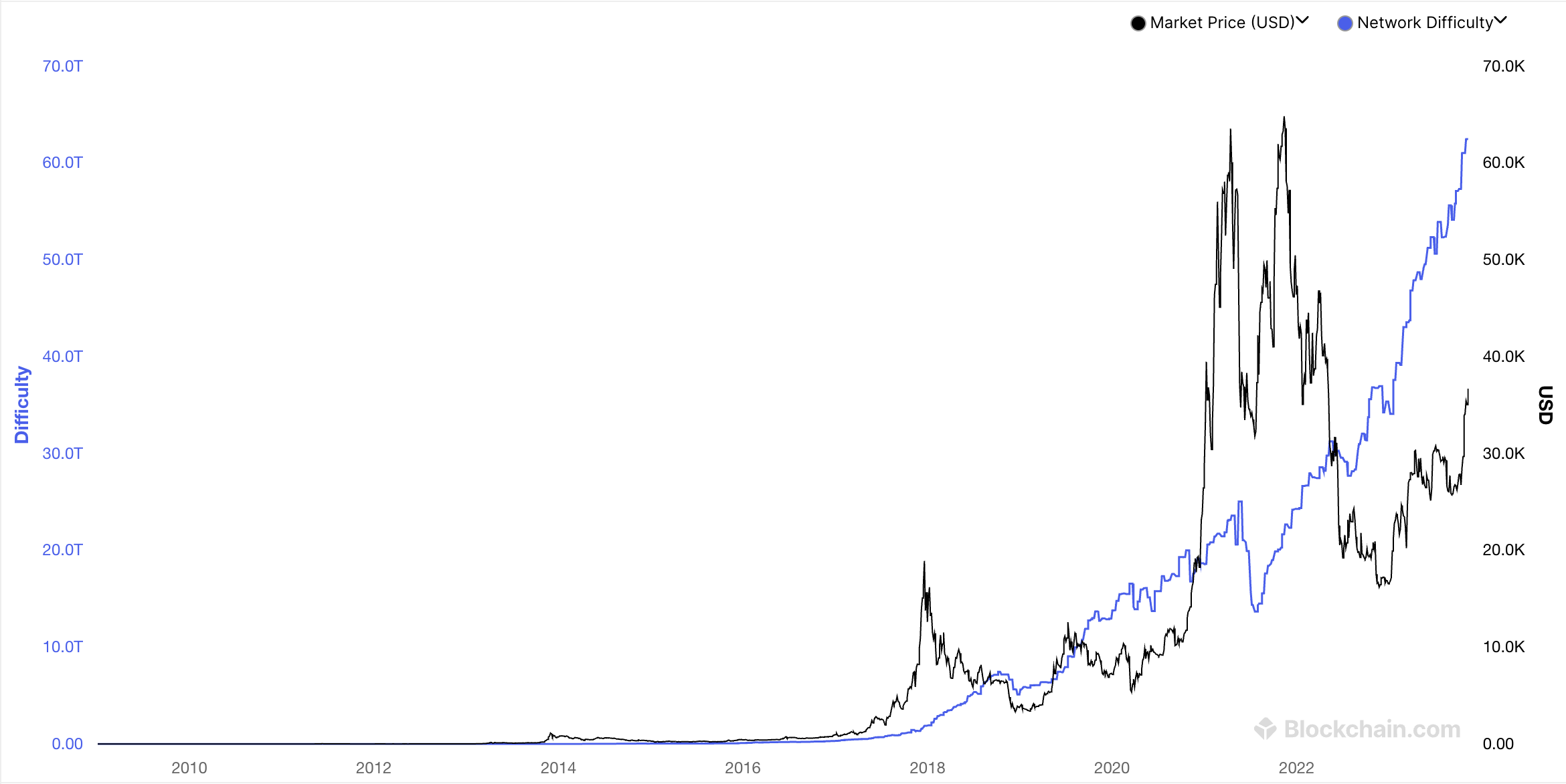

Miners are plugging in new rigs to cash in on the Bitcoin (BTC) rally ahead of next year’s halving. According to analysts at US bank JPMorgan, hashrate, a measure of online mining power on the Bitcoin network, has touched record highs in recent months.

The upcoming halving in April 2024 has seen several miners buy new equipment to take advantage of Bitcoin’s rally. The asset has risen 37% to some $37,000 in the past month, causing the 30-day average of miner revenues to increase to an 18-month high of $32.5 billion on Nov. 11.

Bitcoin (BTC) Miners Try to Beat Rising Difficulty

The increase in Bitcoin mining power is noticed by the Bitcoin algorithm. The algorithm checks the average time successful miners took to solve each of the previous 2,016 blocks.

If they took more than 10 minutes, the software makes it less difficult to solve the next 2,016 blocks. If they took less than ten minutes, something that is likely to happen when running more computers, then the algorithm increases the difficulty to ensure decentralization of power. This adjustment occurs once roughly every two weeks.

Miners try to beat the system by buying machines that use less power per hash. By moving to areas with cheap electricity, miners can also improve their margin for each correctly-guessed hash. Last month, Blockstream, a Bitcoin infrastructure vendor, said machines are usually more expensive after the halving, which may be a reason why miners are buying them now.

Miners currently earn $81 per petahash per second, an increase of $11 compared to the start of November. This is lower than the $127 they made in May.

Read more: The 7 Best Cryptocurrency Mining Hardware for 2023

Halving Will Wash Out Smaller Miners

The halving, which lowers the pace at which the Bitcoin software releases more coins into circulation, will reduce the revenue miners earn per block from 6.25 Bitcoin to 3.125 Bitcoin. Some miners who do not have optimized power-purchasing agreements may fold when revenues fall, says Didar Bekbauov, the CEO of Texas-based mining company Xive.

Big miners like Marathon Digital and Riot plan to acquire smaller miners that fail after the halving, he said. Some, like his own company, will need to turn off some machines if prices go low after the halving.

“We might see some mergers and acquisitions. We might see some bankruptcies. We might see some liquidations in terms of loans. There will be a very unstable market where the bigger players can get bigger, and they can improve their market positions, and weak players can die or be acquired by some of these companies.”

Read more: Best Crypto Mining Stocks to Buy or Watch Now

William Szamosszegi, the CEO of a mining company Sazmining, also opined that companies with smaller operations could be wiped out.

“Every halving forces miners not playing that game at a high enough level to get washed out,” he said.

Do you have something to say about how Bitcoin miners are preparing for the halving or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).