After reaching an all-time high on Jan. 3, Bitcoin (BTC) fell the day after, creating successive bearish daily candlesticks.

Bitcoin is expected to break down from its short-term pattern and decrease towards the support levels outlined below.

Bitcoin Rally Stalls

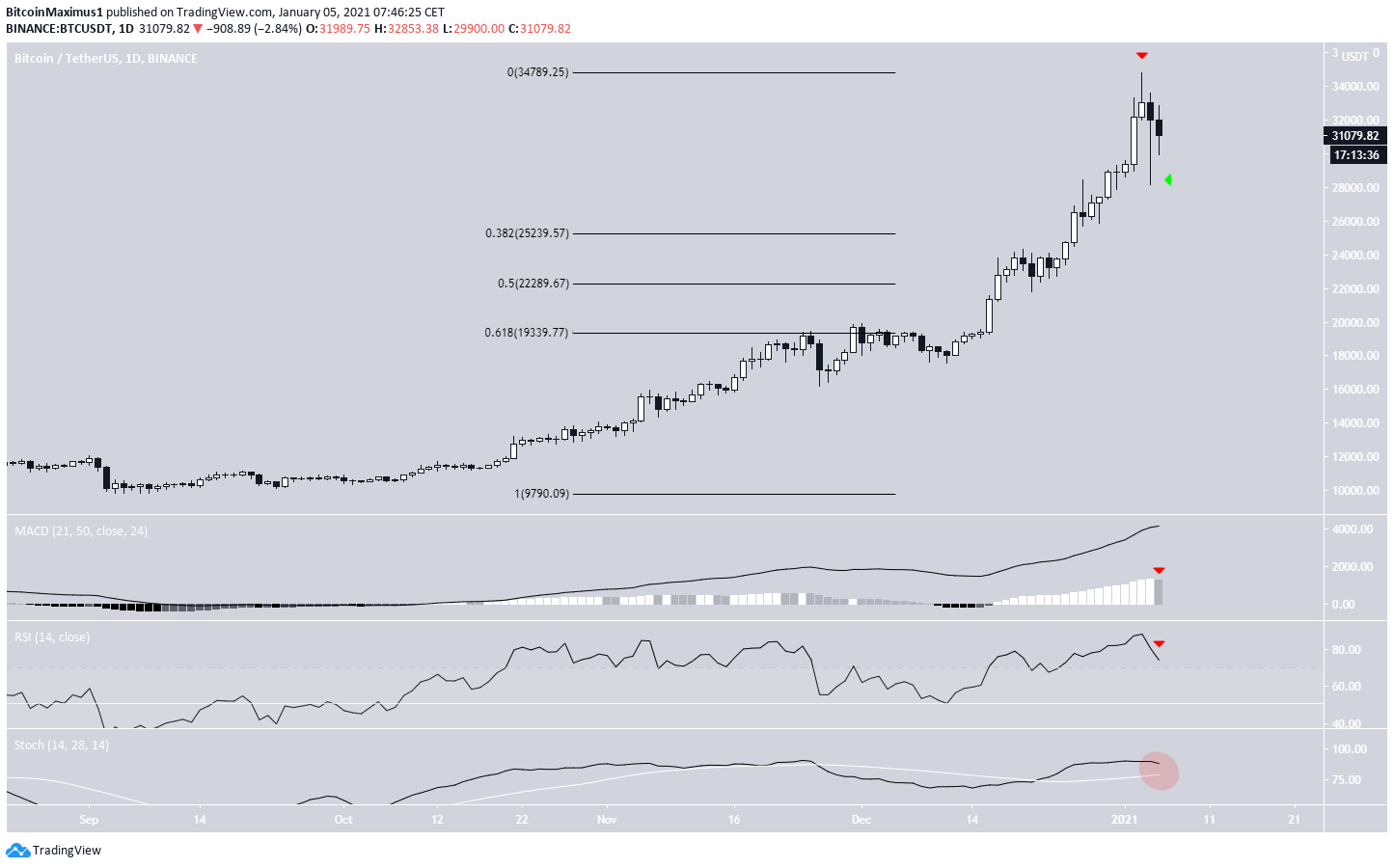

After reaching an all-time high price of $34,789 on Jan. 3, BTC stalled the next day, dropping all the way to a low of $28,130. However, it proceeded to create a long lower wick (shown with the green arrow in the image below) and reach a close of $31,988.

While the lower wick is a bullish sign, the candlestick is not. BTC so far has created two bearish candlesticks, a shooting star on Jan. 3 and a hanging man on Jan. 4 — both normally considered bearish reversal signs.

Despite the bearish candlesticks, technical indicators do not yet confirm the bearish reversal. While the MACD has generated a lower volume bar on the daily, it has yet to reach a close. Furthermore, the Stochastic oscillator has not yet made a bearish cross nor has the RSI crossed down below 70.

If a downward move were to occur, the three closest support levels would be found at $25,230, $22,290 and $19,340 (0.382, 0.5, and 0.618 Fib retracement levels respectively). Besides being Fib levels, the latter two also provide horizontal support.

Short-Term BTC Movement

The two-hour chart also provides a somewhat bearish outlook.

First, we can see that BTC is possibly trading inside a descending triangle, which is considered a bearish reversal pattern.

Second, BTC appeared to have broken out from this pattern last night but was rejected by the $32,800 resistance area (red arrow), making the previous breakout only a deviation.

Therefore, until BTC is able to successfully break out and reclaim the $32,800 minor resistance area, the trend is considered bearish and a breakdown is expected.

A breakdown that travels the entire height of the pattern would take BTC down to $25,240, close to the 0.382 Fib retracement level from the previous section.

This view is supported by the six-hour time-frame, which similarly shows that the previous support area has turned to resistance, rejecting BTC last night and leaving a long upper wick in place.

Technical indicators have also turned bearish, supporting the possibility of a breakdown.

Conclusion

Bitcoin is expected to break down from its descending triangle and gradually decrease towards the closest support area at $25,240.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.