Bitcoin’s (BTC) price is down 24% since topping out at $71,758 in early June. As sentiment remains soar, the next directional bias for the pioneer cryptocurrency hinges on four critical narratives that continue to unfold.

Retail traders adjust their trading strategies based on market sentiment, which explains the highly volatile nature of crypto.

Critical Factors Impacting Bitcoin Price Now

The $54,450 level has presented as a possible support for Bitcoin price. Two failed breakdowns after the Relative Strength Index (RSI) tested the critical threshold of 30 suggest that BTC may have bottomed out.

Nevertheless, whether a recovery is sustainable will depend on how the four macro market movers play out.

Ethereum ETFs Launch Could Inspire Positive Market Sentiment

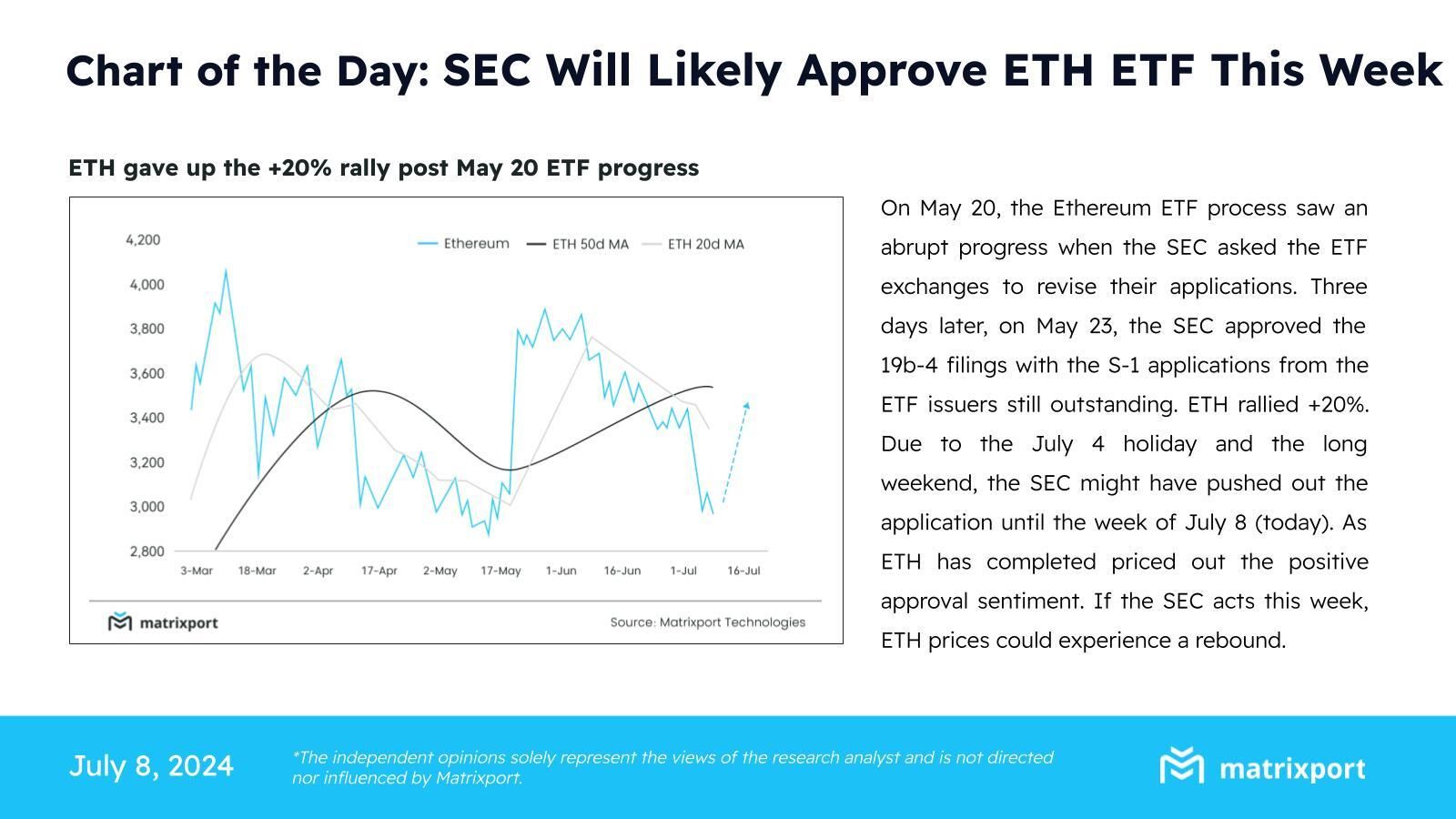

Crypto supporters join Ethereum token holders to see whether Spot Ethereum ETFs (Exchange-traded funds) will begin trading this week. The US Securities and Exchange Commission (SEC) collected final S-1 Forms from prospective ETH ETF issuers on Monday. This suggests progress in the approval process for these financial instruments.

Crypto financial services platform Matrixport shares the optimism. The firm anticipates possible launches this week as the deadline for issuers to submit amended S-1 filings reaches.

According to the report, progress could be as swift as in May, when the regulator green-lit the 19b-4 forms only three days after submissions.

Read more: Ethereum ETF Explained: What It Is and How It Works

Along with the expected launch, the Matrixport report anticipates a 12% recovery in the Ethereum price to $3,400. This speculation comes as ETH jumped 20% in May after approval of 19-b filings. Bullish sentiment from an approval is expected to spill over to Bitcoin, supporting a recovery.

Mt. Gox Impact May Already Be Priced In

Anxiety around Mt. Gox repayments continues to fade as the market has already accounted for or priced in the impact. Mt. Gox Rehabilitation Trustee initiated repayments in Bitcoin and Bitcoin Cash (BCH) last week.

Bitstamp exchange, in agreement with Mt. Gox, indicated that it will ensure that investors are compensated as soon as possible. It highlighted a 60-day timeline for token distribution, with some creditors already confirming receipt. Kraken, one of the five exchanges the trustee will use for reimbursement, has a 90-day timeline.

Japan’s Bitbank and SBI VC Trade exchanges have already received and reportedly distributed their allocated funds. In so doing, they effectively beat their 14-day timeline. As creditor reimbursement by the defunct exchange’s trustee continues, optimism continues to be restored in the market.

This could bode well for Bitcoin price, especially if creditors do not cash in upon reception.

“Many of these creditors are long-term Bitcoiners, early adopters who are technologically adept and have previously rejected aggressive offers to liquidate their claims for cash,” Alex Thorn, Galaxy’s head of research opined.

German Government’s Bitcoin Sell-off

Since June 19, the German government has moved more than 10,000 BTC. This is worth almost $1 billion in Bitcoin moved to various crypto wallets and exchanges. This catalyzed the recent Bitcoin sell-off as investors front-run a possible supply shock.

“As it seems Bitcoin is still being plagued by the sales from Germany and the Mt. Gox settlements. If we want some evidence that these factors are indeed having an outsized impact on the price, simply take a look at the S&P500, which is currently on a carefree trip into deep all time high territory. Rest assured, these sellers will be exhausted at some point soon but there really is no telling exactly how much more damage they can do in the short term,” Mati Greenspan, Quantum Economics founder & CEO, told BeInCrypto.

Read more: Who Owns the Most Bitcoin in 2024?

However, based on Arkham data, token balances are depleting in the govenment’s reserve. There is speculation that the German government will eventually slow down on Bitcoin transactions, which could play in favor of the flagship crypto asset. One of the country’s MPs, Joana Cotar, who is a renowned crypto activist, said German’s local media had captured the call out, with investors in the country expressing anger.

Federal Reserve Chair Testimony This Week

Inflation is steadily decelerating in the US, and the country’s economy is showing strength but is still far away from satisfactory levels. With these, a soft landing seems likely, especially after the July 5 positive payroll data. The Federal Reserve’s long-awaited pivot in monetary policy now looks like a possibility.

“Fed’s latest projections are keeping investors cautious. Fewer rate cuts than hoped for are putting pressure on riskier assets. Political uncertainty in Europe and a stronger USD are pushing BTC down,” a popular account on X wrote.

Crypto markets continue to feel the heat of these macro events. This week is critical as Fed Chair Jerome Powell prepares to address Congress on July 9 and 10.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.