Bitcoin (BTC) experienced a sharp decline today. On April 2, 2024, at 02.45 UTC, Bitcoin’s price briefly dipped below $67,000, triggering over $500 million in trader liquidations.

The downturn comes after BTC managed to climb back to $71,000 yesterday.

Should Bitcoin Investors Watch Out for Further Corrections?

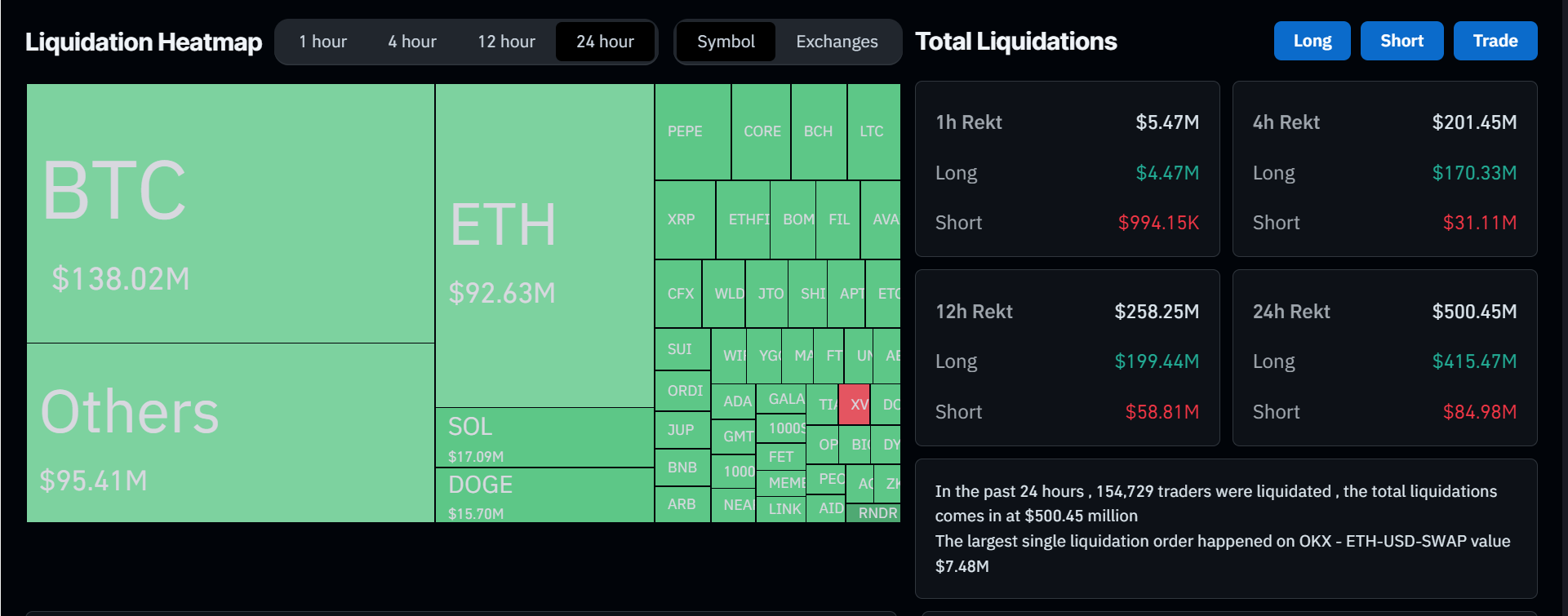

Based on the data provided by CoinGlass, in the last 24 hours, the cryptocurrency market witnessed a significant amount of liquidation. The total liquidation amount reached a staggering $500.45 million, leading to the liquidation of 154,729 traders.

It is worth noting that the majority of these liquidations, around 84.19%, were from long positions. Among all the cryptocurrency exchanges, Binance and OKX witnessed the largest liquidations, with $202.84 million and $176.48 million, respectively.

Read more: 10 Best Crypto Exchanges and Apps for Beginners in 2024

Further compounding the market’s woes is the notable outflow from Bitcoin ETFs, amounting to $85 million. The Grayscale Bitcoin Trust (GBTC) significantly contributes to this outflow, with $302.6 million moving away from the fund.

GBTC has experienced significant outflows, with total outflows reaching $15.07 billion to date. This is in stark contrast to the positive cumulative flows of other SEC-approved spot Bitcoin ETFs.

Cryptocurrency analyst Jason Pizzino has cautioned that Bitcoin’s price may continue to fall based on its recent market performance.

“Watch the emotional fireworks if Bitcoin breaks $68,300 and for many altcoins to continue grinding lower vs BTC pairs at the moment,” Pizzino said.

Pizzino’s analysis highlights the potential for a broader market correction as Bitcoin’s price action often influences other cryptocurrencies. Indeed, the total cryptocurrency market capitalization has dipped to $2.63 trillion, equal to 6.1% down for the last 24 hours.

Read more: 11 Best Altcoin Exchanges for Crypto Trading in April 2024

Specifically, Ethereum (ETH) has witnessed a decline of 6.4% in the last 24 hours. Similarly, Solana (SOL) has experienced a sharper drop of 9.2% in its value. The meme coins category faced even greater drops. In the same period, Dogwifhat (WIF) was down by 12.8%, and PEPE was down by 15%.