B. Riley and Nomura, two banks that back bitcoin mining and wallet companies, are part of an ongoing investigation against a $294 million hedge fund fraud. B.Riley has invested in crypto mining companies Iris Energy and Core Scientific, but there are no hints of a bank collapse that could affect them.

The banks are implicated in fraud that names a B. Riley client, allegedly named Brian Kahn, as complicit in the securities fraud.

Bitcoin Mining Companies Have $170M Exposure

John Hughes, the co-founder of the hedge fund Prophecy Asset Management, said the unnamed CEO of a multibillion-dollar retail franchise company has been a co-conspirator in the fraud case. Nomura, which has backed Paris-based crypto wallet firm Ledger, helped B. Riley finance Kahn’s takeover of the Delaware-based Franchise Group.

Read more: Best Crypto Mining Stocks to Buy or Watch Now

The banks have called the SEC’s allegations “baseless” and have called the charges a reiteration of the narrative that short-sellers have peddled for several months. It says these entities are looking to take down the bank. Short-sellers borrow stock to sell it, hoping to buy it back when its price falls to make a profit.

“The short thesis is wrong – plain and simple.It…ignores obvious facts that undermine the entire argument. The short sellers have jumped from one incorrect theory to another in an attempt to push the acceptable limits of financial research to profit at the expense of B. Riley’s employees and clients,” a company official stated.

Last year, Australian Bitcoin mining company Iris Energy sold $100 million in equity to B. Riley, while Core Scientific was recently approved to borrow $70 million from B. Riley Commercial Capital. Last week, Core Scientific received permission to end its bankruptcy after a judge approved its reorganization plan.

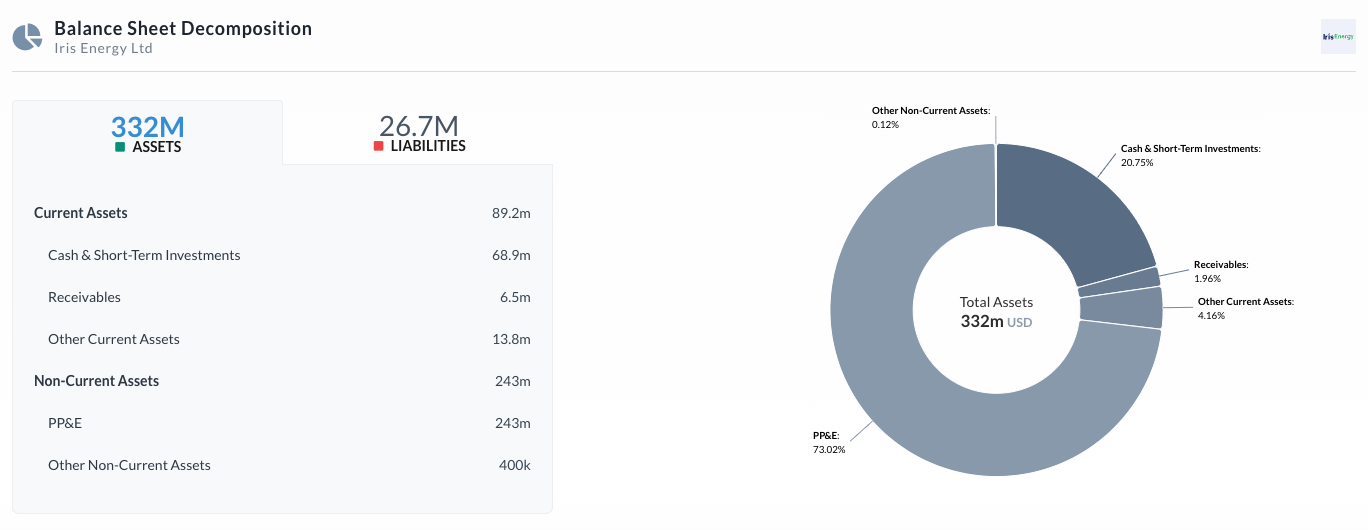

Iris Energy allowed the repossession of $103 million of mining equipment last November. However, the company appears solvent, according to its latest financial reports, making it unlikely to pull out of the equity agreement.

Crypto Bank Collapse May be Exaggerated

If the allegations against B. Riley are false, those influencing the short-selling process could face an investigation for market manipulation charges. The US Justice Department probed GameStop short-sellers for alleged market manipulation practices during the short squeeze in 2022. Activist short-sellers take up positions in a company’s stock, investigate a company’s alleged irregularities, and publish research that could cause the company’s stock price to fall.

Read more: 2023 US Banking Crisis Explained: Causes, Impact, and Solutions

In a research piece last February, Wolfpack Research founder Dan David stated that B. Riley stopped assuring investors it complied with a credit agreement entered into with Nomura Bank. He called the bank “a lender of last resort for the dregs of the public market,” that lent funds to companies that “degenerated into zombies.”

“In its Q3 2022 10-Q, B. Riley Financial (Nasdaq: RILY) abruptly stopped assuring investors that it was in compliance with the covenants of two credit agreements – its $380 million Nomura credit agreement, as well as its $75 million BRPAC credit agreement,” said David.