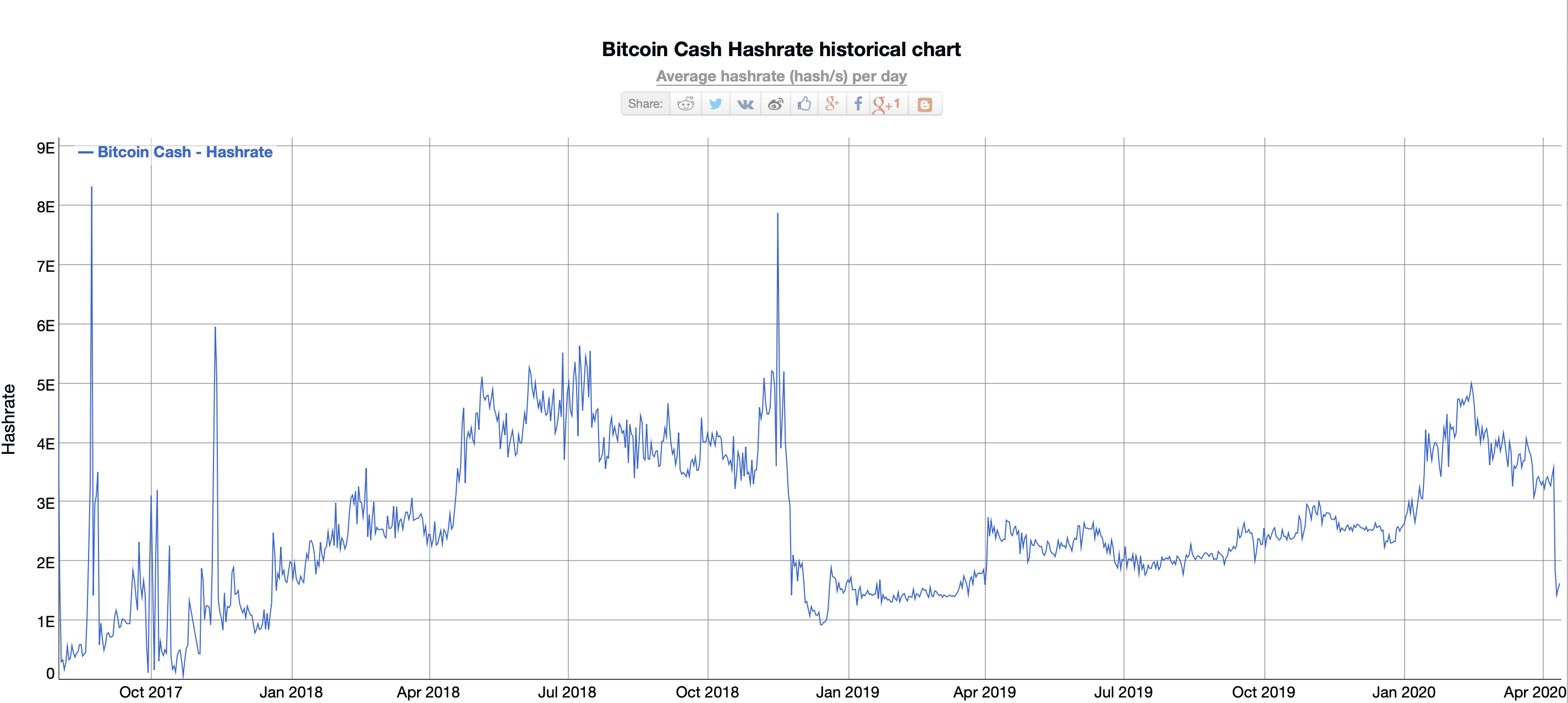

Bitcoin Cash has seen its hashrate plummet after its halving event as miners leave the network in droves.

Bitcoin Cash’s halving event took place last week and, despite a small bump in price, the gains have completely evaporated. Even worse, miners are leaving the ecosystem resulting in a crash of the network’s hashrate.

Bitcoin Cash Hash Rate Plummets

The drop in hashrate for Bitcoin Cash (BCH) has been nothing short of drastic. Since April 6, it has fallen some 60% to lows not seen since April 2019. The halving seems to have intensified selling pressure. Some analysts fear that this may be a bad sign for what’s to come for Bitcoin after its own upcoming halving next month.

Could it Be Capitulation?

It’s still too early to tell whether or not Bitcoin Cash miners are moving to ming Bitcoin. However, Bitcoin’s own hashrate continues to tick upward after hitting a local low in mid-March. As analyst Mati Greenspan (@MatiGreenspan) writes, this could be the capitulation event for Bitcoin Cash’s hashrate — assuming that it drops lower. We could, therefore, see a further decline in Bitcoin Cash’s price.

According to research recently published by BeInCrypto, there is evidence to suggest that Bitcoin’s hashrate dominance suggests forks liked BCH and BSV are significantly overvalued.

As analyst Mati Greenspan (@MatiGreenspan) writes, this could be the capitulation event for Bitcoin Cash’s hashrate — assuming that it drops lower. We could, therefore, see a further decline in Bitcoin Cash’s price.

According to research recently published by BeInCrypto, there is evidence to suggest that Bitcoin’s hashrate dominance suggests forks liked BCH and BSV are significantly overvalued.

At the current time, conducting a 51% attack on the Bitcoin Cash blockchain is easier than ever. Using rented hash power, a malicious actor could do so for less than $10,000. That’s incredibly cheap for a cryptocurrency project with a market capitalization of $4 billion. The long-term security, therefore, remains in serious doubt. Even worse, it may be a bad sign for Bitcoin. As one Reddit user writes, Bitcoin Cash adjusts its difficulty every 24 hours whereas BTC adjusts it every 14 days — if BTC were to suffer a similar hashrate crash post-halving, it would be disastrous. BTC’s halving is set to take place in mid-May.Bitcoin Cash hashrate capitulation.

— Mati.Quantum (@MatiGreenspan) April 13, 2020

After the halving on April 8th, it's no longer profitable to mine BCH causing many miners to switch over to BTC. pic.twitter.com/vISDMX5l7z

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Advertorial

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

READ FULL BIO

Sponsored

Sponsored