Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee as we explore Bitcoin’s position among top assets and the implications of rising treasury yields for Bitcoin. As investors progressively distrust US debt sustainability, fearing deficits, Bitcoin’s appeal as a hyperinflation hedge grows as the Federal Reserve (Fed) buying bonds signals inflation fears.

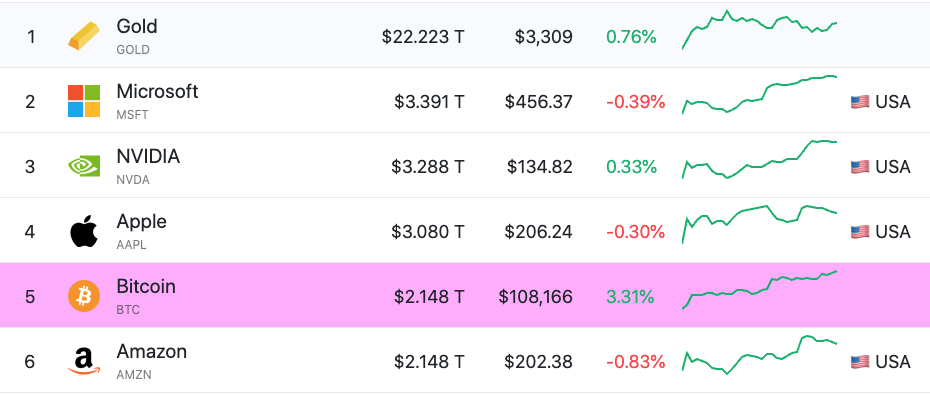

Crypto News of the Day: Bitcoin Overtakes Amazon and Google After All-Time High

A recent US Crypto News publication indicated that Bitcoin had overtaken Google in market cap rankings. At the time, its market cap stood at $1.86 trillion.

The latest data shows that Bitcoin’s market cap has risen to $2.16 trillion, a 14% increase since April 23. With this, Bitcoin has ascended to the sixth position on market cap metrics, effectively sidestepping Google as it closes in on Amazon.

“Bitcoin flips Google and is now the 6th largest asset on the planet, overtaking Alphabet (Google) with a market cap of over $2 Trillion. BTC now trails only Gold, Microsoft, Nvidia, Apple, and Amazon. This isn’t just a number—it’s history in the making,” wrote Bitward Investment co-founder and COO Dariusz Kowalczyk.

The sentiment on X (Twitter) is that Bitcoin is on the verge of flipping Amazon. This could happen soon, as there is only a modest 2.7% difference in the market cap of the two assets.

Other users are optimistic that Bitcoin could dethrone gold and become the largest asset by market cap rankings.

Indeed, the optimism comes with good reason, considering that Bitcoin remains among the top assets that have attained the $1 trillion market cap threshold in record time.

Meanwhile, Bitcoin’s surge is unsurprising, given its growing influence against economic uncertainty. For instance, Bitcoin is emerging as a radical alternative in Japan as the country faces surging inflation. Inflation in the country has reached 3.6%, now exceeding the US Consumer Price Index (CPI).

In the same tone, a recent US Crypto News publication noted Bitcoin’s emerging role as a hedge against US Treasury and Traditional Finance (TradFi) risks.

“I think Bitcoin is a hedge against both TradFi and US Treasury risks…Bitcoin’s number one purpose in a portfolio is as a hedge against risks to the existing financial system, due to its decentralized ledger,” said Geoff Kendrick, the Head of Digital Asset Research at Standard Chartered, in a recent interview with BeInCrypto.

Robert Kiyosaki Says No One Wants US Bonds

Elsewhere, Rich Dad Poor Dad author Robert Kiyosaki notes that a US Treasury bond auction failed on May 20, with the Fed buying $50 billion of its bonds.

“What if you threw a party and no one showed up? That is what happened yesterday. The Fed held an auction for US Bonds and no one showed up. So the Fed quietly bought $50 billion of its own fake money with fake money,” wrote Kiyosaki.

The renowned says Columbia professor Charles Calomiris warned about this scenario in 2023. He cites investor distrust in US debt sustainability, which could fuel inflation by increasing the money supply.

Specifically, Kiyosaki predicts hyperinflation and financial ruin for many, while forecasting massive price surges in alternative assets.

“Good news. Gold will go to $25,000. Silver to $70. Bitcoin to $500,000 to $ 1 million,” he added.

The sentiment comes as these assets are inflation hedges amid rising money supply concerns. His $500,000 Bitcoin target aligns with Standard Chartered’s forecast, which was also reported in a recent US Crypto News publication.

According to Kiyosaki, however, a broken monetary system drives economic issues, with investors advocating for sound money like gold or Bitcoin.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- SEC alleges Unicoin and executives misled investors about fundraising and asset backing. Regulators claim over 5,000 investors were deceived by inflated figures and SEC registration claims.

- The TRUMP meme coin saw a 13% surge ahead of a private dinner with President Trump and the top 220 holders.

- On Tuesday, Bitcoin spot ETFs saw over $300 million in inflows, with BlackRock’s IBIT leading at $287.45 million.

- Over 86 million PI tokens were withdrawn from OKX, causing Pi Network’s price to surge 11% amid speculation of a supply shock.

- Ethereum co-founder Jeffrey Wilcke moved $262 million worth of ETH to Kraken, sparking speculation of a potential selloff, but concerns were later eased.

- Metaplanet, Japan’s most shorted stock, faces scrutiny amid rising inflation and bond market turmoil, with short positions driven by its Bitcoin treasury strategy.

- The golden era of effortless airdrops is over, as projects now favor VC alignment and stricter participation criteria.

- XRP faces a $470 million selloff as investor confidence weakens, with whale holders contributing to the selling pressure.

- South Korea’s presidential candidates are vying for the support of 15 million crypto investors by promising digital asset reforms, such as crypto ETFs and stablecoin markets.

Crypto Equities Pre-Market Overview

| Company | At the Close of May 20 | Pre-Market Overview |

| Strategy (MSTR) | $416.92 | $417.21 (+0.07%) |

| Coinbase Global (COIN) | $261.38 | $262.35 (+0.37%) |

| Galaxy Digital Holdings (GLXY.TO) | $30.52 | $29.58 (-3.08%) |

| MARA Holdings (MARA) | $16.19 | $16.09 (-0.62%) |

| Riot Platforms (RIOT) | $8.93 | $8.87 (-0.68%) |

| Core Scientific (CORZ) | $10.92 | $10.86 (-0.55%) |