The Bitcoin supply being steadfastly held is increasing, as is the reluctance to sell. Furthermore, recent market action has been one of the tightest trading ranges over the last few years.

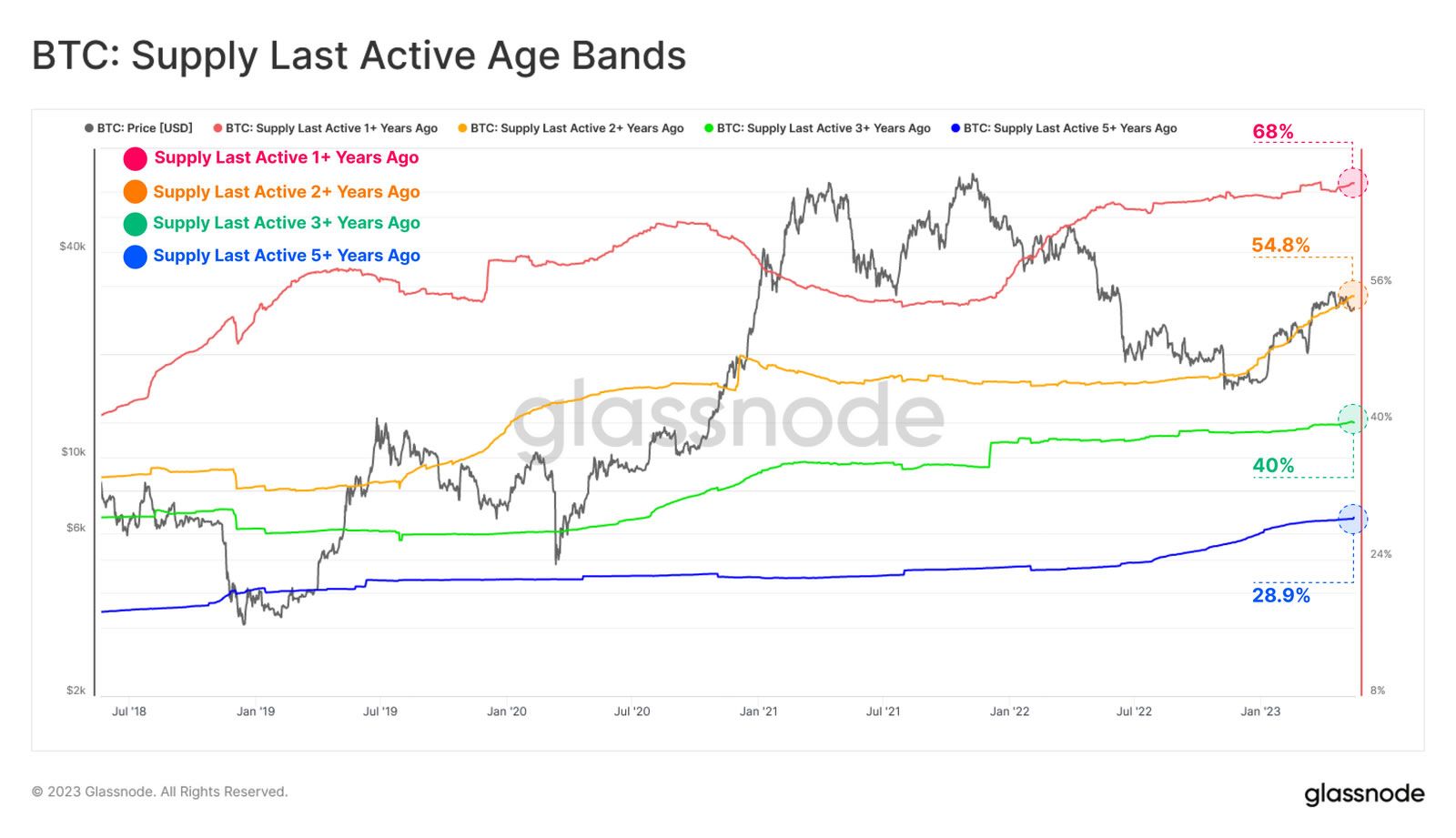

On May 22, on-chain analytics provider Glassnode reported that large swathes of Bitcoin supply remain dormant in investor wallets. Several key age bands are hitting all-time highs, it added.

The Bitcoin supply held for longer than a year continues to push to new highs as the hodl narrative grows.

Bitcoin Holders Resolute

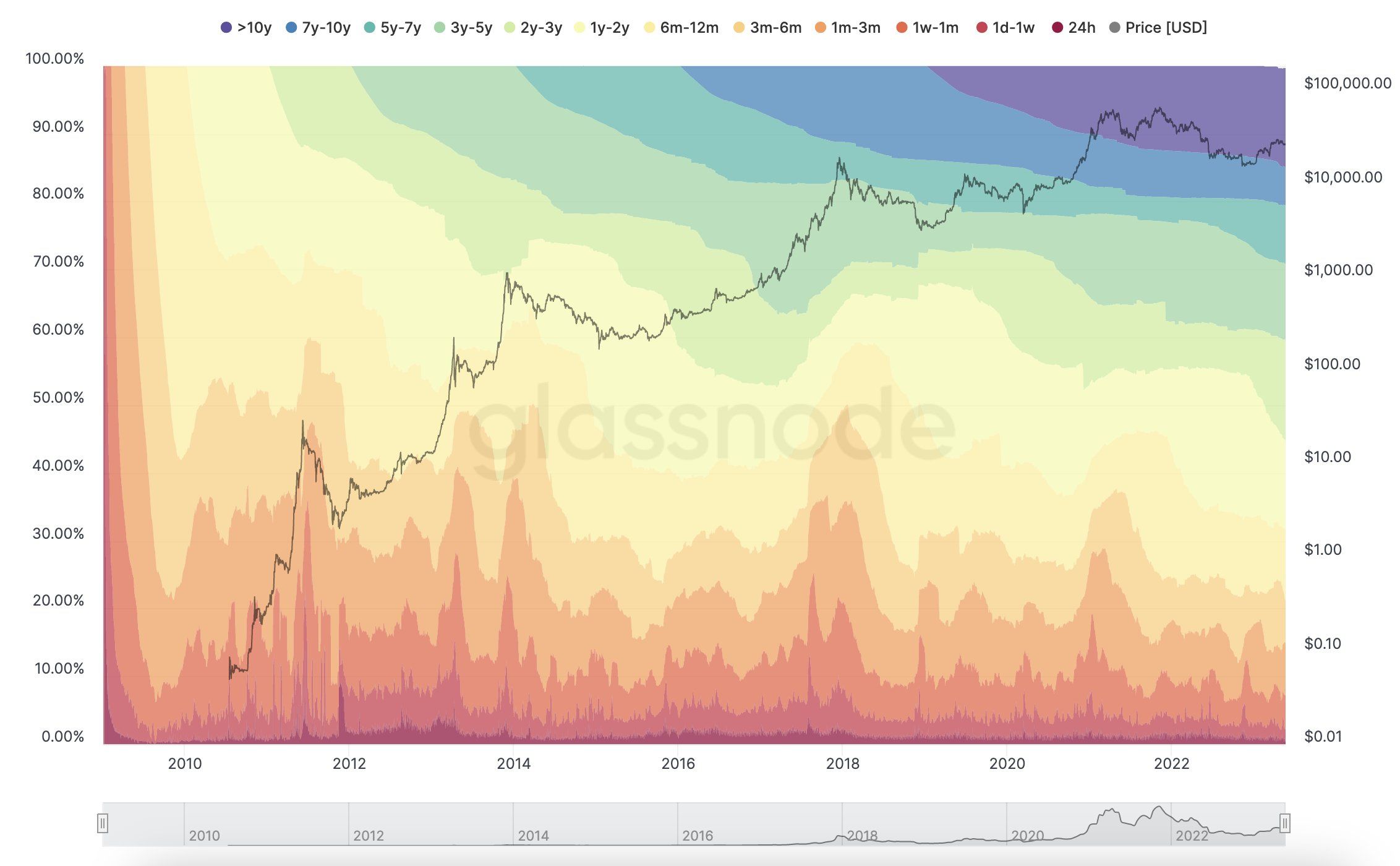

“The remarkable level of HODLing across the supply continues, with such high coin inactivity supporting the extreme lows of on-chain volume throughput.”

The chart below shows an increase in hodling across all bands, with the steepest in the two years last active band. These were coins accumulated in early 2021 at the beginning of the bull market.

Moreover, the supply of long-term holders, or BTC held for more than 155 days, has reached a new all-time high of 14.46 million BTC. “This reflects coins acquired immediately after the FTX failure maturing into LTH status,” Glassnode noted.

Additionally, the Bitcoin liveliness metric, which compares hodling and spending behavior, has fallen to its lowest level since December 2020. This confirms that hodling is the dominant market activity at the moment.

“Persistent downtrends in Liveliness reaffirm that HODLing is certainly the current primary market dynamic across the majority of supply.”

On May 23, Unchained confirmed the sentiment that Bitcoin is not being moved. It noted that a record-high 68.13% of Bitcoin hasn’t moved in over a year.

Historically, Bitcoin finds a price bottom when sellers have been exhausted, forging the latest wave of long-term holders, it said.

Glassnode concluded that these metrics paint a relatively constructive view of Bitcoin holder conviction. “Most are simply not interested in spending their coins just yet.”

On May 22, BeInCrypto reported that market volatility was imminent following a prolonged period of tight price ranges.

BTC Price Outlook

However, that volatility hasn’t materialized just yet as BTC is still consolidating. The king of crypto has gained 2.3% on the day in a move to $27,283 at the time of writing.

The move keeps BTC within its tight weekly range and will continue to do so unless resistance at $27,600 is broken.

On the downside, support can be found at $26,600, where Bitcoin has rebounded twice in the past week.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.