addresses are interesting. While accounts with more than 1,000 (purple) and 10,000 BTC (yellow) fell in the beginning of 2021, they have begun to increase sharply since March (red circle).

Therefore, while large addresses started to distribute their holdings in the beginning of 2021, they have begun to stack at a significant rate since the correction began.

For Be[in]Crypto’s latest bitcoin (BTC) analysis, click here