New whales aggressively accumulate Bitcoin, while old whales slightly reduce their holdings.

This behavior suggests a mix of bullish sentiment among new market entrants and strategic repositioning among long-term holders. Large holders also show strong accumulation, supporting Bitcoin’s mid-term prospects.

New Whales Accumulating BTC

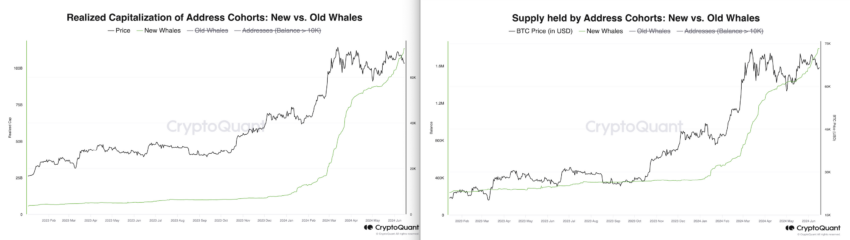

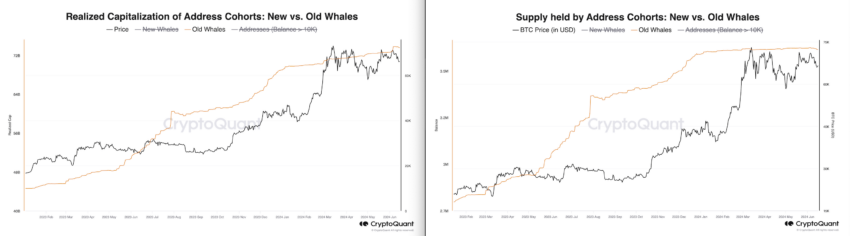

The supply held by new whales, defined as addresses holding more than 1,000 BTC and with an average detention time of less than six months, has seen a substantial increase.

The total supply for this cohort rose from approximately 1,577,544 BTC to 1,784,327 BTC, an increase of 206,783 BTC.

Moreover, the realized capitalization for new whales showed a consistent upward trend, increasing from approximately $98.44 billion to $113.12 billion, indicating a rise of $14.68 billion.

Read More: Bitcoin Halving History: Everything You Need To Know

Bitcoin’s Realized Cap gives a snapshot of its actual value by considering the price at which each Bitcoin was last transacted. Unlike traditional market capitalization, which only looks at the current market price, Realized Cap goes deeper, reflecting the historical transaction prices on the blockchain.

The aggressive accumulation of new whales often signals confidence in Bitcoin’s near-term potential. Therefore, their increasing presence and higher realized capitalization suggest that recent entrants to the market are optimistic about future price appreciation and are willing to buy BTC at higher prices.

Old Whales Reducing Holdings

In contrast, the supply held by old whales—addresses with more than 1,000 BTC and an average detention time exceeding six months—decreased slightly. Their holdings dropped from about 3,621,388 BTC to 3,614,122 BTC, resulting in a reduction of 7,266 BTC.

Meanwhile, the realized capitalization for old whales remained relatively stable, increasing slightly from around $72.62 billion to $73.56 billion. Marking a modest rise of $940 million.

The slight reduction in holdings by old whales might indicate a strategic realignment, possibly taking advantage of recent price gains or preparing for market volatility.

The stable realized capitalization suggests that these long-term holders maintain their positions with minimal net selling or buying activity, indicating a strong conviction in the market.

Large Holders Are Accumulating Bitcoin

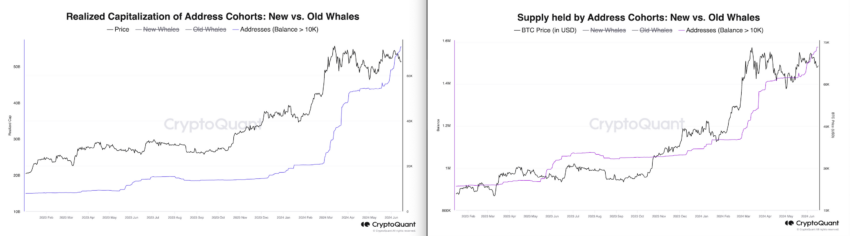

Strong Support from Large Holders: Addresses with a balance exceeding 10,000 BTC experienced a notable increase in supply. The total holdings in this cohort rose from 1,494,362 BTC to 1,568,702 BTC, reflecting an increase of 74,340 BTC.

The realized capitalization for these large holders also significantly increased, rising from $49.06 billion to $55.43 billion, indicating an increase of $6.37 billion.

Read More: Bitcoin (BTC) Price Prediction 2024/2025/2030

The increase in supply and realized capitalization among addresses holding more than 10,000 BTC reflects strong confidence among the biggest market participants. This accumulation phase underscores a significant bullish sentiment, providing a solid support level for Bitcoin and mitigating downside risks.

Given the accumulation patterns observed among new whales and large holders, Bitcoin is likely to target the $80,000 mark in the near term.

The bullish sentiment among new entrants and the strong support from large holders suggest a positive outlook for Bitcoin’s price movement. The increasing realized cap reflects growing confidence and the entry of new capital, supporting a potential rise to 80,000 in the midterm.

If short-term whales stop buying or long-term whales start selling significantly, it could indicate a potential price reversal. Short-term whales have been driving the recent bullish momentum. If these whales stop buying, it signals a loss of confidence or a shift in market sentiment. This reduction in demand can weaken price support, increasing the chances of downward price pressure.

On the other hand, long-term whales usually provide market stability. If these whales begin significant selling, it could suggest a strategic exit or a reaction to anticipated market downturns. Therefore, their selling pressure can flood the market with BTC, increasing supply and potentially driving prices down to below $60,000.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.