When it comes to Bitcoin (BTC) mining, the major questions on people’s minds are “how profitable is Bitcoin mining” and “how long would it take to mine one Bitcoin?” To answer these questions, we need to take an in-depth look at the current state of the Bitcoin mining industry — and how it has changed — over the last several years.

Bitcoin mining is, essentially, the process of participating in Bitcoin’s underlying security mechanism — known as proof-of-work — to help secure the Bitcoin blockchain. In return, participants receive compensation in bitcoins (BTC).

When you participate in Bitcoin mining, you are essentially searching for blocks by crunching complex cryptographic challenges using your mining hardware. Once a block is discovered, new transactions are recorded and verified within the block and the block discoverer receives the block rewards — currently set at 12.5 BTC — as well as the transactions fees for the transactions included within the block.

Once the maximum supply of 21 million Bitcoins has been mined, no further Bitcoins will ever come into existence. This property makes Bitcoin deflationary, something which many argue will inevitably increase the value of each Bitcoin unit as it becomes more scarce due to increased global adoption.

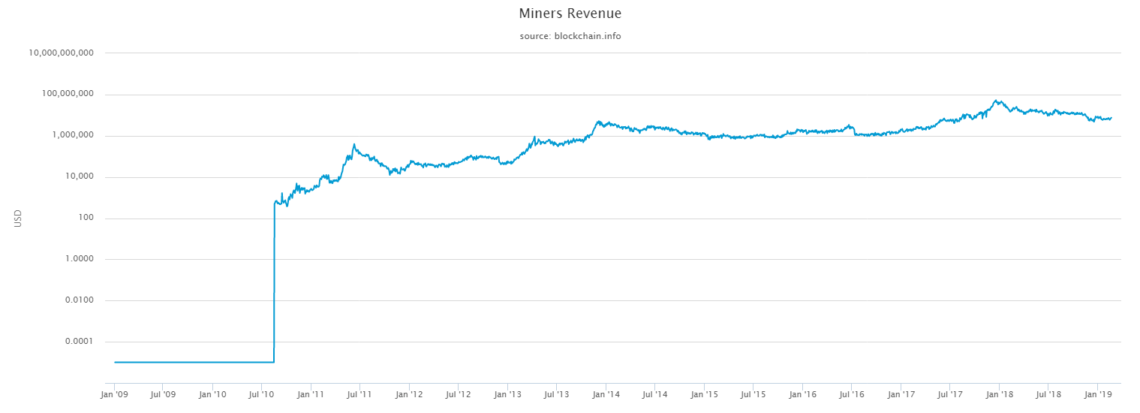

The limited supply of Bitcoin is also one of the reasons why Bitcoin mining has become so popular. In previous years, Bitcoin mining proved to be a lucrative investment option — netting miners with several fold returns on their investment with relatively little effort.

Mining Hardware

The mining hardware you choose will mostly depend on your circumstances — in terms of budget, location and electricity costs. Since the amount of hashing power you can dedicate to the mining process is directly correlated with how much Bitcoin you will mine per day, it is wise to ensure your hardware is still competitive in 2019. Bitcoin uses SHA256 as its mining algorithm. Because of this, only hardware compatible with this algorithm can be used to mine Bitcoin. Although it is technically possible to mine Bitcoin on your current computer hardware — using your CPU or GPU — this will almost certainly not generate a positive return on your investment and you may end up damaging your device. The most cost-effective way to mine Bitcoin in 2019 is using application-specific integrated circuit (ASIC) mining hardware. These are specially-designed machines that offer much higher performance per watt than typical computers and have been an absolutely essential purchase for anybody looking to get into Bitcoin mining since the first Avalon ASICs were shipped in 2013. When it comes to selecting Bitcoin mining hardware, there are several main parameters to consider — though the importance of each of these may vary based on personal circumstances and budget.Performance per Watt

When it comes to Bitcoin mining, performance per watt is a measure of how many gigahashes per watt a machine is capable of and is, hence, a simple measure of its efficiency. Since electricity costs are likely to be one of the largest expenses when mining Bitcoin, it is usually a good idea to ensure that you are getting good performance per watt out of your hardware. Ideally, your mining hardware would be highly efficient, allowing it to mine Bitcoin with lower energy requirements — though this will need to be balanced with acquisition costs, as often the most efficient hardware is also the most expensive. This means it may take longer to see a return on investment. In countries with cheap electricity, performance per watt is often less of a concern than acquisition costs and price-performance ratio. In most countries, operating outdated mining hardware is typically cost prohibitive, as energy costs outweigh the income generated by the mining equipment. However, this may not be the case for those operating in countries with extremely cheap electricity — such as Kuwait and Venezuela — as even older equipment can still be profitable. Similarly, miners with a free energy surplus, such as from wind or solar electric generators, can benefit from the minimal gains offered by still running outdated hardware.Longevity

The lifetime of mining hardware also plays a critical role in determining how profitable your mining venture will be. It’s always a good idea to do whatever possible to ensure it runs as smoothly as possible. Since mining equipment tends to run at a full (or almost full) load for extended periods, they also tend to break down and fail more frequently than most electronics — which can seriously damage your profitability. Equipment failure is even more common when purchasing second-hand equipment. Since warranty claims are often challenging, it can often take a long time to receive a warranty replacement.Price-Performance Ratio

In many cases, one of the major criteria used to select mining hardware is the price-performance ratio — a measure of how much performance a machine outputs per unit price. In the case of cryptocurrency mining hardware, this is commonly expressed as gigahashes per dollar or GH/$. Under ideal circumstances, the mining hardware would have a high price-performance ratio, ensuring you get a lot of bang for your buck. However, this must also be considered in combination with the acquisition costs and the expected lifetime of the machine — since the absolute most powerful machines are not always the cheapest or most energy efficient.Acquisition Costs

Acquisition costs are almost always the biggest barrier to entry for most Bitcoin miners since most top-end mining hardware costs several thousand dollars. This problem is further compounded by the fact that many hardware manufacturers offer discounts for bulk purchases, allowing those with deeper pockets to achieve a better price-performance ratio. Acquisition costs include all the costs involved in purchasing any mining equipment, including hardware costs, shipping costs, import duties, and any further costs. For example, many ASIC miners do not include a power supply — which can be another considerable expense, since the 1,000W+ power supplies usually required tend to cost several hundred dollars alone. Ensuring your equipment runs smoothly can also add in additional costs, such as cooling and maintenance expenses. In addition, some miners may want to invest in uninterruptible power supplies to ensure their hardware keeps running — even if the power fails temporarily.

Current Generation Hardware

One of the most recent additions to the Bitcoin mining hardware market is the Ebang Ebit E11++, which was released in October 2018. Using a 10nm fabrication process for its processors, the Ebit E11++ is able to achieve one of the highest hash rates on the market at 44TH/s. In terms of efficiency, the Ebang Ebit E11++ is arguably the best on the market, offering 44TH/s of hash rate while drawing just 1,980W of power, offering 22.2GH/W performance. However, as of writing, the Ebang Ebit E11++ is out of stock until March 31, 2019 — while its price of $2,024 (excluding shipping) may make it prohibitively expensive for those first getting involved with Bitcoin mining. Another popular choice is the ASICminer 8 Nano, a machine released in October 2018 that offers 44TH/s for $3,900 excluding shipping. The ASICminer 8 Nano draws 2,100W of power, giving it an efficiency of almost 21GH/W — slightly lower than the Ebit E11++ while costing almost double the price. However, unlike the E11++, the 8 Nano is actually in stock and available to purchase. ASICminer also offers the 8 Nano Pro, a machine launched in mid-2018 that offers 80 TH/s of hash rate for $9,500 (excluding shipping). However, unlike the Ebit E11++ and 8 Nano, the minimum order quantity for the 8 Nano Pro is curiously set at five, meaning you will need to lay out a minimum of $47,500 in order to actually get your hands on one (or five). While the 8 Nano Pro doesn’t offer the same performance per watt as the Ebit E11+ or AICMiner 8 Nano, it is one of the quieter miners on this list, making it more suitable for a home or office environment. That being said, the ASICminer 8 Nano Pro is easily the most expensive miner per TH on this list — costing a whopping $118.75/TH, compared to the $46/TH offered by the E11++ and $88.64 offered by the 8 Nano. The latest hardware on this list is the Innosilicon T3 43T, which is currently available for pre-order at $2,279, and estimated to ship in March 2019. Offering 43TH/s of performance at 2,100W, the T3 43T comes in at an efficiency of 20.4GH/W, which is around 10 percent less energy efficient than the Ebit E11++. The T3 43T also has a minimum order quantity of three units, making the minimum acquisition cost $6837 + shipping for preorders. All in all, the T3 43T is more costly and less efficient than the E11++ but may arrive slightly earlier since Ebang will not ship the E11++ units until at least end March 29, 2019. Finally, this list would not be complete without including Bitmain’s latest offering, the Antminer S15-28TH/s, which — as its name suggests — offers 28TH/s of hash power while drawing just under 1600W at the wall. The Antminer S15 is one of the only SHA256 miners to use 7nm processors, making it somewhat smaller than some of the other devices on this list. Like most pieces of top-end Bitcoin mining hardware, the Antminer S15 27TH/s model is currently sold out, with current orders not shipping until mid-February 2019. However, the S15 is offered at a significantly lower price than many of its competitors at just $1020 (excluding shipping), with no minimum quantity restriction. At these rates, the Antminer comes in at just $37.78/TH — though its energy efficiency is a much less impressive 17.5GH/W.| Mining Hardware | Mining Hardware Comparison | |

| Performance (GH/W) | Price Performance Ratio ($/TH) | |

| Ebang Ebit E11++ | 22.2GH/W | $46/TH |

| ASICminer 8 Nano | 21GH/W | $88.64/TH |

| ASICminer 8 Nano Pro | 19GH/W | $118.75/TH |

| Innosilicon T3 43T | 20.4GH/W | $53/TH |

| Antminer S15-28TH/s | 17.5GH/W | $37.78/TH |

How To Select a Good Mining Pool

Mining pools are platforms that allow miners to pool their resources together to achieve a higher collective hash rate — which, in turn, allows the collective to mine more blocks than they would be able to achieve alone. Typically, these mining pools will distribute block rewards to contributing miners based on the proportion of the hash rate they supply. If a pool contributing a total of 20 TH/s of hash rate successfully mines the next block, a user responsible for 10 percent of this hash rate will receive 10 percent of the 12.5 BTC reward. Pools essentially allow smaller miners to compete with large private mining organizations by ensuring that the collective hash rate is high enough to successfully mine blocks on regular basis. Without operating through a mining pool, many miners would be unlikely to discover any blocks at all — due to only contributing a tiny fraction of the overall Bitcoin hash rate. While it is quite possible to be successful mining without a pool, this typically requires an extremely large mining operation and is usually not recommended — unless you have enough hash rate to mine blocks on a regular basis. Although it is technically possible to discover blocks mining solo and keep the entire 12.5 BTC reward for yourself, the odds of this actually occurring are practically zero — making pool collaboration practically the only way to compete in 2019 and beyond. Selecting the best pool for you can be a challenging job since the vast majority of pools are quite similar and offer similar features and comparable fees. Because of this, we have broken down the qualities you should be looking for in a new pool into four categories; reputation, hash rate, pool fees, and usability/features:Reputation

The reputation of a pool is one of the most important factors in selecting the pool that is best for you. Well-reputed pools will tend to be much larger than newer or less well-established pools since few pools with a poor reputation can stand the test of time. Well-reputed pools also tend to be more transparent about their operation, many of which provide tools to ensure that each user is getting the correct reward based on the hash rate contributed. By using only pools with a great reputation, you also ensure your hash rate is not being used for nefarious purposes — such as powering a 51 percent attack. When comparing a list of pools that appear suitable for you, it is a wise move to read their user reviews before making your choice — ensuring you don’t end up mining at a pool that steals your hard-fought earnings.Hash Rate

When it comes to mining Bitcoin, the probability of discovering the next block is directly related to the amount of hashing power you contribute to the network. Because of this, one of the major features you should be considering when selecting your pool is its total hash rate — which is often closely related to the proportion of new blocks mined by the pool Since the total hash rate of a pool is directly related to how quickly it discovers new blocks, this means the largest pools tend to discover a relative majority of blocks — leading to more regular rewards. However, the very largest pools also tend the have higher fees but often make up for this with sheer success and additional features. Sometimes, some of the largest pools have a minimum hash rate requirement ù leaving some of the smaller miners left out of the loop. Although smaller pools typically have more relaxed requirements with reduced performance thresholds, these pools may be only slightly more profitable than mining solo.Pool Fees

When choosing a suitable pool, typically one of the major considerations is its fees. Typically, most pools will charge a small fee that is deducted from your earnings and is usually around 1-2 percent — but sometimes slightly lower or higher. There are also pools that offer 0 percent fees. However, these are often much smaller than the major pools and tend to make their money in a different way — such as through monthly subscriptions or donations. Ideally, you will choose the pool that offers the best balance of fees to other features. Usually, the pool with the absolute lowest fees is not the best choice. Additionally, pools with the lowest fees often have the highest withdrawal minimums — making pool hopping uneconomical for most.Usability and Features

When first starting out with Bitcoin mining, learning how to set up a pool and navigating through the settings can be a challenge. Because of this, several pools target their services to newer users by offering a simple to navigate user interface and providing detailed learning resources and prompt customer support. However, for more experienced miners, simple pools don’t tend to offer a variety of features needed to maximize profitability. For example, although many mining pools focus their entire hash rate towards mining a single cryptocurrency, some are large enough to offer additional options — allowing users to mine other SHA256 coins such as Bitcoin Cash (BCH) or Fantom if they choose. These pools are technically more challenging to use and mostly designed for those familiar with mining, happy to hop from coin to coin mining whichever is most profitable at the time. There are even some exchanges that automatically direct their combined hash rate at the most profitable cryptocurrency — taking the guesswork out of the equation.

Best Mining Pools for 2019

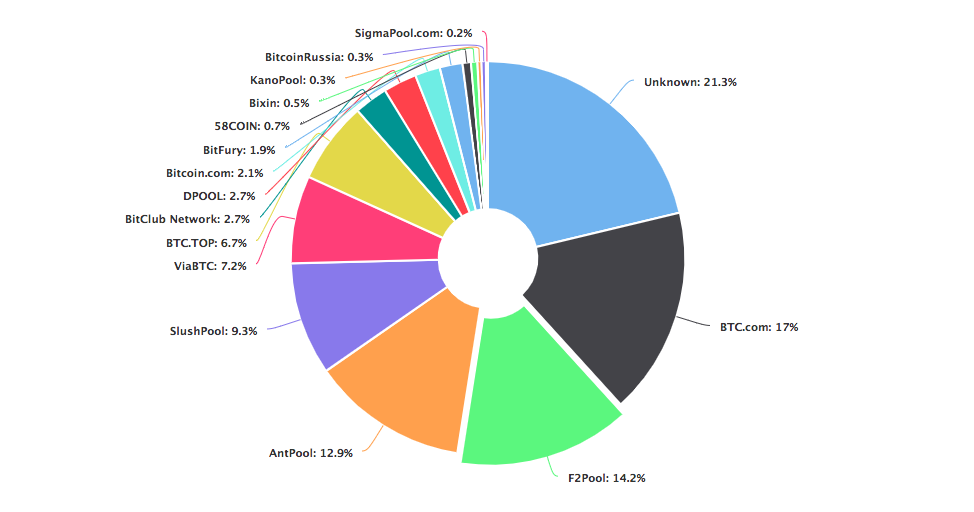

The Bitcoin mining pool industry has a large number of players, but the vast majority of the Bitcoin hash rate is concentrated within just a few pools. Currently, there are dozens of suitable pools to choose from — but we have selected just a few of the best to help get you started on your journey. Slushpool was the first Bitcoin mining pool released, being launched way back in 2010 under the name “Bitcoin Pooled Mining Server.” Since then, Slushpool has grown into one of the most popular pools around — currently accounting for just under 10 percent of the total Bitcoin hash rate. Although Slushpool isn’t one of the very largest pools, it does offer a newbie-friendly interface alongside more advanced features for those that need them. The pool has moderately high fees of 2 percent but offers servers in several countries — including the U.S., Europe, China, and Japan — giving it a good balance of fees to features. BTC.com is another potential candidate for your pool and currently stands as the largest public Bitcoin mining pool. It is responsible for mining around 17 percent of new blocks. Being the largest public mining pool provides users with a sense of security, ensuring blocks are mined regularly and a stable income is made.

Electricity Costs

While your mining hardware is most important when it comes to how much BTC you can earn when mining, your electricity costs are usually the largest additional expense. With electricity costs often varying dramatically between countries, ensuring you are on the best cost-per-KWh plan available will help to keep costs down when mining. Most commonly, large mining operations will be set up in countries where electricity costs are the lowest — such as Iceland, India, and Ukraine. Since China has one of the lowest energy costs in the world, it was previously the epicenter of Bitcoin mining. However, since the government began cracking down on cryptocurrencies, it has largely fallen out of favor with miners. Technically, Venezuela is one of the cheapest countries in the world in terms of electricity, with the government heavily subsidizing these energy costs — while Bitcoin offers an escape from the hyperinflation suffered by the Venezuelan bolivar. Despite this, importing mining hardware into the country is a costly endeavor, making it impractical for many people. Finding ways to lower your electricity costs is one of the best ways to improve your mining profitability. This can include investing in renewable energy sources such as solar, geothermal, or wind — which can yield increased profitability over the long term.

Difficulty

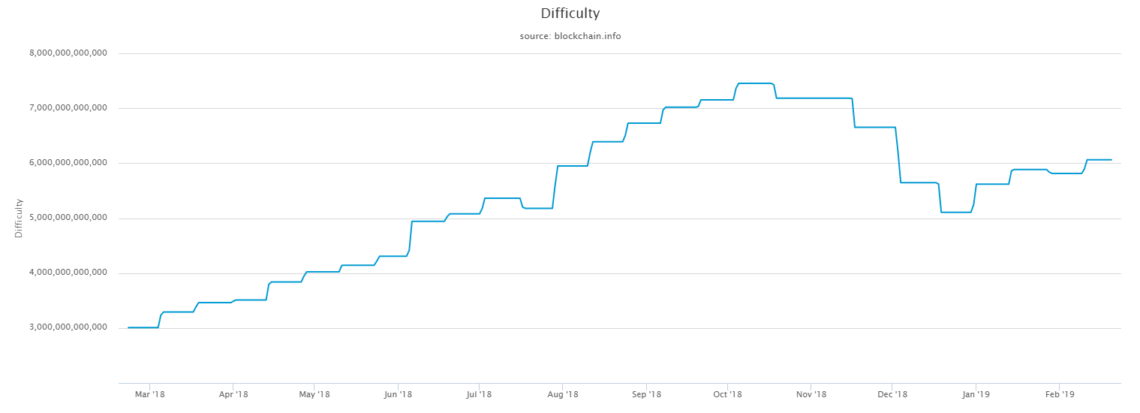

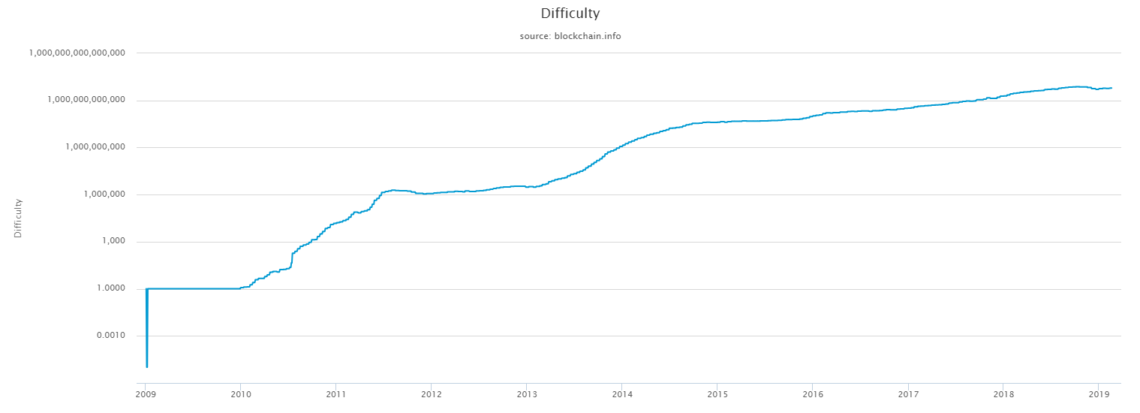

One of the major challenges of simply using a Bitcoin profitability calculator to estimate how long it will take and how profitable Bitcoin mining will be is the regularly-changing Bitcoin difficulty. Since very few profitability calculators make any prediction about how difficulty might change over the length of the calculation, they can produce wildly inaccurate estimates — particularly when projecting long-term income. To understand how difficulty affects mining profitability, we first need to understand how and why the Bitcoin protocol includes an algorithm that controls the rate of block discovery — and, hence, how many new coins enter circulation. Through a process known as controlled supply, the Bitcoin algorithm automatically adjusts how difficult block discovery is — ensuring that a new block is discovered approximately once every ten minutes. In addition to this, the number of BTC rewarded for discovering a block is halved approximately every four years after every 210,000 blocks have been mined. This process is colloquially known as “the halvening,” with the next halving event expected to occur on May 24, 2020. The difficulty of the Bitcoin blockchain changes depending on the block discovery time, which is a function of the total hash rate dedicated to the network. In times where the hash rate is lower, the difficulty will fall to ensure Bitcoin maintains a 10-minute block discovery time (approximately). When hash rates increase, the difficulty will also increase. The system for adjusting the difficulty is relatively simple. If the last 2016 blocks were discovered in less than two weeks, then the difficulty is increased. If the last 2016 blocks took longer than two weeks to discover, then the difficulty is reduced.

Difficulty Tends to Increase

For almost every year since its inception in 2009, the Bitcoin mining difficulty has increased drastically over the previous year — with the difficulty typically multiplying over the course of a year. With the advent of ASIC miners in 2013, the Bitcoin difficulty jumped from just 3M in January 2013 up to 1.4G just a year later — an almost 500x increment. Although the 2013-14 difficulty increase is an extreme example, it does demonstrate the fact that Bitcoin profitability calculators can produce wildly inaccurate estimates. Had you predicted a $5,000 per month mining income in January 2013 and maintained Bitcoin mining using the same hardware for a year, your revenue would have fallen to just $10 per month while gradually reducing in the year between. In recent times, the rate of difficulty change has somewhat slowed as ASICs have become commonplace. Between January 2018 and January 2019, the difficulty increase by 2.7x — with the great majority of difficulty retargeting rounds leading to an increase. As increasingly-powerful mining hardware continues to be deployed, it is likely that this trend will continue and, as such, should be factored into which hardware you purchase and how you calculate your mining profitability.

How Long Does it Take To Mine A Bitcoin?

Assuming the difficulty increment is uniform and equally distributed over each retargeting round, we can expect the difficulty to increase by at least 2.7x between January 2019 and January 2020. Under the worst case scenario, if Bitcoin difficulty increases at the same rate as it did between January 2017 and January 2018, then we can expect a roughly 6.08x increase in the next year. Although the difficulty increment will almost certainly not be uniform, it should produce a closer estimate than simply disregarding difficulty changes. Based on this uniform distribution, we can expect the Bitcoin difficulty to increase by between 10.3 percent and 23.3 percent every retargeting period. Based on the minimum estimates, assuming a 10.3 percent biweekly difficulty increase, we get the following results:| Mining Hardware | Mining Revenue Calculations | ||

| Average Bitcoin Mined Per Week | Bitcoin Mined Per Year | Time to Mine 1 BTC (adjusted for difficulty) | |

| Ebang Ebit E11++ | 0.0045 BTC | 0.233 BTC | Never |

| ASICminer 8 Nano | 0.0045 BTC | 0.233 BTC | Never |

| ASICminer 8 Nano Pro | 0.0082 BTC | 0.424 BTC | Never |

| Innosilicon T3 43T | 0.0044 BTC | 0.228 BTC | Never |

| Antminer S15-28TH/s | 0.0029 BTC | 0.149 BTC | Never |

| Mining Hardware | Mining Revenue Calculations | ||

| Average Bitcoin Mined Per Week | Bitcoin Mined Per Year | Time to Mine 1 BTC (assuming constant difficulty) | |

| Ebang Ebit E11++ | 0.0134 BTC | 0.695 BTC | 1.44 Years |

| ASICminer 8 Nano | 0.0134 BTC | 0.695 BTC | 1.44 Years |

| ASICminer 8 Nano Pro | 0.0243 BTC | 1.263 BTC | 0.79 Years |

| Innosilicon T3 43T | 0.0044 BTC | 0.679 BTC | 1.47 Years |

| Antminer S15-28TH/s | 0.0131 BTC | 0.441 BTC | 2.27 Years |

How Much Does It Cost to Mine One Bitcoin?

When calculating how much it costs to mine one BTC, there are two major factors to consider:- Electricity costs

- Performance per watt

| Mining Hardware | Electricity Costs Involved in Mining One Bitcoin (US Dollars) | |||||||

| Venezuela | India | Spain | U.K. | U.S. | Canada | |||

| Ebang Ebit E11++ | 249.76 | 1998.08 | 5994.24 | 5494.72 | 3246.88 | 2747.36 | ||

| ASICminer 8 Nano | 249.76 | 1998.08 | 5994.24 | 5494.72 | 3246.88 | 2747.36 | ||

| ASICminer 8 Nano Pro | 290.66 | 2325.28 | 6975.84 | 6394.52 | 3778.58 | 3197.26 | ||

| Innosilicon T3 43T | 270.42 | 2163.36 | 6490.08 | 5949.24 | 3515.46 | 2974.62 | ||

| Antminer S15-28TH/s | 317.37 | 2538.96 | 7616.88 | 6982.14 | 4125.81 | 3491.07 | ||

Are Cloud Mining Platforms Worth It?

Cloud mining is a term used to describe a remote Bitcoin mining operation that allows users to mine bitcoins through a cloud mining provider — without having to buy, set up, or manage any hardware of their own. These providers often have access to electricity at a far lower rate than is available to most people, allowing them to mine Bitcoin at a much more profitable rate. Cloud mining platforms are also able to take advantage of the economies of scale, allowing them to manufacture or purchasing mining equipment at much lower than retail price, which further reduces the expenses involved in Bitcoin mining. The mining provider then leases this hardware to users, typically for a fixed initial fee, plus additional costs — including maintenance and electricity. Usually, these contracts will be provided for a fixed term, with the fees being reduced for longer term contracts. Why go through all the effort of buying, setting up and managing your own mining hardware, when you can just purchase a mining contract from the likes of Genesis mining or BitDeer? Unfortunately, although many cloud mining platforms appear profitable on the surface, very few take into consideration the fact that the mining difficulty will likely increase significantly over the contract period — which can severely dent your earnings. Cloud mining platforms have regularly been criticized for taking advantage of uninformed users, luring them into a contract that will, in all likelihood, fail to generate a positive return on investment. These platforms typically market themselves as the easiest way to get involved in Bitcoin mining but do not mention that the easiest way is rarely the best. Because of this, we do not recommend investing in a cloud mining contract unless you are genuinely just looking to test the waters before jumping in. What is your opinion on Bitcoin mining in 2019? Do you think the hash rate will continue to grow this year, or will it break the trend? Let us know your thoughts in the comments below!Disclaimer: Bitcoin mining is unlikely to achieve a positive return on investment unless certain, highly favorable circumstances are met. As such, for the great majority of cases, Bitcoin mining is unlikely to generate a profit. This article is not intended as investment advice and should not be taken as such. BeInCrypto is independent and has no relationship with any of the companies mentioned.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Daniel Phillips

After obtaining a Masters degree in Regenerative Medicine, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite any evidence to the contrary. Nowadays, Daniel works in the blockchain space full time, as both a copywriter and blockchain marketer.

After obtaining a Masters degree in Regenerative Medicine, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite any evidence to the contrary. Nowadays, Daniel works in the blockchain space full time, as both a copywriter and blockchain marketer.

READ FULL BIO

Sponsored

Sponsored