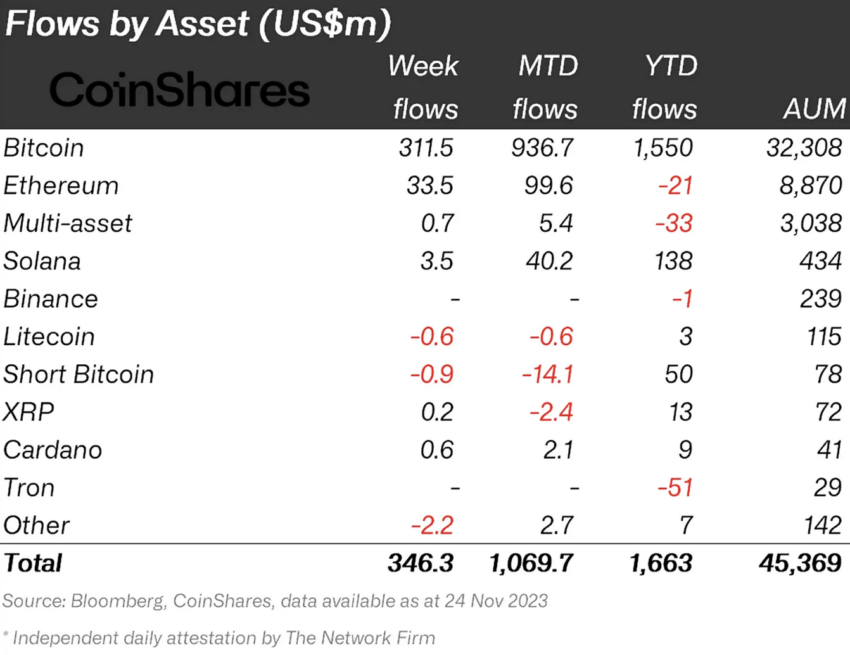

According to the latest CoinShares report, total crypto inflows for the week just gone have been the highest in the past three months, pointing to a bullish sentiment in the market.

“Digital asset investment products saw inflows totaling US$346m last week, the largest weekly inflows in this nine consecutive week run,” the statement noted.

Bitcoin ETF Hype Sparks Crypto Investment Surge

According to the recent report, Bitcoin had inflows of $312 million last week. The total inflows for 2023 so far is $1.5 billion. It was declared that the hype around Bitcoin exchange-traded funds (ETF) has led to a record-breaking week for inflows of funds.

“ETF Anticipation Fuelling the Largest Surge in Inflows Since Late 2021.”

Excitement surrounding the imminent approval of a Bitcoin ETF reportedly triggered the rise in crypto inflows:

“This run, spurred by anticipation of a spot-based ETF launch in the US, is the largest since the bull market in late-2021. The combination of price rises and inflows have now pushed up total assets under management (AuM) to US$45.3bn, the highest in over one and a half years.”

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

Bitcoin ETF Speculation Rises

This comes amid several reports of industry leaders speculating over the approval of Bitcoin ETFs.

Pantera Capital’s Dan Morehead outlined his belief of the importance of a Bitcoin ETF.

“The existence of an ETF is a very important step in becoming an asset class,” he said before adding, “Once an ETF exists, if you don’t have exposure, you’re effectively short.”

Read more: Where To Trade Bitcoin Futures: A Comprehensive Guide

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.