The Bitcoin (BTC) price increased to nearly $50,000 after the approval of its ETF. However, Bitcoin fell on January 13 and created a bearish candlestick.

Bitcoin reached a bearish weekly close, and signs of weakness developed in multiple time frames.

Bitcoin Creates Bearish Candlestick

The technical analysis of the weekly time frame shows that the BTC price has increased since the start of the year. After struggling with the $31,000 resistance area, BTC broke out in October, accelerating its rate of increase.

The upward movement led to a high of $49,000 on January 11, one day after the Bitcoin ETF was approved. This caused a breakout above an important horizontal and Fib resistance area.

However, Bitcoin fell significantly on January 13, creating a long upper wick and bearish candlestick (red icon).

Market traders use the RSI as a momentum indicator to identify overbought or oversold conditions and to decide whether to accumulate or sell an asset.

Readings above 50 and an upward trend indicate that bulls still have an advantage, whereas readings below 50 suggest the opposite. Even though it is above 50, the weekly RSI is falling, generating a bearish divergence (green), a sign of weakness.

Read More: Where To Trade Bitcoin Futures

What Do the Analysts Say?

Cryptocurrency traders and analysts on X have a bearish outlook on the future BTC trend.

AltStreetBet shows a large bearish divergence in the weekly time frame to predict that the price will fall.

CryptoMichNL suggests that the Bitcoin ETF will mark a short-term top but suggests that the price will eventually increase much higher. He tweeted:

However, in the short-term, price of Bitcoin is likely going to consolidate and take a breather. Several reasons for this: – Rotation from GBTC towards the ETF requires a selloff on BTC. – Rotation from institutionals from spot Bitcoin towards the ETF to be compliant with regulatory framework. – Hype-based speculants and prop. firms selling their positions (or getting stopped out) on the fact that the hype is over. – The hype itself stops the sudden euphoria on buying the actual asset for now, until there’s a new event.

Finally, JJCycles and Inmortal used fractals to suggest the BTC price reached a local top. JJCycles used a 2016 fractal, while Inmortal used one from 2019.

Read More: Who Owns the Most Bitcoin in 2024?

BTC Price Prediction: Is the Local Top in Place?

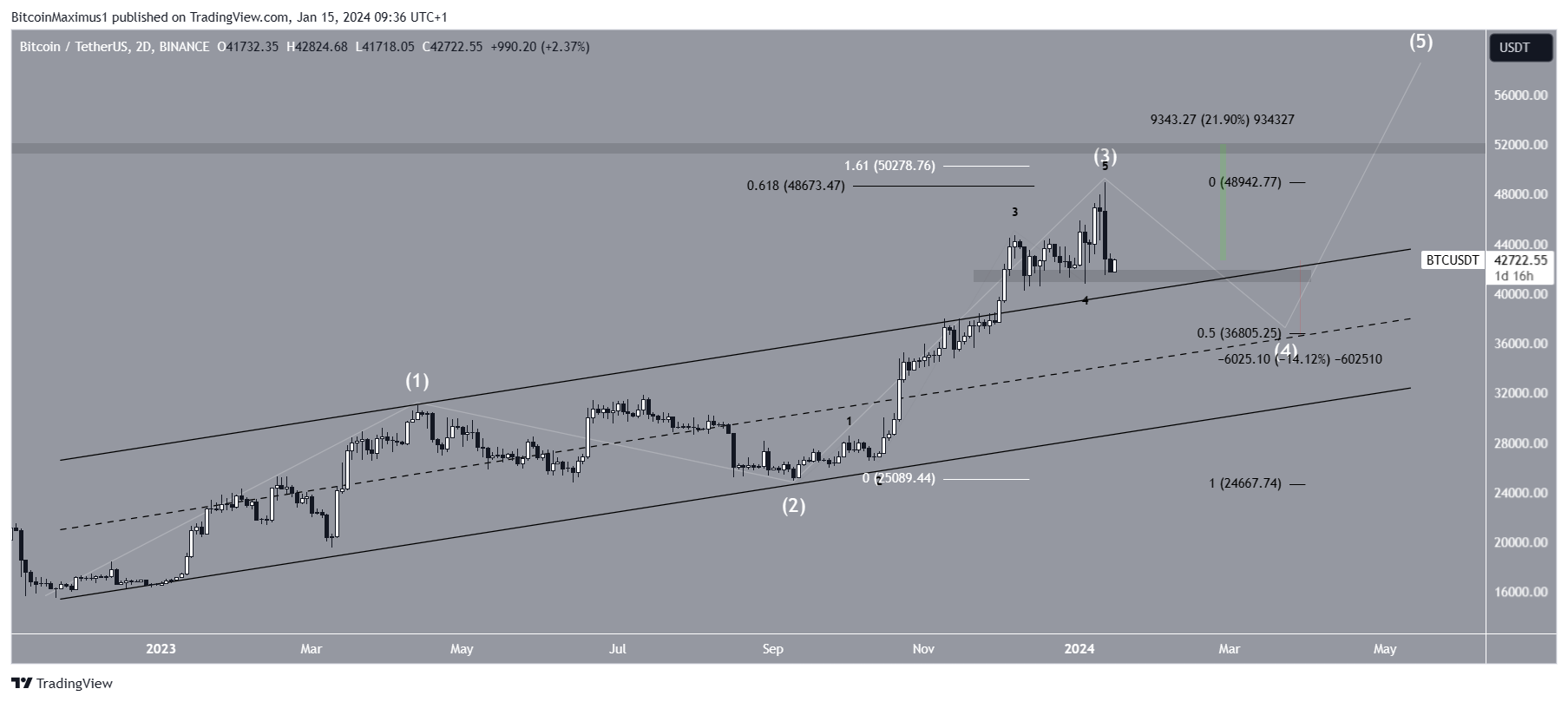

The 2-day time frame suggests the BTC price has reached a local top because of the wave count.

Technical analysts employ the Elliott Wave theory to identify recurring long-term price patterns and investor psychology, which helps them determine the direction of a trend.

The most likely count states that BTC has begun wave four in a five-wave upward movement (white).

The sub-wave count (black) indicates that the price has completed an extended third wave, nearly 1.61 times bigger than wave one. Bitcoin’s high was also made at the 0.618 Fib retracement resistance level.

BTC currently trades inside the $41,500 horizontal support area. A breakdown from it will confirm that wave four has started and can lead to a 14% drop to the 0.5 Fib retracement support level at $36,800, coinciding with the middle of the long-term channel.

Due to the length of wave two, this correction could continue for several months.

Despite this bearish BTC price prediction, an increase above the $49,050 high will mean the price is still in wave three. Then, BTC could reach a high near $52,000, 22% above the current price.

For BeInCrypto’s latest crypto market analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.