If data from Google search results are anything to go by, the anticipation for the upcoming Bitcoin (BTC) halving event is beginning to reach a fever pitch. Bitcoin’s historical trend has seen the price reach new all-time highs on the back of the previous two halvings.

Meanwhile, spikes are also emerging in on-chain activities, even leading to a significant increase in transaction fees. On the network fundamentals side of things, the hashrate has set a new ATH in time for the block reward halving a week away.

Bitcoin Halving Anticipation Continues to Grow

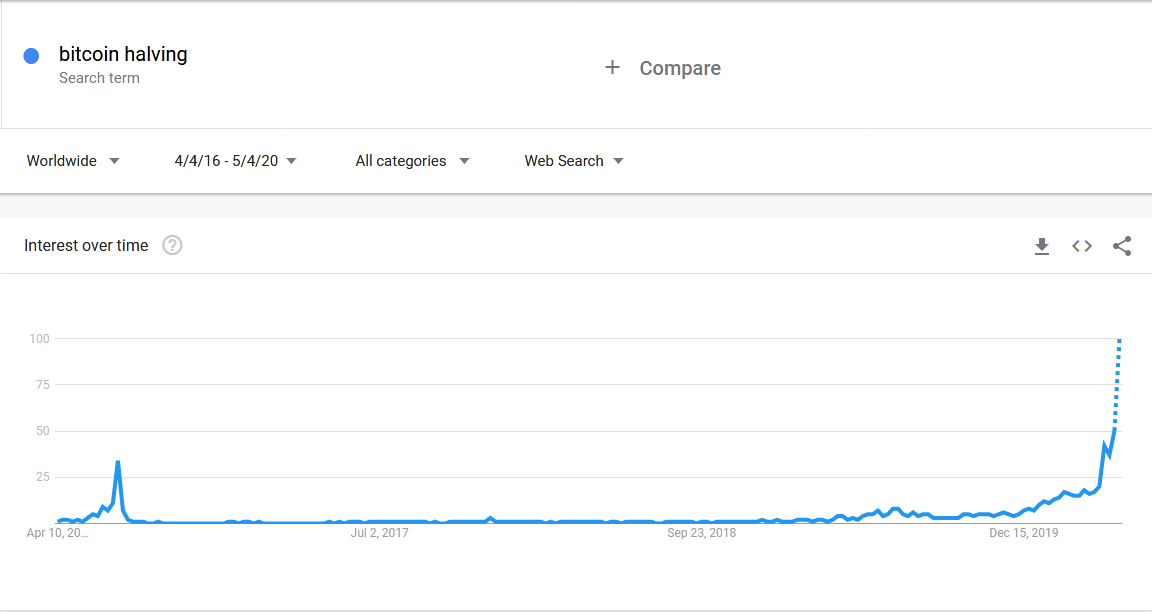

According to data from Google Trends pointed out by @runtheirstops on Twitter, search interest in the Bitcoin halving is now four times the level seen before the 2016 halving. Indeed, as previously reported by BeInCrypto, Bitcoin halving searches have been steadily climbing over the past few weeks.

On-Chain Activity Spike

Google search interest is not the only indicator of growing anticipation for the upcoming halving. On-chain activity is also on the rise, leading to a spike in transaction fees as buyers continue to accumulate BTC. Again, this accumulation, backed up by trends seen from retail buyers since February 2020, points to market expectations of another massive upward price gain for BTC. Even the flash crash of Black Thursday in mid-March appears to have done little to quell retail appetite for Bitcoin. On the institutional side, crypto derivatives numbers and investment inflows in instruments like Grayscale Bitcoin Trust are also pointing to renewed interest from big-money players.

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Osato Avan-Nomayo

Osato is a reporter at BeInCrypto and Bitcoin believer based in Lagos, Nigeria. When not immersed in the daily happenings in the crypto scene, he can be found watching historical documentaries or trying to beat his Scrabble high score.

Osato is a reporter at BeInCrypto and Bitcoin believer based in Lagos, Nigeria. When not immersed in the daily happenings in the crypto scene, he can be found watching historical documentaries or trying to beat his Scrabble high score.

READ FULL BIO

Sponsored

Sponsored