When Human Greed Takes Over

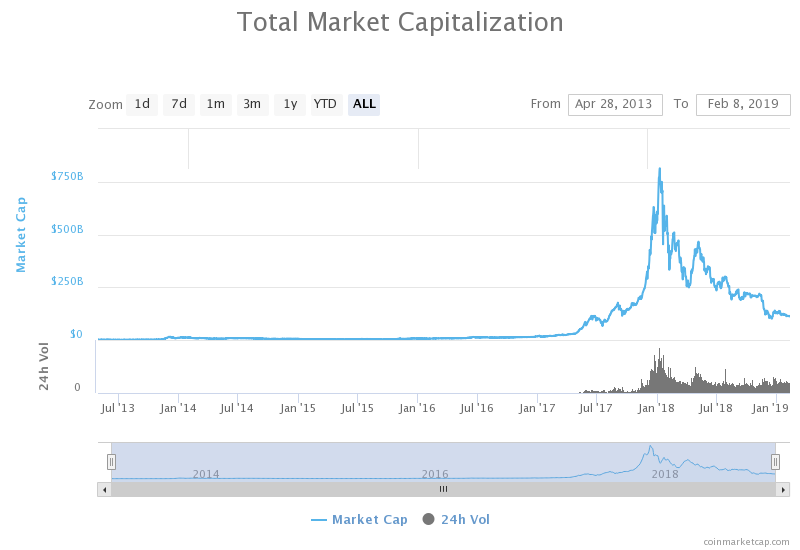

Truth be told, most of the newcomers of 2017 didn’t even know why Nakamoto created Bitcoin in the first place. They didn’t even care. They just had a general idea about Bitcoin and, more specifically, the buzzwords repeated over and over again on both social media and mainstream media — like ‘decentralization, privacy, anonymity, smart contracts, and ICOs.’ Most didn’t even bother to look into the matter or verify if the information was correct. Instead, they just wanted to profit big and get rich quick. For many, their plan didn’t succeed. 2018 confirmed the investors’ real drive. As soon as the prices collapsed, they fled, forgetting all about ‘decentralization, privacy, or sound money.’ The next bull run could be more of the same, as one cryptocurrency analyst rightly predicted a few days ago.Indeed, human greed may be the market’s last hope. The bull run of 2017 proved Bitcoin is not quite ready to be used as a worldwide currency. The Lightning Network may be a step in the right direction — yet, we don’t know how big of a step it will be. Furthermore, for Average Joe, Bitcoin is still difficult to use. This is why we currently see many Bitcoin maximalists preaching the ‘store of value’ gospel. They know the majority will continue to use fiat currencies in the foreseeable future. As a result, they have to promote Bitcoin as digital gold and as a medium-term speculative asset. Make no mistake; these Bitcoin maximalists are also driven by greed and wealth accumulation. Shifting the narrative from a medium of exchange to store of value primarily, in their attempt to convince future buyers, is the ultimate proof. You will notice the same pattern across all cryptocurrency markets. Whether it’s Ethereum, Ripple, EOS, Bitcoin Cash (BCH), or any other, somebody will try to convince you why you really need to buy a specific altcoin. Behind their arguments, more often than not, there will be the unblemished human greed and the acting in one’s self-interest.3/ There are far fewer people who care about decentralized sovereign uninflatable currency for its own sake than you'd like to think.

— Murad (@MustStopMurad) February 3, 2019

Cryptocurrency's biggest use case is speculation. That is a fact.

For better or worse, Speculation and human greed are your biggest hope.

What About Jack (Dorsey)?

The millionaires and billionaires promoting cryptocurrencies are quite a different beast. Unsurprisingly, they all are directly involved in the industry. Mike Novogratz, for example, owns a cryptocurrency investment firm. Patrick Byrne’s company, Overstock.com, was the first online major retailer to accept bitcoins. Byrne also founded security token trading platform tZero, raising $134 million from its ICO. Then there is Twitter and Square CEO Jack Dorsey — who has caused a stir in the cryptocurrency world, as of late. During a recent episode of Joe Rogan’s podcast, Dorsey said Bitcoin will ‘probably’ become the native currency of the Internet. The discussion continued on Twitter, speaking about how the Lightning Network (LN) is a game changer. He also revealed he holds ‘only’ Bitcoin. How much? ‘Enough,’ he replied. Cryptocurrency investor and trader Anondran had an interesting response following Dorsey’s tweetstorm.There’s nothing wrong with Dorsey promoting his investment. He wants his investments to succeed and, therefore, he takes advantage of any opportunity to ‘shill.’ Nevertheless, it is important to know why he is doing it and why he may be biased against other cryptocurrencies. Remember, if an executive, trader, or developer talks excessively of one coin or token while dismissing all the others, it usually means he or she is acting in his/her own self-interest. It’s best not to blindly trust such advice and do your own research before you start investing financially and emotionally in any project. Most importantly, know thyself and learn to act in your own self-interest. Don’t worry if you are greedy — we all are, one way or another. It’s human nature, after all. Is human greed the real trigger in a cryptocurrency bull run? Can Bitcoin succeed as a currency and not necessarily as a speculative asset? Please share your thoughts in the comment section below!Jack is primarily shilling Bitcoin and that alone because he invested in @lightning labs a year ago. So its in his self-interest to integrate it into twitter and other apps and make a massive return out of his lightning stake.

— Anondran (@AnondranCrypto) February 6, 2019

Most people do not know this.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.