Bitcoin mining company Core Scientific announced the successful resolution of its Chapter 11 bankruptcy plan. The firm plans to resume normal business operations by the end of this month.

“The Bankruptcy Court’s approval of the Plan clears the way for Core Scientific to emerge and re-list on Nasdaq by the end of January 2024,” the statement declares.

Bitcoin Miner Core Scientific Announces New Share Plan

In a recent statement, investors with a stake in the business will receive shares under Core Scientific’s new share plan. This follows its Chapter 11 bankruptcy plan being resolved. The company declared bankruptcy in December 2022:

“Under the terms of the Plan, shareholders (as of the anticipated record date of January 23, 2024) will receive shares of the Company’s new common stock and warrants, constituting approximately 60% of the Company’s new equity (following exercise of the warrants issued to existing shareholders and including new shares issued as part of the equity rights offering).”

Core Scientific initially went into bankruptcy due to the volatile crypto market. Additionally, a series of major negative events within the industry. Just a month before it filed for bankruptcy, major cryptocurrency exchange FTX filed for bankruptcy. This led to a plunge in crypto tokens across the market.

Furthermore, the company at the time cited rising energy costs and an unpaid debt from the now-defunct crypto lending platform Celsius.

Read more: How To Mine Cryptocurrency: A Step-by-Step Guide

Core Scientific further notes that it has paid off its debtor-in-financing debt, which is a type of financing available for companies going through a restructuring process.

“Plan approval comes shortly after the Company announced it had fully paid off its DIP financing and successfully completed an oversubscribed $55 million Equity Rights Offering,” the statement notes.

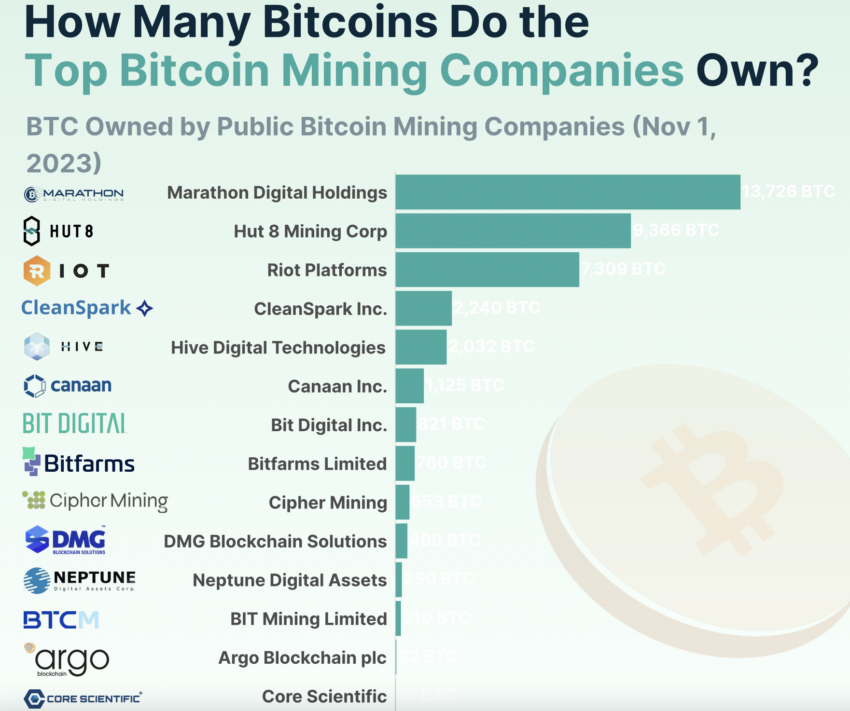

Meanwhile, as per a report from CoinGecko, Core Scientific maintained control of 10 Bitcoin (BTC) in its assets as of November 2023. However, major Bitcoin mining company Marathon Digital recorded 13,726 Bitcoins on its balance sheet as of the same time.

In July 2022, BeInCrypto reported that Core Scientific sold approximately 7,202 Bitcoins at around $23,000 per coin to service outstanding debt.

At the time of publication, Bitcoin’s price is $42,914, meaning that the amount sold would be worth $309.07 million.

Core Scientific Receives Helping Hand Last Year

However, it was only a few months ago that Core Scientific received a significant lending hand from a Bitcoin mining manufacturer in the industry.

In September 2023, BeInCrypto reported that digital currency mining server manufacturer Bitmain proposed to invest a whopping $53.9 million in Core Scientific.

Meanwhile, the investment deal, a combination of equity and cash, went towards financing the purchase of new and more efficient Bitcoin mining equipment. Bitmain also offered to supply Core Scientific with 27,000 Bitmain S19J XP 151 Bitcoin mining units.

The bankruptcy filing by Core Scientific, attributed partly to Celsius’ inability to pay, was in an effort to avoid liquidation. The intention was to enable the business to continue while negotiating a deal with its main creditors.

However, amid the filing, Core did warn its equity stockholders about the risk of losing all of their investments. It blamed this on the liquidity issues caused by the failure of Celsius.

Read more: How To Build a Mining Rig: A Step-by-Step Guide

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.