In recent weeks, significant movements and sell pressure have rocked Bitcoin.

Long-term holders, early miners, and ETF managers have sold billions in BTC, raising concerns about the cryptocurrency’s short-term stability.

Bitcoin Selling Pressure Accelerates

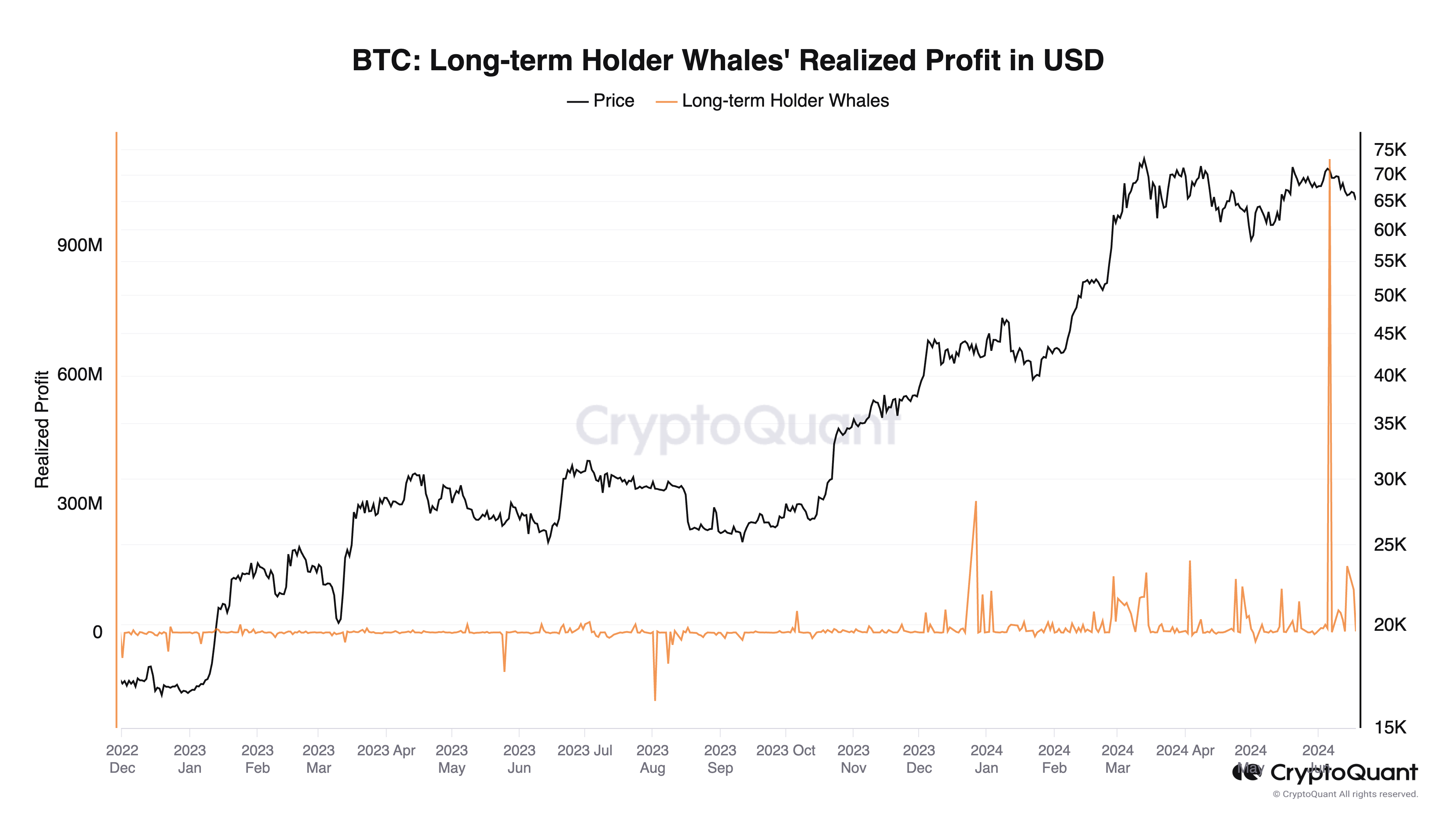

Bitcoin long-term holders sold $1.2 billion in the past two weeks. This substantial sell-off has added pressure on the market.

According to Ki Young Ju, CEO of blockchain analytics firm CryptoQuant, this amount of capital in sell-side liquidity must be absorbed through over-the-counter transactions. Otherwise, brokers may deposit Bitcoin to exchanges, potentially impacting the market further.

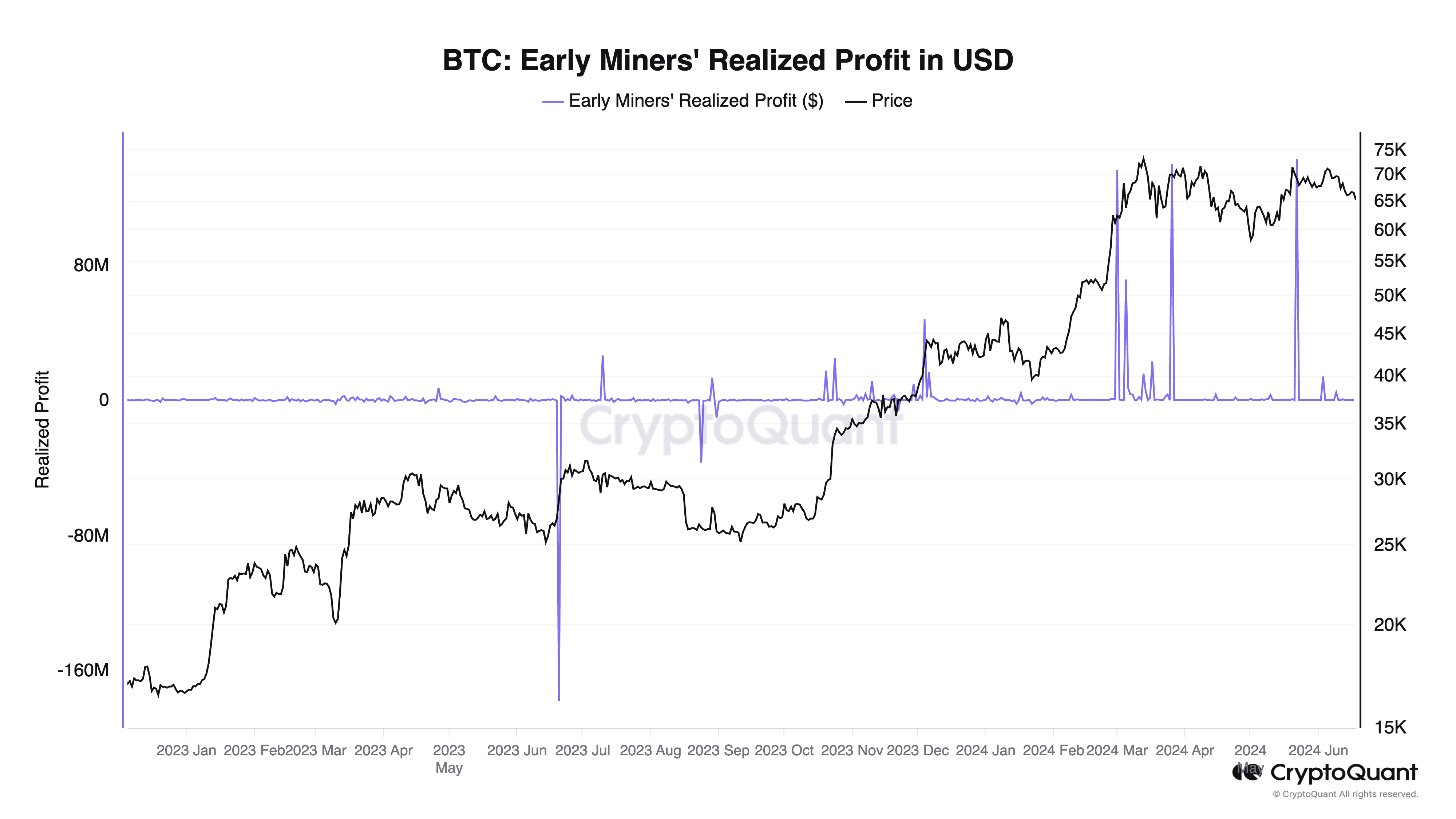

Early Bitcoin miners have also contributed to the sell-off. They have realized about $550 million in profits this year when Bitcoin traded between $62,000 and $70,000. This trend has intensified the downward pressure on Bitcoin’s price.

Interestingly, on-chain analysis suggests this “rare” miner capitulation is linked to the recent Bitcoin halving. This process eliminates weaker miners, leading to a temporary increase in BTC being sold. As these miners exit, the market experiences a dip before potentially rebounding.

“Despite increased selling pressure following the halving, historical market cycles show that the 6 to12 months post-halving tend to be bullish. Miners typically sell heavily post-halving to bolster reserves in anticipation of the downtrend that usually follows,” Matteo Greco, Research Analyst at Fineqia, told BeInCrypto.

However, on-chain analyst Willy Woo maintains that this phase requires a clearing of open interest in futures markets before a bullish trend can resume.

“We need a solid amount of liquidations still before we get the all clear for further bullish activity,” Woo emphasized.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

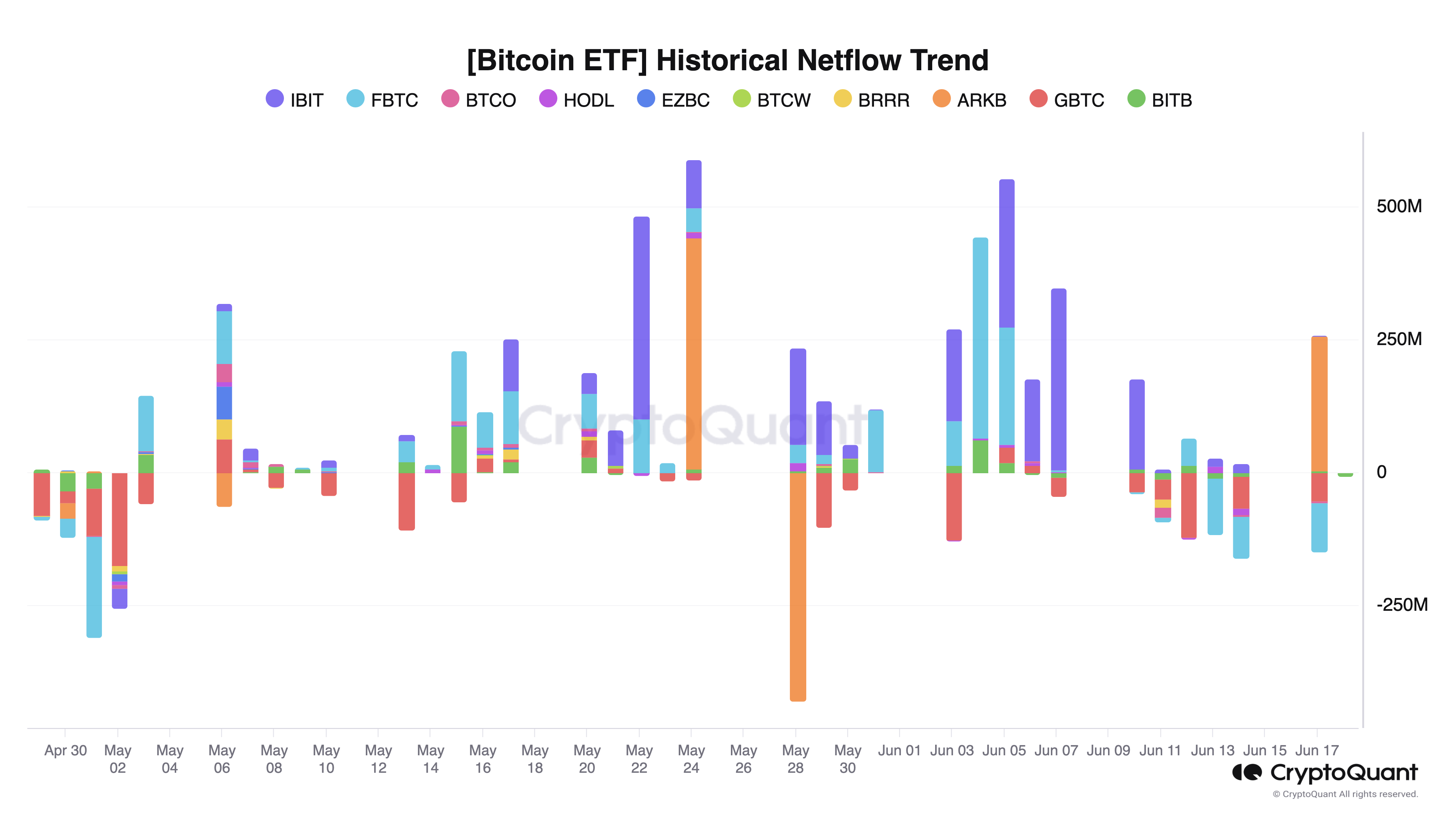

Adding to the market’s challenges, analysts at AI-driven analytics platform Spot on Chain highlighted persistent negative net flows in Bitcoin ETFs.

On June 18, 2024, the Bitcoin ETFs net outflow reached $152 million. This marks the fourth consecutive day of negative net inflows, totaling $714 million. Notably, Grayscale and Fidelity saw significant outflows, exacerbating the bearish sentiment.

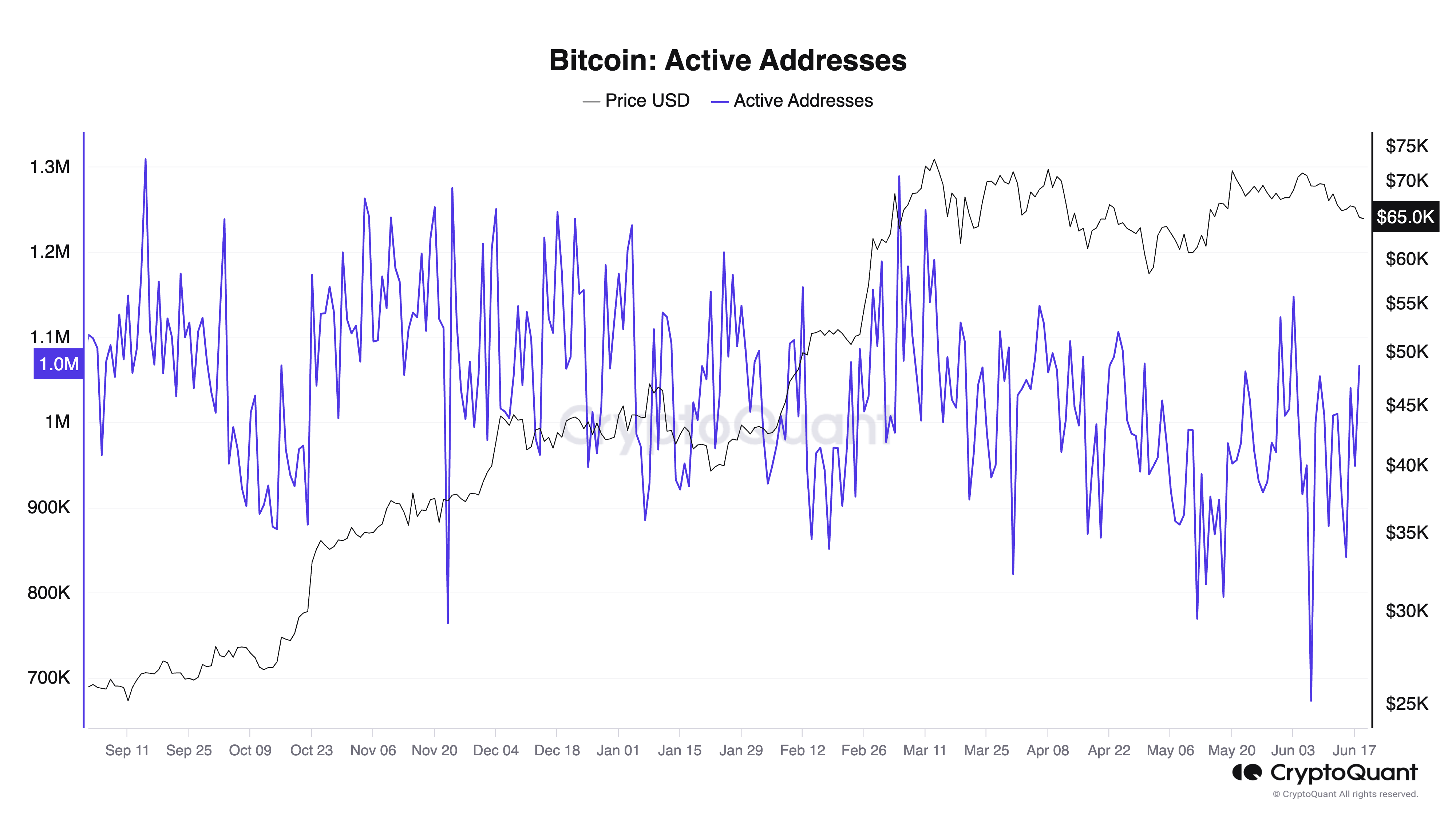

Finally, analysts at data science company IntoTheBlock noted that the number of Bitcoin transactions spiked earlier this year due to the excitement around ordinals and Runes. However, the increase in usage and whale activity does not involve a significant influx of new participants.

“Typically, crypto bull markets are fueled by widespread Bitcoin enthusiasm. Yet despite Bitcoin’s early rise, [there’s a] lack of retail user growth,” analysts at IntoTheBlock wrote.

Indeed, the number of new Bitcoin users has dropped to a multi-year low, even below levels seen during the 2018 bear market. This lack of retail investor growth raises critical questions about the sustainability of the current market dynamics.

Read more: Bitcoin (BTC) Price Prediction 2024 / 2025 / 2030

While Ju maintains that the media sentiment remains bullish, this optimistic outlook might not be beneficial. With substantial sell-offs from long-term holders, early miners, and persistent negative ETF netflows, Bitcoin could face a prolonged corrective period.