After a challenging period, Bitcoin exchange-traded funds (ETFs) have recorded net inflows in the last three trading days.

Indeed, investors have injected over $500 million into Bitcoin ETFs this week as BTC nears the significant $60,000 mark. This substantial investment demonstrates a rebound in ETF investors’ sentiment.

Investors’ Accumulation Pushes Bitcoin’s Price Towards $60,000

Currently, Bitcoin trades at $59,000, showing a notable rise from this week’s low of $54,200. Since Monday, the crypto’s value has surged over 9%, indicating a market recovery and a bullish outlook from investors.

Particularly, ETFs have experienced a significant influx, with BlackRock’s iShares Bitcoin Trust (IBIT) taking the lead. According to data from Farside Investors, this week, IBIT recorded impressive inflows of $308.2 million, positioning it at the forefront of investment activity.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Not far behind, Fidelity’s Wise Origin Bitcoin Fund (FBTC) secured the second-highest inflows, totaling $152.5 million. On Monday and Tuesday alone, the inflows were $61.5 million and $91 million, respectively. Such accumulation illustrates investors’ strategic approach to “buy the dip” following recent price fluctuations in Bitcoin.

“Significant inflows into Bitcoin ETFs, such as BlackRock’s iShares and Fidelity’s funds, suggest strong institutional and retail investor confidence in Bitcoin’s long-term value. These investments reflect a belief in Bitcoin’s potential as a store of value and hedge against inflation, particularly in an era of economic uncertainty,” Michael Kwok, Chief Investment Officer at AQN Digital told BeInCrypto.

On the other hand, the Grayscale Bitcoin Trust (GBTC) encountered a downturn, with net outflows amounting to $12.4 million over two days. This reflects a more cautious stance from certain market segments.

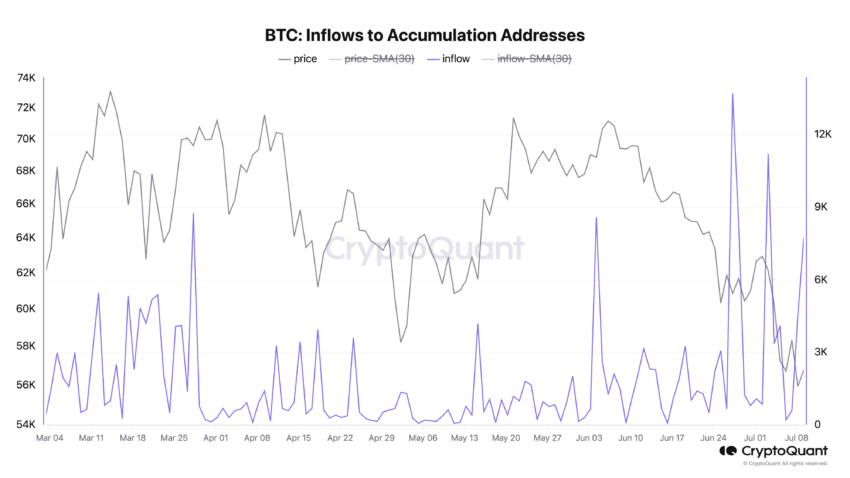

Moreover, the surge in Bitcoin accumulation extends beyond ETFs. According to CryptoQuant, Bitcoin accumulation addresses received about 7,700 BTC, worth approximately $436.5 million, on Tuesday. This substantial activity suggests widespread confidence in Bitcoin’s potential for a continued price rise.

Bitcoin Inflows to Accumulation Addresses. Source: CryptoQuant

Despite these optimistic investment trends, the overall market sentiment remains mixed. The crypto fear and greed index stands at 29, indicating ongoing fears within the community. This anxiety largely stems from broader economic uncertainties, especially with the imminent US CPI announcement, which could impact monetary policies and Bitcoin’s price trajectory.

“The crypto market rebounds as Bitcoin marches towards $60,000. The Fed’s inflation response with rate hikes is a cloud on the horizon. However, if inflation is controlled, it could lead to price increases,” Avinash Shekhar, co-founder of Pi42, a crypto derivatives exchange, told BeInCrypto.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.