The Bitcoin market isn’t exactly showing strength. Now, it may receive a knockdown blow from a torrent of Mt. Gox sellers.

The Telegraph reported yesterday that Bitcoin investors may be looking at yet another round of “intense selling pressure,” courtesy of infamous Japanese cryptocurrency exchange Mt. Gox.

The notorious exchange, which once handled over 70 percent of all bitcoin (BTC) transactions, is now reportedly being forced to pay out $1 billion worth of coins following the company’s liquidation after 850,000 bitcoins were presumed stolen in 2011.

‘Completely Crash the Market’

The market crash would conceivably take place as a result of investors selling their upwards of 160,000 bitcoins upon receipt at current valuations. It is unlikely that the current market will see enough buyers to meet the selling demand, potentially triggering a cascading sell-off to new yearly lows. As noted by The Telegraph, investors have until Oct 22 to legally file claims on their lost bitcoins.

Who Will Buy?

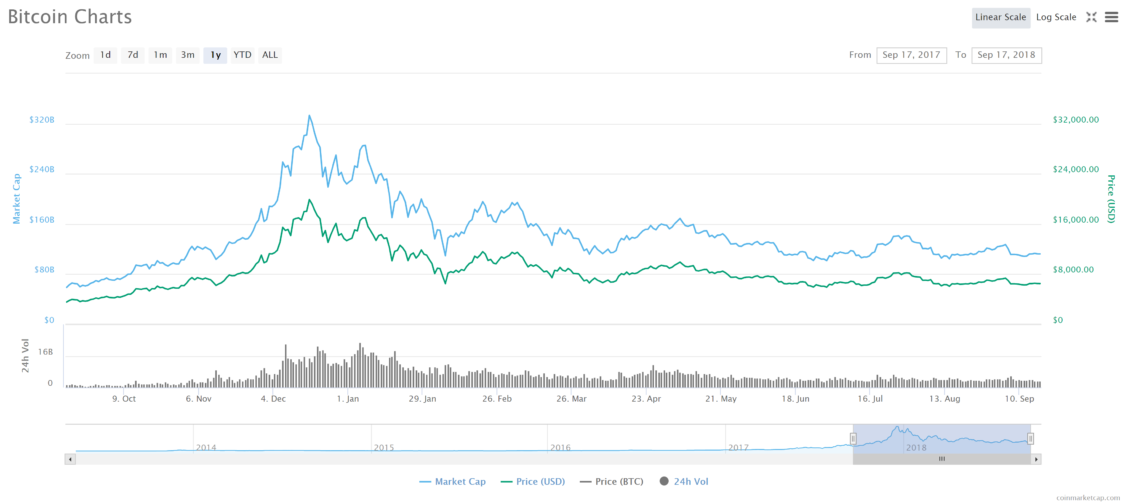

At the time of this writing, Bitcoin is trading at $6,482 per coin after a week of fairly uneventful consolidation following the last dramatic sell-off. Volume remains especially low. When said volume re-enters the market — say, from Mt. Gox sellers — the price could conceivably be moved dramatically. Willing buyers may not be found until the ‘big even’ psychological support of $5,000. What do you think about the impending sell-off of from Mt. Gox investors? Do you think this event will crash the market, or is it merely just FUD (Fear, Uncertainty, and Doubt)? Let us know your thoughts in the comments below! [Disclaimer: This article is not intended as financial advice. BeInCrypto is not responsible for any readers’ financial gains or losses.] [Full Disclosure: The author of this article holds and trades Bitcoin (BTC).]

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Kyle Baird

Kyle migrated from the East Coast USA to South-East Asia after graduating from Pennsylvania's East Stroudsburg University with a Bachelor of Science degree in 2010. Following in the footsteps of his grandfather, Kyle got his start buying stocks and precious metals in his teens. This sparked his interest in learning and writing about cryptocurrencies. He started as a copywriter for Bitcoinist in 2016 before taking on an editor's role at BeInCrypto at the beginning of 2018.

Kyle migrated from the East Coast USA to South-East Asia after graduating from Pennsylvania's East Stroudsburg University with a Bachelor of Science degree in 2010. Following in the footsteps of his grandfather, Kyle got his start buying stocks and precious metals in his teens. This sparked his interest in learning and writing about cryptocurrencies. He started as a copywriter for Bitcoinist in 2016 before taking on an editor's role at BeInCrypto at the beginning of 2018.

READ FULL BIO

Sponsored

Sponsored