Bitcoin market volatility has been extremely low recently. However, such periods of inactivity are usually followed by a big move, but which way will it be?

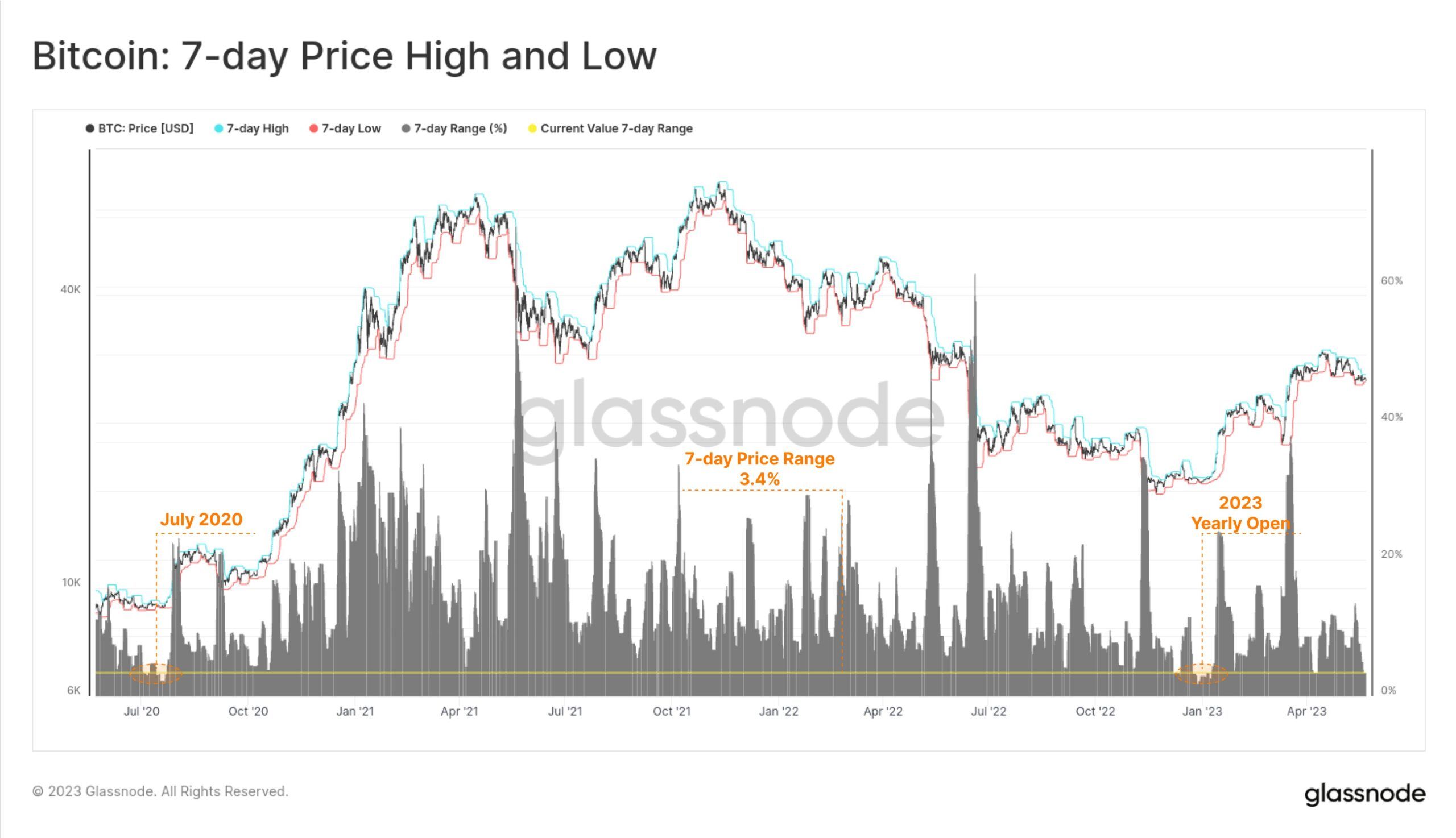

On May 22, on-chain analysis platform Glassnode reported that volatility had been very low in recent weeks.

It stated that the seven-day price range of Bitcoin was just 3.4%. Furthermore, this has consolidated within one of the tightest ranges over the last three years.

Big Bitcoin Move Approaches

The squeeze in price range is comparable with that in January, it added. There was also a similar low range in July 2020, “both of which preceded large market moves.”

“This suggests high volatility is likely on the horizon.”

Bitcoin prices oscillated around $17,000 in December and January for weeks before surging above $23,000 over the span of around two weeks. A similar upswing occurred in July 2020 when, after weeks of hovering just above $9,000, BTC cranked to $12,000.

Furthermore, markets were in choppy bear territory on both occasions, which is where they are at the moment. BTC remains down 61% from its November 2021 all-time high and may fall further in the next big market move.

On May 21, trader and analyst “Rekt Capital” commented that a weekly close below $27,600 “would double-confirm a breakdown and could set BTC up for downside continuation.”

The weekly candle closed around $26,800, so the analyst could be onto something. “Price needs to reclaim $27,600 to have a chance at bullish momentum,” he added.

Furthermore, Bitcoin miner outflows have also indicated that selling pressure will increase.

BTC Price Outlook

Bitcoin has retreated 1.3% on the day to trade at $26,758 at the time of writing. The asset dropped to an intraday low of $26,543 in the early hours of May 22 but appears to be bouncing back.

BTC has been in a choppy sideways channel for the past ten days as volatility diminishes. On the low side, support can be found at around $24,400 should a big move occur. This has also been an area that on-chain analysts have eyed.

It represents a cost basis of young coin supply and a psychological level to monitor, wrote Glassnode earlier this month. It also marks February’s highs which could be revisited should the correction continue.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.