Crypto liquidations on centralized exchanges totaled $138 million in the past 24 hours. Long positions accounted for $120 million in losses, while short-sellers lost $18 million as traders grappled with the recent volatility of Bitcoin.

Traders lost around $30 million from leveraged Bitcoin positions and $24 million from long positions.

Why Crypto Liquidation Rose Yesterday

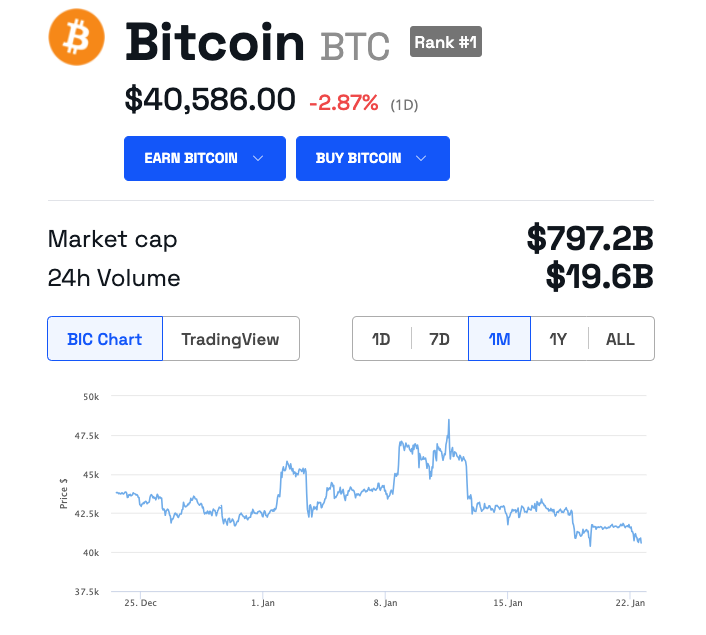

The liquidations may have been due to the increased volatility in the Bitcoin price, which has fallen 2.2% in the last 24 hours. The volatility of the asset has increased since the US Securities and Exchange Commission (SEC) approved 11 spot Bitcoin exchange-traded funds (ETFs).

Read more: Four Mistakes To Avoid When Trading Bitcoin with Leverage

The former CEO of BitMEX, Arthur Hayes, said he had bought put options at a strike price of $35,000 to hedge against BTC downside. The decrease in unrealized profits since the SEC approved spot Bitcoin ETFs has lowered additional downside risk by reducing sell pressure.

“$BTC looks mad heavy. I think we break $40k. I went long some 29Mar $35k strike puts,” said Hayes.

Some of the recent volatility has been due to the movements of BTC out of institutional products or transferred to alternative products. Following the SEC’s approval of spot ETFs, exchange-traded products (ETPs) in other jurisdictions saw notable outflows.

Bitcoin ETPs in Canada and Europe saw net outflows of around 5,000 BTC. There are about 20 spot Bitcoin ETPs in Canada.

Most European ETPs are institutionally focused, suggesting that institutions may have driven outflows into US ETF products. Jacobi Asset Management is the only company offering a European Bitcoin product structured as an ETF. The product requires a minimum investment of $100,000.

Crypto Liquidations Come in Deeper Markets

Last year, Bitcoin’s price swings, especially in October, were partly due to the lack of market depth. The asset recorded swings of more than 10% during October as the market struggled to bring in new liquidity after the collapse of Alameda Research in 2022.

FalconX, which measures market depth as the volume of Bitcoin trading activities within 1% of the current Bitcoin price, said that the liquidity at the time was at a yearly low. Since the approval of spot ETFs, the price has decreased from $48,494 to $40,612. Barring an initial decline of roughly 12% between Jan. 11, 2024, and Jan. 15, 2024, the price has traded within a 5% range in the past week.

Read more: What Causes Bitcoins Volatility?

Galaxy Digital CEO Mike Novogratz expects the asset’s volatility to abate in roughly six months. After that, Bitcoin should be higher. Until then, he expects people to move Bitcoin between funds rather than cash out completely.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.